Private: ‘Nixon shock’ still a threat to global economy, 50 years on

South China Post Opinion/Harminder Singh

Repost from 8-25-2021

USAGOLD note: Hong Kong’s government is called to task in this editorial for over-reliance on the U.S. dollar. “Eventually,” says Singh in this opinion piece, ” this house of cards will come down and be replaced by a new monetary system. Central banks and world leaders appear to be preparing for this inevitability.”

Gold starts the week on a subdued note after Friday’s sharp advance

Mobius says 10% of assets should be in gold, stresses physical ownership

(USAGOLD – 8/30/2021) – Gold began the week on a subdued note after Friday’s sharp advance. It is level this morning at $1818. Silver is up 13¢ at $24.22. Press reports attributed Friday’s nearly $25 gain to a confluence of geopolitical, public health, and economic concerns – most notably the Afghanistan fallout, the surging Delta variant, and rising inflation. Mark Mobius, the veteran market analyst, told Bloomberg this morning that investors should put 10% of their assets in gold. “Currency devaluation globally is going to be quite significant next year given the incredible amount of money supply that has been printed.” In this interview, Mobius once again stressed personal ownership of the physical metal as the best course of action for private investors.

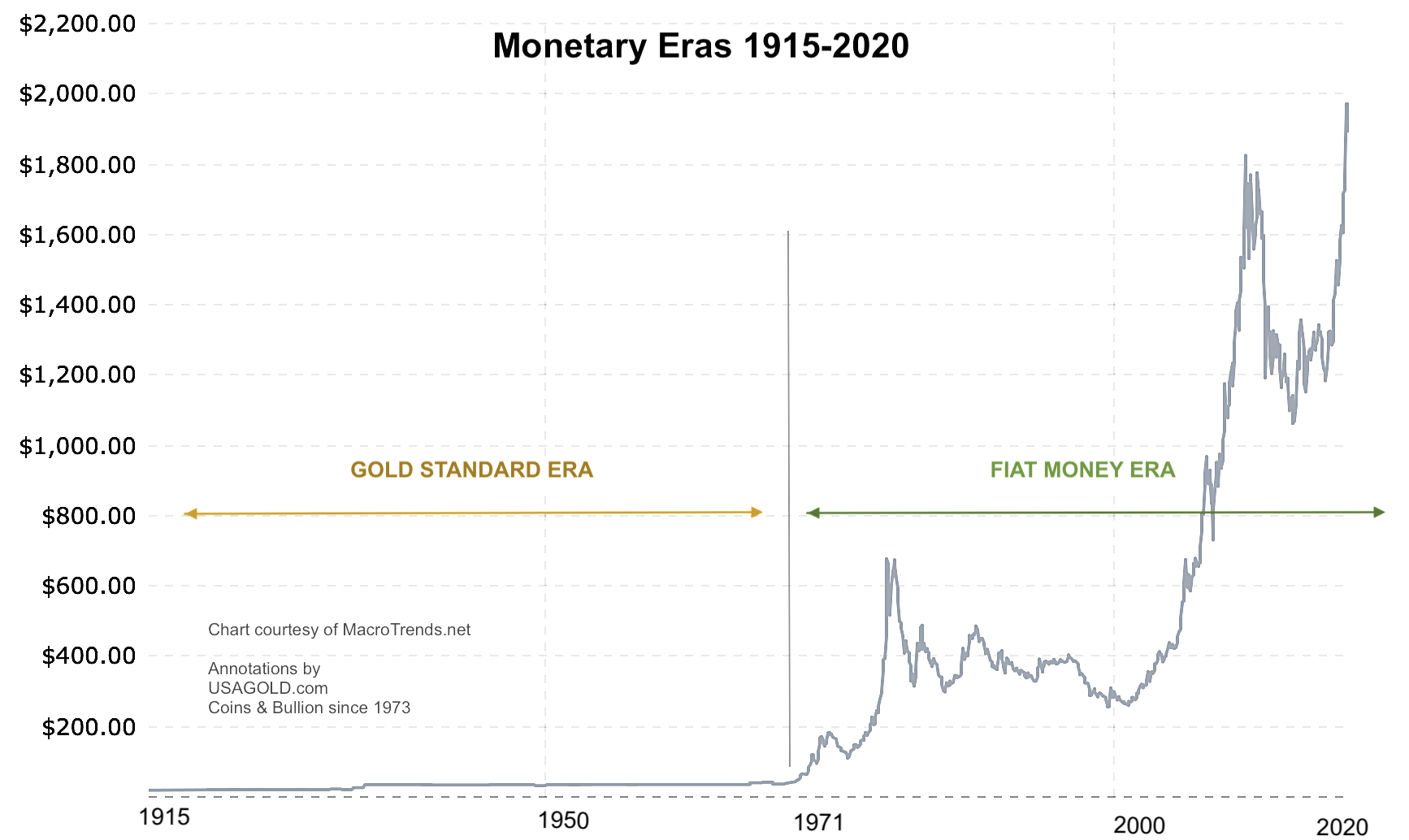

Chart of the Day

Chart note: This chart is central to understanding why gold continues to make sense as a long-term portfolio holding. When the United States abandoned the gold standard in 1971 and freed currencies to float against the dollar, the fiat money era began. We are still in that era today. This chart shows gold’s performance from the early 1900s to 1971 when gold backed the dollar and the era from 1971 to present when it did not. Gold has had its ups and downs since 1971, but clearly, over the long run, in the absence of an official gold standard, individual investors have been well-served by putting themselves on a private gold standard.

Private: European investors pour nearly $1bn into gold ETF in July

Financial Times/Alex Hamer and Emma Boyde

Repost from 8-24-2021

“’Gold is currently in transition,’ said Mobeen Tahir, associate director of research at WisdomTree in Europe, which manages a range of gold exchange traded products.”

