Monthly Archives: January 2021

Short and Sweet

‘I expect a true crash to take a decade of stock market gains.’

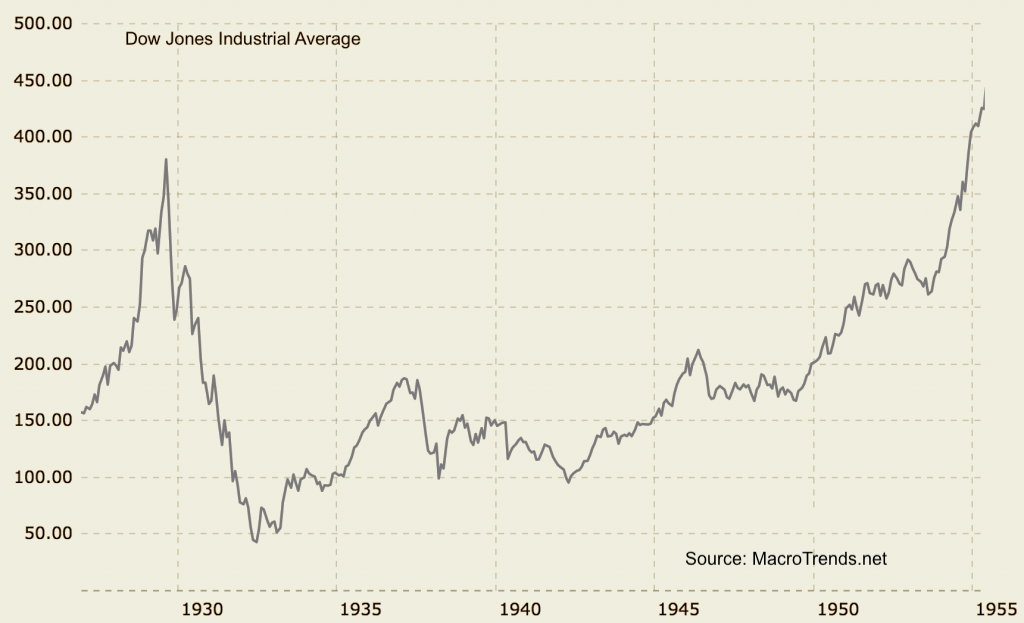

“‘If the pandemic doesn’t pop this bubble then, of course, it will be something else that eventually accomplishes this,’ says [Universa Investments’ Mark Spitznagel in a MarketWatch report], “reiterating his long-held belief that easy-money central banks and the bubble they continue to pump will eventually lead to a major global reversal. How bad could it get when it really goes sideways? ‘I expect a true crash to take back a decade [worth of stock-market gains],’ he told The Wall Street Journal last month.'” Spitznagel is a protege of Nicholas Taleb of The Black Swan fame. Some would consider his prediction going overboard. We should keep in mind, though, that from 1929 to 1933 the stock market lost almost 90% of its value. It did not return to its 1929 highs until 1955 – 26 years later. In short, what he is suggesting is not without historical precedent.

Chart courtesy of MacroTrends.net

Are you looking to solidify your hard-earned wealth for the long run?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/[email protected]

ORDER GOLD & SILVER ONLINE 24-7

Short and Sweet

Beware the new mantra that stocks are a good inflation hedge

“So, to be clear, this April really was cruel,” writes John Authers in his regular Bloomberg column, “In terms of the basic economic numbers that affect us most, it was the cruelest month for the U.S. in many decades. It was only one month. It is way too soon to proclaim the beginning or end of a major economic trend, on the base of the data we have so far. But April’s data were not only very, very bad, but also very, very surprising. They need to be confronted and understood.” Authers is surprised at the markets’ muted reaction to “a bad unemployment number followed by a bad inflation number.” He warns that if inflation does take root, stocks have plenty of room to fall further.

