Daily Gold Market Report

Mixed Fortunes for Gold ETFs:

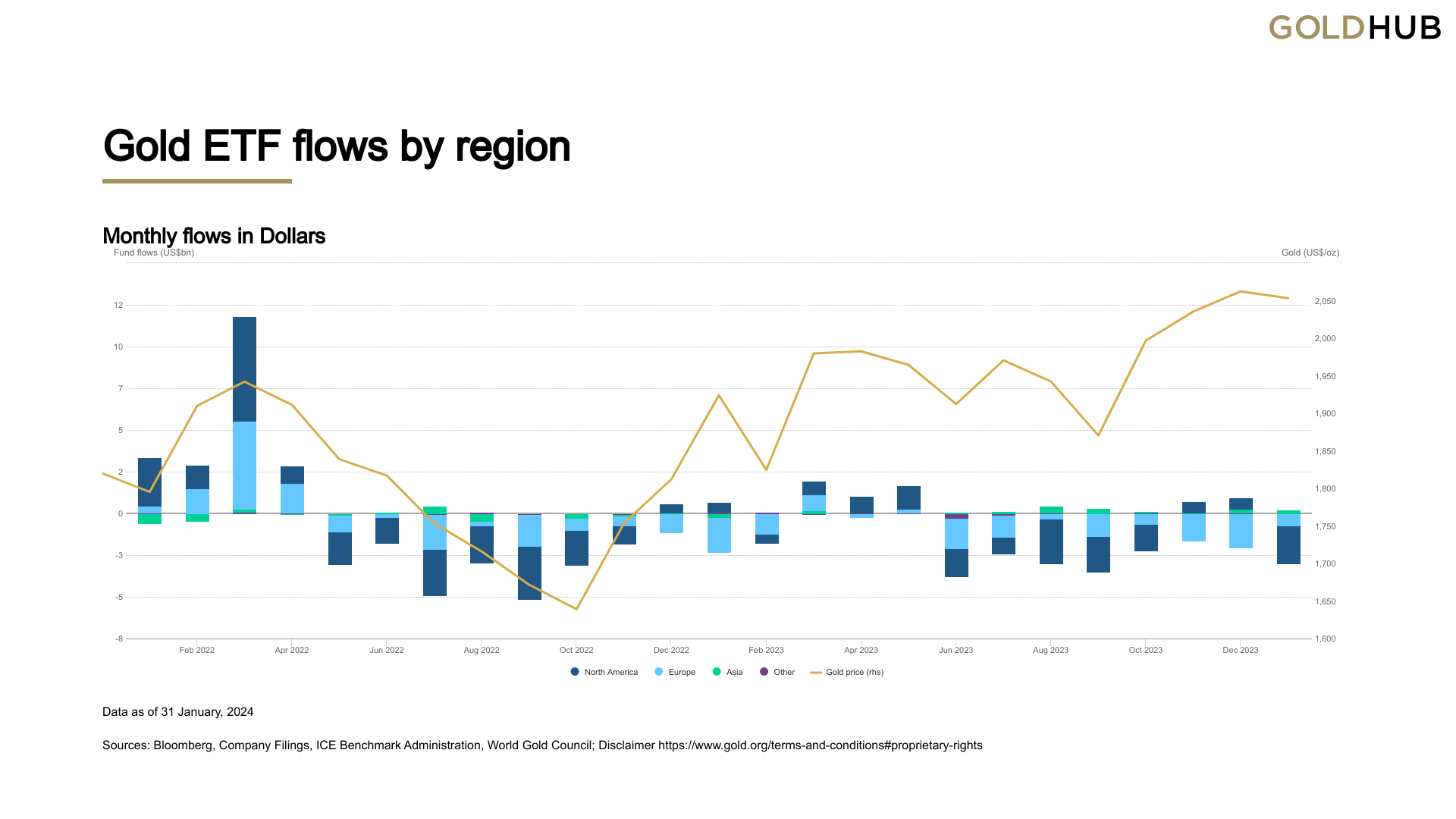

North America and Europe See Declines, Asia Invests More

(USAGOLD – 2/08/2024) The gold market is facing ongoing challenges due to persistent selling pressure, as there has been little to no change in the U.S. labor market activities compared to last week. Gold is trading at $2033.67, down $1.69. Silver is trading at $22.53, up 31 cents. In January 2024, global gold-backed ETFs saw a significant outflow of 51 tonnes, marking the eighth consecutive month of net redemptions, predominantly in North America, as reported by the World Gold Council. This outflow amounted to a $2.8 billion reduction in value, decreasing the total gold ETF holdings to 3,175 tonnes and assets under administration to $210 billion. The decline was primarily attributed to a market pushback against early central bank rate cuts, which led to a decrease in gold prices and dimmed investor interest in gold ETFs. North American ETF holdings notably dropped to a four-year low, with a 36-tonne decrease to 1,606 tonnes, while European ETFs also experienced a decline, and Asian ETFs saw a modest increase in investor interest due to a demand for safe-haven assets amidst a fall in local equities and a weaker currency.