USAGOLD note: We missed this article when it was first posted on the FT website on August 10th. Under the radar, inflows into European gold ETFs jumped dramatically in July even as American ETF stockpiles declined. Theoretically, one analyst points out, American investors are buying into the Fed mantra that inflation is transitory. Funds and institutions are the leading buyers of ETF, so perhaps European money managers see inflation and the Delta variant as bigger problems than their American counterparts. In recent years, as shown in the accompanying chart, ETF inflows and outflows have closely coincided with ups and downs in the gold price. So……Is European institutional interest leading the market? Time will tell.

Private: The real significance of Afghanistan to markets may be how it’s shaped Fed succession battle

Repost from 8-25-2021

“But what does matter to financial markets is the decision on who will be the next Federal Reserve chair, as Jerome Powell’s term ends next year. Leave it to Tim Duy, the provocative University of Oregon professor and chief U.S. economist at SGH Macro Advisors, to make the connection.”

USAGOLD note: There is some merit to Duy’s argument. He believes that Powell is the steady choice during a time of turmoil caused by events in Afghanistan. According to Bloomberg, Biden will make his choice around Labor Day, even though Powell’s current term doesn’t end until February. If there is going to be a challenge to Powell, it will likely come in the form of strong support for current Board member, Lael Brainard, pictured above with Powell during a Fed Board of Governors meeting.

Private: The ghost of Arthur Burns

Project Syndicate/Stephen S. Roach

Repost from 5-27-2021

“Memories can be tricky. I have long been haunted by the inflation of the 1970s. Fifty years ago, when I had just started my career as a professional economist at the Federal Reserve, I was witness to the birth of the Great Inflation as a Fed insider. That left me with the recurring nightmares of a financial post-traumatic stress disorder. The bad dreams are back. They center on the Fed’s legendary chairman at the time, Arthur F. Burns, who brought a unique perspective to the US central bank as an expert on the business cycle.”

USAGOLD note: Jerome Powell’s Federal Reserve has taken many of the same positions Arthur Burns took as Fed chairman while overseeing the Great Inflation of the 1970s. In particular, as Stephen Roach reminds us in this essay, Burns “poured fuel on the fire” by allowing real rates to go negative – the policy option the current Fed favors. Roach says overall there are “haunting similarities that bear watching.” Burns was chairman of the Fed from 1970 through 1978 under presidents Richard Nixon, Gerald Ford and Jimmy Carter in a time increasingly being compared to our own.

