Monthly Archives: December 2023

Daily Gold Market Report

Global Gold-Backed ETFs

A Mixed Picture in November with North American Gains and European Losses

(USAGOLD – 12/07/2023) Gold prices are slightly up this morning, eyeing resistance at $2,050 per ounce, coinciding with signs of stabilization in the U.S. labor market, as the quantity of American workers seeking first-time unemployment benefits shows little change from the previous week. Gold is trading at $2,035.21, up $9.66 cents. Silver is trading at $23.91, up 1 cents. In November, gold-backed ETFs saw decreased outflows compared to October, according to the World Gold Council. Global ETFs had net outflows of $920 million and a physical holding reduction to 3,236 tonnes. Despite this, AUMs increased by 2% to $212.2 billion, aided by gold prices exceeding $2,000 per ounce. North American ETFs reversed a five-month trend of redemptions with net inflows of $659 million, while European funds continued to see withdrawals for the sixth consecutive month, attributed to high opportunity costs and strong local currencies. Asian funds experienced modest inflows.

Today’s top gold news and opinion

12/07/2023

Gold firms as spotlight shifts to US jobs print (Reuters)

Focus shifts to US non-farm payroll on Friday

Why Gold Prices Are Hitting Records (WSJ)

Bets on the Federal Reserve cutting rates early is helping propel gains

Investors Bet on 44% Argentine Peso Devaluation After Milei’s Debut (Bloomberg)

Move signals beginning of end for country’s capital controls…

Today’s top gold news and opinion

12/06/2023

Young Chinese spurn traditional investments in favour of gold (Reuters)

“Incomes are not really appreciating, real estate is not really appreciating, the stock market is not really appreciating. Gold is a little bit of a unicorn in this environment.”

EV Boom Drives Miner’s $100 Million Hunt for New Palladium Uses (Bloomberg)

Potential uses include products in hydrogen and solar sectors

Gold’s Bold Move to New Closing High (Sprott)

Central banks and sovereign buying have put a floor under gold prices…

Daily Gold Market Report

Anticipating U.S. Rate Cuts in 2024

Market Expectations Versus Economic Realities

(USAGOLD – 12/06/2023) The gold market is experiencing a resurgence in purchasing activity due to a notable slowdown in the U.S. labor market last month, as reported by recent figures from the private-sector payroll company ADP. Gold is trading at $2,031.75, up $12.39 cents. Silver is trading at $24.22, up 6 cents. US businesses advertised 8.7 million job vacancies in October, down from 9.6 million in September, according to the labour department’s Job Openings and Labor Turnover Survey released on Tuesday. Business Insider also reported that layoffs also have remained an unfortunate reality of 2023, continuing pace with the cuts made at dozens of companies toward the end of last year. While markets are pricing in a high likelihood of rate cuts by May 2024, the actual evidence to support this, such as a slowdown in employment and core inflation, is not yet apparent as these a lagging indicators. Employment reports, including the monthly report from the Bureau of Labor Statistics, indicate healthy employment gains, suggesting that the Fed may not be inclined to signal cuts yet. The resolution of strikes by the Screen Actors Guild and United Auto Workers positively impacted non-farm job gains, and there is an expectation of a rebound in the service sector in November, although this rebound is projected to stay below the long-term average. The overall sentiment is that while there are expectations of rate cuts in 2024, more significant evidence of an economic slowdown is needed for these to materialize.

Daily Gold Market Report

Gold Prices Ride a Rollercoaster

Surge and Dip on Fed Rate Speculations

(USAGOLD – 12/05/2023) Gold prices are trading lower this morning after much volatility yesterday. Gold is trading at $2,028.54, down 88 cents. Silver is trading at $24.43, down 8 cents. Gold prices experienced significant fluctuations yesterday, initially surging to ~$2140/oz then retracting back to $2020/oz, in response to evolving market expectations regarding U.S. Federal Reserve interest rate policies. After Federal Reserve Chair Jerome Powell’s comments suggested potential rate cuts, gold briefly hit a record high before declining due to reassessed expectations and a strengthening dollar. Despite this volatility, gold has been on an upward trend, gaining about 12% since early October and up ~11% YTD. This rise is attributed to both a demand for safe-haven assets following the Hamas attack on Israel and anticipation of looser U.S. monetary policy. Central bank purchases have also bolstered gold prices, offsetting reductions in exchange-traded fund holdings. Investors are now closely watching U.S. jobs data this week for further insights into the Fed’s monetary policy decisions.

Today’s top gold news and opinion

12/05/2023

Gold price hits all-time high as traders bet on interest rate cuts (FT)

Gold remains far from its inflation-adjusted high of about $3,300 per troy ounce achieved in 1980..

