Monthly Archives: October 2021

Stocks look dangerously overvalued and are at risk of a sharp correction – Deutsche Bank

Repost from 9-15-2021

USAGOLD note: This article is a follow-up to our post on Monday that five major banks, including Deutsche Bank, have issued warnings of “a storm brewing” in the U.S. stock market. The other four are Goldman, Morgan Stanley, Citigroup, and Bank of America.

No DMR today.

We will post an update later in the day HERE if anything of interest develops.

Below is yesterday’s report.

Gold firms in overnight trading on China, energy and stagflation concerns

Gold’s divergence on real rate chart in 2021 due to ‘rosy expectations’

(USAGOLD – 10/12/2021) – Gold firmed in overnight trading on a combination of concerns – the developing credit crisis in China, an energy crunch that appears to be gaining momentum, and the overarching prospect of global stagflation. It is up $8 at $1763.50. Silver is up 3¢ at $22.68. In an e-mail investment update this morning, the World Gold Council warned that stagflation is a real risk that appears to be in the cards.

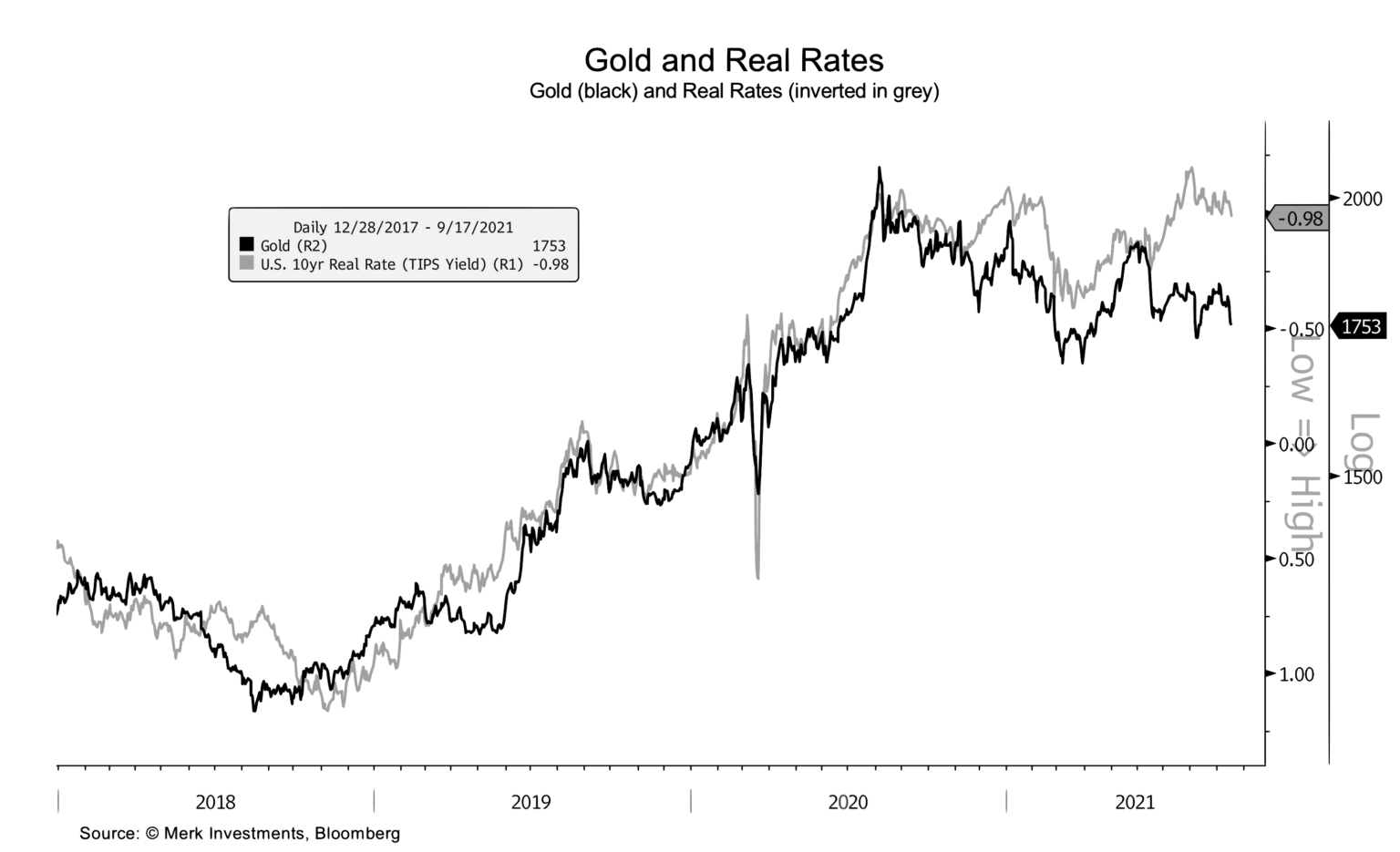

Chart of the Day courtesy of Merk Investments • • • Click to enlarge

“Stagflation, if severe,” it says, “can be damaging to both the economy and financial markets. But we don’t need a repeat of the 1970s for assets to be affected. Our analysis shows that even mild stagflationary conditions can have similar asset impacts to those in more severe stagflations. Stagflation has historically hit equities hard. Fixed-income returns have been variable, while both commodities and gold have fared well. Gold’s historically strong performance can be attributed to higher inflation and market volatility supporting capital preservation motives, and lower real interest rates supporting both opportunity cost and growth risk motives.”

As you can see in our Chart of the Day, gold has followed the course of real rates (inverted), with a notable divergence occurring in 2021. In that same report, the World Gold Council says the anomaly “has to do with rosy expectations about inflation, growth, and equities.” That could all change, we will add, if inflation proves to be other than transitory and safe-haven interest begins to migrate once again in gold’s direction.