(Burns is seated left in the photo above with then-Treasury Secretary John Connally and President Richard Nixon.)

Private: Don’t rely on markets to see inflation threat, says Summers

Repost from 7-12-2021

USAGOLD note: In short, don’t look to the markets for a clue as to where we are headed next. At the moment, investors have bought into the transitory theme, but that can change, as well know, in a heartbeat.

Private: Michael Burry’s pretty big short hinges on Treasuries sinking

Bloomberg/Liz McCormick and Ye Xie

Repost from 8-20-2021

USAGOLD note: Burry is essentially betting that the Federal Reserve will retract its support of the U.S. Treasuries market sufficiently to trigger a sell-off in the bond market. Whereas the Big Short ran against the grain in 2008, the Pretty Big Short, as Bloomberg points out, is “largely in line with the calls of most Wall Street strategists.”

Private: Nato allies urge rethink on alliance after Biden’s ‘unilateral’ Afghanistan exit

Financial Times/Helen Warrell, Guy Chazan and Richard Milne

Repost from 8-20-2021

“European allies had hoped Joe Biden’s election to the US presidency would bolster Nato’s relevance after Donald Trump’s acrimonious tenure. Washington’s messy withdrawal from Afghanistan is prompting a rethink.”

USAGOLD note: Financial Times chronicles some of the early geopolitical fallout from the Afganistan withdrawal. An elevated concern for the Biden Administration has to be the 10,000 to 15,000 Americans still stranded there, according to press reports.

Gold drifts marginally higher ahead of Powell speech

Gundlach says gold is going ‘a lot higher,’ dollar losing sole reserve currency status

(USAGOLD – 8/27/2021) – Gold drifted marginally higher ahead of Fed Chairman Powell’s Jackson Hole speech with expectations building he will tread lightly on the tapering front. The metal is also getting an assist this morning from ongoing dollar weakness. It is up $5.50 at $1799. Silver is up 6¢ at $23.68. DoubleLine’s Jeff Gundlach, known on Wall Street as the “bond king,” is well known for his bearish longer-term views on the dollar. This past July, he went so far as to say that the greenback is “doomed” due to rising government deficits. “As long as we continue to run these policies,” he says in an interview posted recently at Yahoo, “and we’re running them more and more aggressively, we’re not pulling back on them in any way, we are looking at a road map that is clearly headed towards the U.S. losing its sole reserve currency status.” Gundlach goes on to say that gold, as a result, is going to go “a lot higher” over the long run.

Chart of the Day

U.S. Dollar Index

Chart note: In that same article (linked above), Gundlach says that the dollar could return to the 80 level (It is now at 93) and eventually take out the recent lows below 75 – a 25% decline.

Private: What is behind Palantir’s $50 million gold bar purchase?

Repost from 8-23-2021

“Palantir bought the gold in case of a ‘black swan.’ We don’t know what that might be, but we have some guesses. It might be a big freaking war, for starters, the chances of which ticked up a bit after the Afghanistan debacle. Or a currency collapse. Or who knows what. We seem to have big black swans every few years, so it’s probably not a bad idea to keep some gold around.”

USAGOLD note: In this article, Dillian delves into what might be behind Palantir’s decision to purchase roughly 28,000 troy ounces of gold in 100-ounce bars and recommends a way of viewing gold we have advocated since the publication of the first edition of The ABCs of Gold Investing in 1996. “As gold investors (I hold a bunch),” says Dillian, “maybe we should stop thinking about gold as a trade or an investment and start thinking about it as an insurance policy.” We first brought attention to Palantir’s purchase last Friday with the observation that they might “know something the rest of us don’t.” The firm, founded by Peter Thiel and Alex Karp, specializes in software programs used by governments.

Private: A $9 trillion binge turns central banks into the market’s biggest whales

Bloomberg/Malcolm Scott, Paul Jackson and Jin Wu

Repost from 7-12-2021

USAGOLD note: To wind or unwind, that is the question. History, though, and the times – as this Bloomberg article makes clear – might make that unwinding an extremely difficult proposition.