UAE: Why is everyone buying gold despite record-high prices? (Zawya)

Huge crowds and busy shops were seen all across the country as people flocked to buy the yellow metal

COT: Speculators add further fuel to gold rally (Saxo)

Firm belief that rates have peaked

Daily Gold Market Report

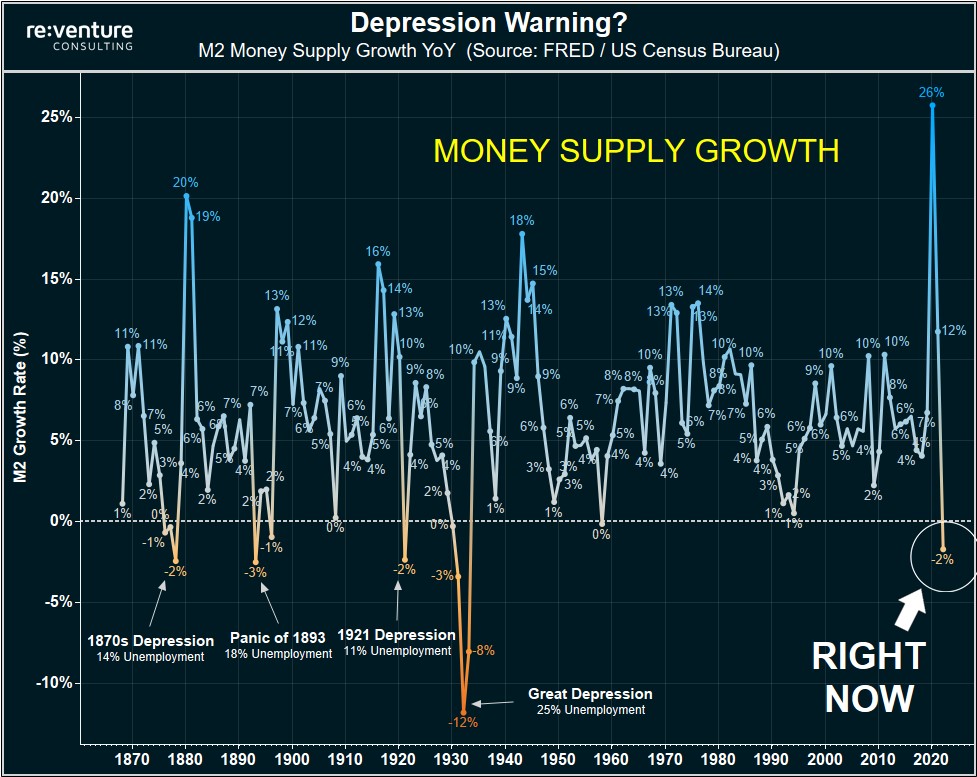

Historic M2 Decline and Its Impact on Gold Prices

A New Era for Investors?

(USAGOLD – 12/04/2023)Gold prices are trading lower this morning after spot gold spiked to a new record high of $2,146.7 overnight. Gold is trading at $2,053.74, down $18.58. Silver is trading at $25.11, down 25 cents. Sean Williams, of The Motley Fool, recently pointed out the recent decline in the M2 money supply, the first significant contraction since the Great Depression, and its implications for the stock market and potential impact on gold prices. M2, which includes cash, coins, checking deposits, savings accounts, money market accounts, and CDs below $100,000, has fallen by 4.51% since its peak in July 2022. This decline is noteworthy as it’s the first notable drop in M2 in nearly 90 years.

Today’s top gold news and opinion

12/04/2023

Fitch sees industrial metal prices falling in 2024, gold set to rise (Mining)

Regional debate around nationalizing the mining sector in areas like Chile and Peru had begun to ebb..

Case for gold fever: NewEdge Wealth sees record rush intensifying (CNBC)

“Central banks are again outbidding gold against dwindling supply”

Precious metals take top spot for a second month (Saxo)

Precious metals sector tops the performance table with a gain around 4%

Today’s top gold news and opinion

12/01/2023

Gold Inches Closer to Record High as Bets for Fed Pivot Beef Up (Yahoo)

Atlanta Fed President Raphael Bostic said he’s growing increasingly confident that inflation is firmly on a downward path

Saudi Arabia studies graphite, rare earths trading platform (Reuters)

There are currently no exchanges offering contracts for graphite or rare earth metals, both important materials for electric vehicle and the energy transition.

Global commodity markets are in a ‘super-squeeze’ (CNBC)

Paul Bloxham of HSBC explains why supply-side disruptions are the reasons behind the elevation of commodity prices

Daily Gold Market Report

Breaking the Barrier

Gold’s Historic Monthly Rise Above $2000 and Its Economic Implications

(USAGOLD – 12/01/2023) Gold prices are trading flat amid some chart consolidation heading into the weekend. Gold is trading at $2,035.63, down 78 cents. Silver is trading at $25.17, down10 cents. The November monthly close of gold above $2000 per ounce is significant for several reasons. Firstly, it marks a notable psychological and financial threshold, often attracting increased attention from investors and the media. Such a high price can indicate strong investor interest in gold as a safe-haven asset. Secondly, crossing this price point might influence the strategies of both individual and institutional investors, potentially leading to increased demand and speculative trading. Finally, this milestone often leads to broader market analysis and speculation about the future of the global economy, as gold prices are frequently seen as a barometer for financial stability and investor sentiment.