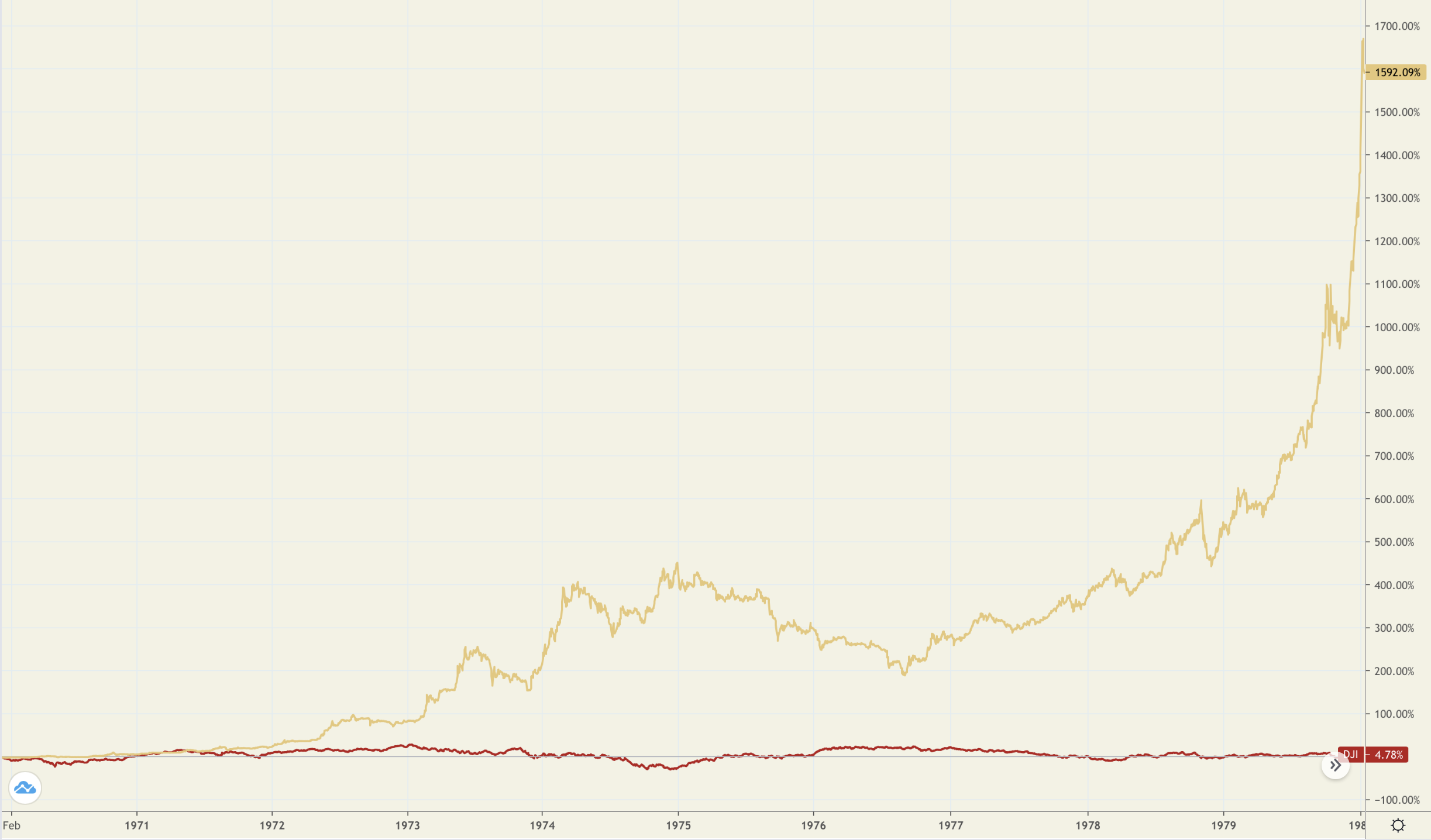

The chart below shows what happened in the 1970s once investors realized that inflation was not “transitory” but entrenched instead. Stocks drifted sideways for most of the decade, managing only a 4.78% gain. Gold, on the other hand, gained 1592%. We sometimes overlook the fact that stocks peaked in the late 1960s, just before the inflation began. Nearly twenty years of sideways to down action followed. Stocks started and ended the 1970s at 1000 while runaway inflation raged.

Gold and Stocks

(In percent, 1970-1979)

Chart courtesy of TradingView.com • • • Click to enlarge

Egyptologists uncover literal ‘tongues of gold’ – with a peculiar biblical link?