The looming stagflationary debt crisis

Project Syndicate/Noriel Roubini

Repost from 7-9-2021

“In April, I warned that today’s extremely loose monetary and fiscal policies, when combined with a number of negative supply shocks, could result in 1970s-style stagflation (high inflation alongside a recession). In fact, the risk today is even bigger than it was then…At some point, this boom will culminate in a Minsky moment (a sudden loss of confidence), and tighter monetary policies will trigger a bust and crash.”

USAGOLD note: Dr. Doom, as he is known on Wall Street, sees symptoms of a breakdown already in motion wherever he looks. He goes so far in this analysis to say that in the end we will get a melding of the 2008 debt crisis and the 1970s stagflation – pretty much a banana republic-style breakdown.

Private: Fed minutes, taper, expectations and Covid bid ill for markets

Blain’s Morning Porridge/Bill Blain

Repost from 8-23-2021

USAGOLD note: The latest ruminations on what really matters in the markets at this point in time from London-based commentator Bill Blain ……

Private: Bitcoin volatility will drive investors back to gold, says mining firm chairman

Repost from 8-23-2021

Gold drifts lower in cautious trading ahead of Powell speech tomorrow

Pento says gold is still the ‘best place to park wealth to maintain purchasing power’

(USAGOLD – 8/25/2021) – Gold drifted marginally lower this morning in cautious trading ahead of Fed Chairman Powell’s speech tomorrow at the Jackson Hole conference. It is down $3 at $1789. Silver is down 16¢ at $23.74. On the one hand, gold is receiving support from safe-haven investors with a growing list of economic and geopolitical concerns. On the other, it is held in check by the prospect of the Fed pulling back on its accommodative monetary policy. The past fifty years of monetary history have shown gold to be the best choice for hedging currency debasement over the long term, according to portfolio strategist Michael Pento.

“Even though gold is not technically an investment (investments are meant to provide a real, after-tax return on your money),” he says in an article posted recently at the Gold Eagle website, “it is the best form of money humans have ever found. And, despite gold being the best place to park your wealth to maintain its purchasing power, it still has a 50-year history of being very competitive with bonds and stocks – even though that comparison isn’t a fair one. Of course, when compared with the Fed’s crappy currency, gold shines brighter than a supernova. For proof of this fact, it took just 35 dollars to buy an ounce of gold in 1971; but today, it takes about $1,800. Sadly, since 1913 the dollar has lost 96% of its purchasing power. (See chart below) Hence, you must evaluate gold in a fair and honest fashion. When doing that, gold proves its value over many millennia. No fiat currency can do that. In fact, all eventually have gone to zero.”

Chart of the Day

Purchasing power of the U.S. dollar

(1913-present)

Source: St. Louis Federal Reserve [FRED], U.S. Bureau of Labor Statistics • • • Click to enlarge

Chart note: Since 1913, the U.S. dollar has lost almost 96% of its purchasing power. Since 1971 and the introduction of the fiat money system, it has lost 85% of its purchasing power. Since 2008 during a period of relative price stability, it still lost over 22% of its purchasing power.

Private: What’s gold got to do with it?

Repost from 8-20-2021

“One big question arises about the Nixon Shock (the end of the dollar’s peg to gold 50 years ago): Did it really matter? Growth carried on in the U.S., and the end of the gold standard didn’t stop economic miracles in much of Asia. It does seem a ludicrously outdated anchor for the world financial system.”

USAGOLD note 1: Financial Times recently noted the present nostalgia for the gold standard, and John Authers addresses its positives and negatives in this opinion piece, as well as the system that replaced the Bretton Woods architecture in 1971. Having spent many years thinking and writing about the gold standard and its absence in the monetary order, we feel justified in saying that, in our view, the best use for gold in monetary affairs is not as an anchor, but simply as an asset on the central bank’s balance sheet.

USAGOLD note 2: If marked to market, it provides a necessary diversification from paper currencies and can be called upon to shore up the national finances in times of need. In short, central banks should use gold like private investors do – as a hedge and savings alternative. As for the debate on a gold-based monetary system versus the paper-based system we now have, we would offer a simple observation: In an imperfect world, there is no such thing as the perfect monetary system.

