Gold takes a breather from renewed push toward $2000 mark

Interest Rate Observer’s James Grant says ‘it’s a terrific time’ to own gold

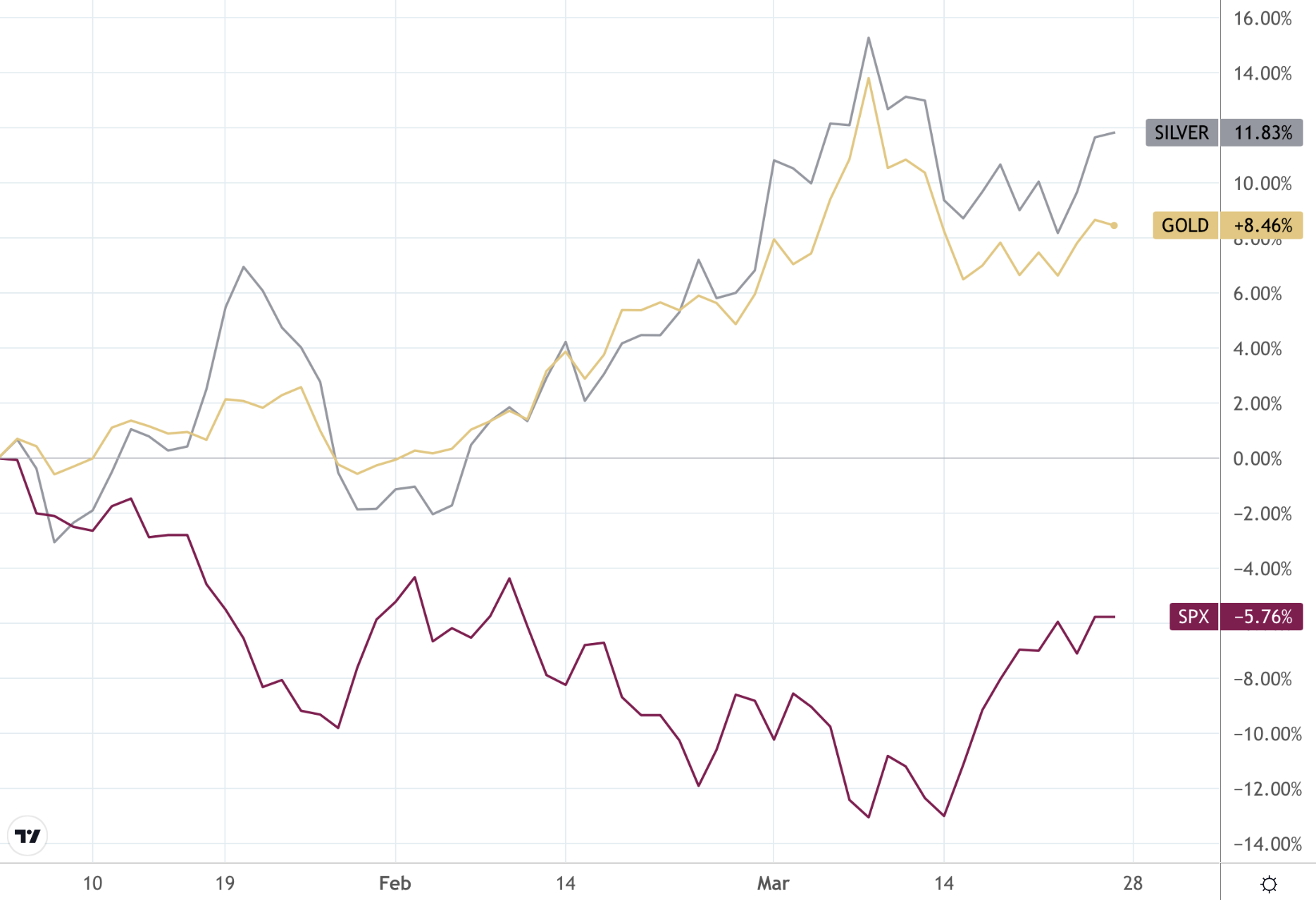

(USAGOLD 3/25/2022) – Gold is taking a bit of a breather from its renewed push toward the $2000 mark this morning as investors weigh the prospect of an inverting yield curve, building stagflationary pressures, and the likelihood of a protracted conflict in Ukraine. It is down $3 at $1958. Silver is up 6¢ at $25.73. Year to date, silver is up 11.83%; gold is up 8.46%, and stocks are down 5.76%.

James Grant, the erudite and widely followed editor of Grant’s Interest Rate Observer, believes the roughly minus 7% real rate of return on yield assets suggests “we are living through a time of truly unusual if not unique monetary events.” In an interview with Wealthion’s Adam Taggert posted yesterday, he says that history in this case “would counsel us to be humble, prepared to listen and to interpret correctly.” Pointing to the “free money” the Fed has cultivated for a dozen years, Grant says gold “is the future. An inveterate gold bug, I am. I do retain my conviction that gold will be the survivor among alternatives to favored currencies, … I think it is a terrific time [to own the metal]. Gold has put in a millennia of service as a monetary medium. … So gold is eternal.”

Gold, silver and stocks performance

(%, year to date)

Chart courtesy of TradingView.com