Daily Gold Market Report

Gold’s Bright Future

How Fed’s Shift to Rate Cuts and QE Underlines Its Value

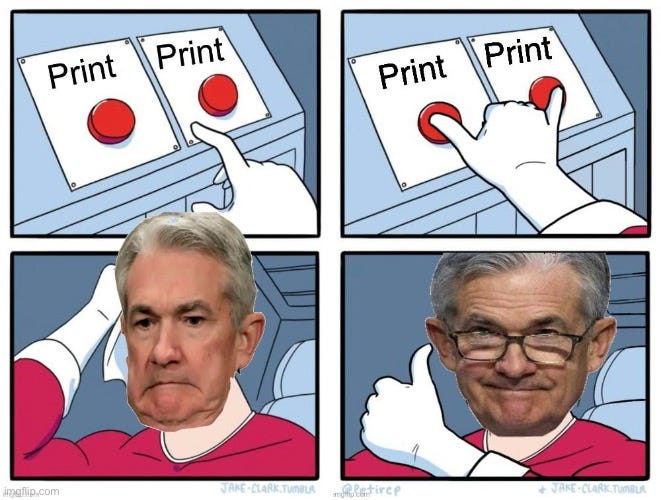

(USAGOLD – 12/18/2023) Gold prices are staring the week flat as the market reacts to the Fed’s decision last week and as we wait for GDP data on Thursday. Gold is trading at $2021.69, up $2.07 cents. Silver is trading at $23.86, flat on the day. The Federal Reserve’s shift towards potential rate cuts in 2024 and a return to Quantitative Easing (QE) indicates a continuation of expansive monetary policy. This change is driven by the Treasury’s significant borrowing, putting upward pressure on interest rates. The Fed’s reliance on the reverse repo market to regulate liquidity has proven inadequate, necessitating a shift back to QE. This scenario mirrors the financial troubles of the 1970s, where similar policies led to severe inflation, only controlled by drastic measures under Fed chair Paul Volker. The Fed’s actions, influenced by political pressures, are likely to repeat these past mistakes, emphasizing the need for gold as a hedge against inflation and currency devaluation.