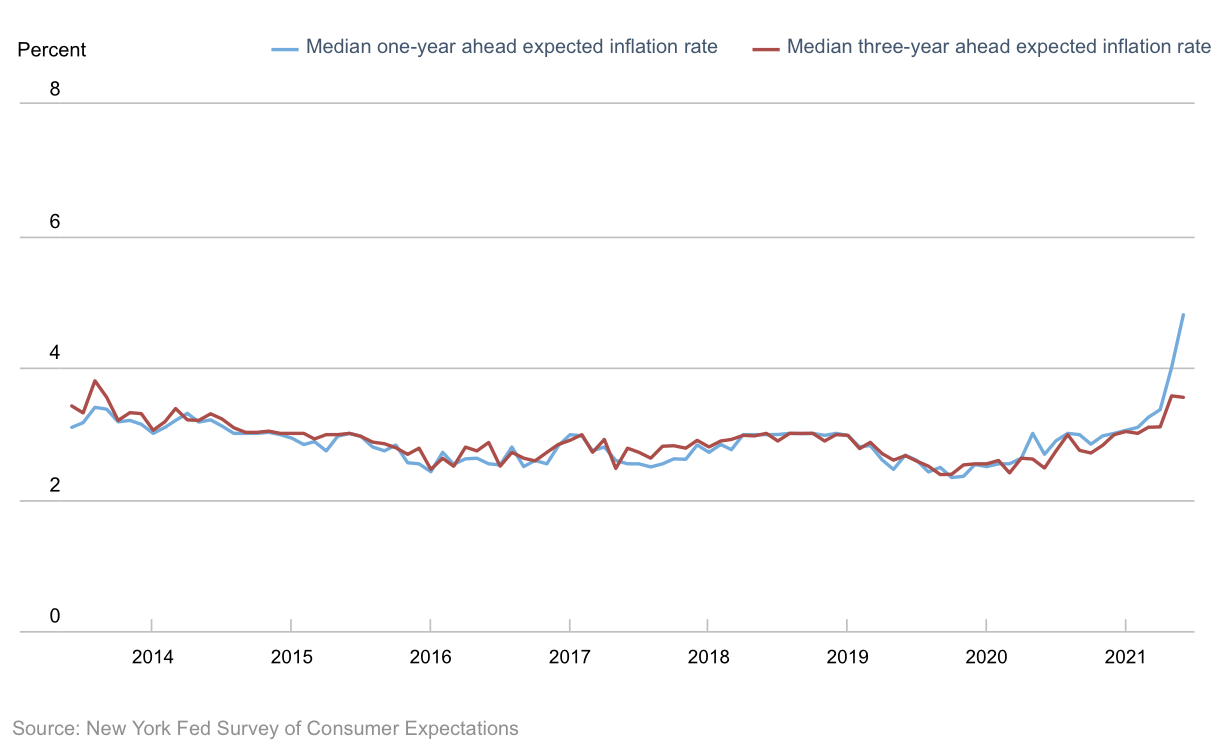

Private: Inflation expectations surge, hitting new high for New York Fed survey

Repost from 7-13-2021

“Despite the Federal Reserve’s assurance that current inflation pressures won’t last, consumers see things differently, according to a survey Monday from the central bank’s New York district.”

USAGOLD note: Inflation expectations surged to 4.8% – the highest reading since inception of the measure in 2013. A good many – consumers and economists alike – will see that 12-month expectation as on the low side.

Survey of Consumer Expectations

(Source: New York Federal Reserve / As of June 2021)

Private: Gold mid-year outlook 2021: Creating opportunities from risks

Repost from 7-9-2021

USAGOLD note: The World Gold Council presents a review of gold’s prospects at mid-year.

Private: The dearth of safe-assets era is over

Repost from 7-27-2021

USAGOLD note: The short answer is “Yes. We should worry.” Why? Because the federal government is producing debt at an unprecedented scale at a time when demand is likely to diminish due to corrosive effects of inflation. In many ways, Schrager states the obvious, but for some, the ongoing bond glut will come as a revelation.

Private: Stagflation in 2022 is the current ‘dominant risk’

Repost from 8-19-2021

USAGOLD note: It’s that last part that will gain some attention, i.e., the possibility that Fed has lost control of inflation.” The more portfolio managers believe it, the higher the demand for gold and silver.