WatchJerusalem/Christopher Eames12-30-2021

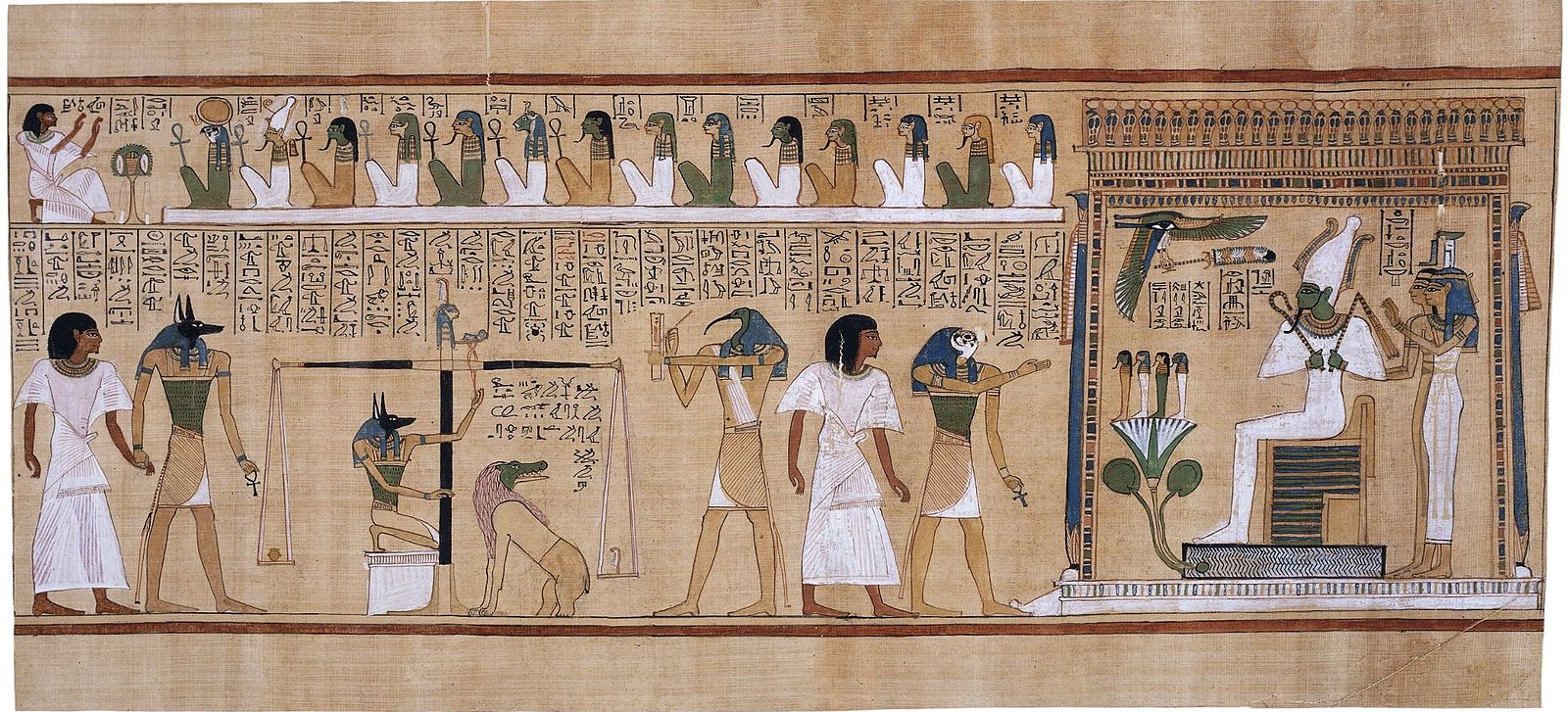

“In their announcement of the discovery, Egypt’s Ministry of Tourism and Antiquities stated that the gold foil tongues were likely intended to help the dead speak with the gods in the afterlife.”

USAGOLD note: Some fascinating history at the link ……The Greeks placed “a coin on or in the mouth of the deceased as payment for the ferryman, Caron, who transported the deceased across the River Styx to the Underworld.”

Image: The judgement of the dead in the presence of Osiris, Book of the Dead of Hunefer

BlackRock says ‘out of favour’ gold may see fortune turn in 2022

TheEdgeMarkets/Ranjeetha Pakiam – Bloomberg/12-16-2021