Short and Sweet

Gold as the ‘generational trade’

Billionaire investor says it will reach $3000 to $5000 as secular bull market resumes

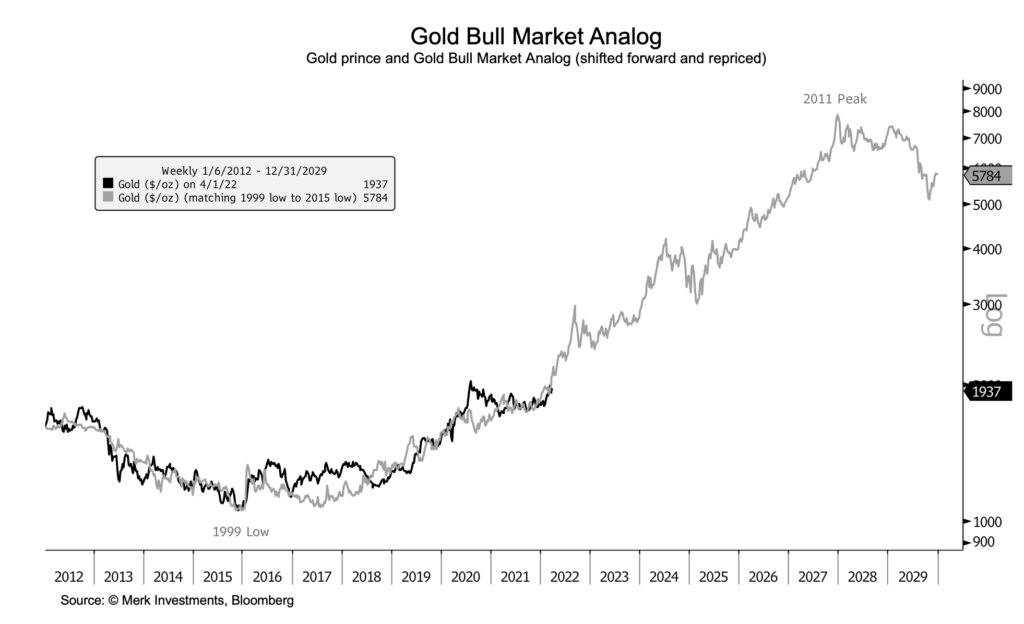

Chart courtesy of Merk Investments • • • Click to enlarge

Wall Street-based billionaire and financier Thomas Kaplan (who once said, “I’m no insect; gold is a great way to make a lot of money.”) is among the group of analysts who believes gold is in the early stages of a new leg in its long-term secular bull market. In 2020, he expanded on the notion in a groundbreaking interview with Stansberry Research’s Daniela Cambone. Though Kaplan made his fortune in the mining business, he is also an Oxford-trained historian (with a Ph.D.) capable of putting gold’s current price trend in the context of a longer-term cycle – one he believes has not yet reached full maturity. (Please see chart above.) His comments, we think you will agree, offer a refreshing perspective at a time when it is sorely needed and when short-termism seems to dominate investor psychology.

“Let’s put it this way,” he says, “gold still remains on Wall Street and in the west probably the most under-owned, least crowded trade in the global financial markets. … The era in which gold was the asset which people loved to hate and hated to love is starting to come to an end. We’re still in the very early innings. It’s still a smart money trade as opposed to a big passive money trade but that’s about to happen.” Merk Investments’ “Gold Bull Market Analog” chart (shown above), which tracks the progress of the current bull market against the one that began in 1999, supports and illustrates Kaplan’s argument. The next leg up, he believes, will be driven by what he calls “bold-faced” names now involved in the gold business. Kaplan mentions Warren Buffett (who at the time of the interview had just purchased stock in mining giant Barrick Gold, Mohamed El Erian, Mark Mobius, Ray Dalio, Paul Tudor Jones, Jeffrey Gundlach, and Kenneth Rogoff. (Long-time readers of this daily newsletter will recognize that list of notables as abbreviated.)

“The difference is this,” he says. “The market is now ready for the next leg of the gold bull market. The first leg was the one that took us up 12 consecutive years in a row regardless of whether there were inflation fears, deflation fears, whether there was a glut of oil or a shortage of oil, political stability or political instability, dollar weakness, dollar strength. It didn’t matter. Every year for 12 years gold went up. The next move is going to be a third wave, a long wave that lasts for a decade or fifteen years, maybe more … I think that you really are looking at a complete paradigm shift that will make gold the generational trade.” From there, Kaplan goes on to say that gold will reach $3000 to $5000 in the years to come.

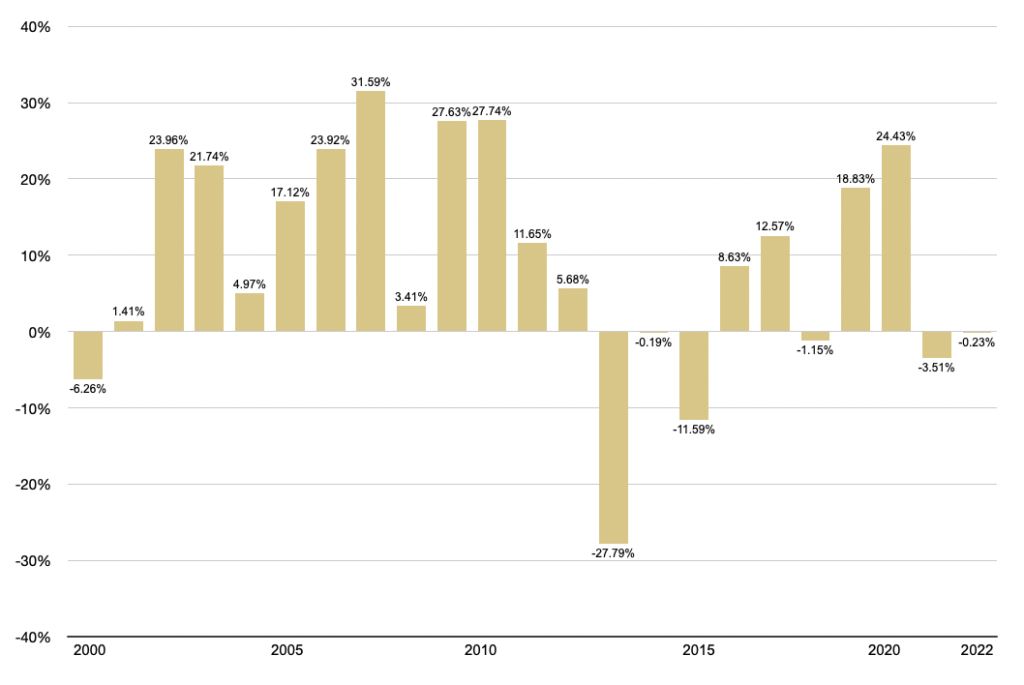

Gold Annual Returns

(Year over year, 2000 to present)

Sources: St. Louis Federal Reserve [FRED], ICE Benchmark Administration

Are you ready to make the ‘generational trade’ part of your holdings?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973