Daily Gold Market Report

The Cost of Growth:

Q4 2023 Reveals Increased Spending and Higher National Debt

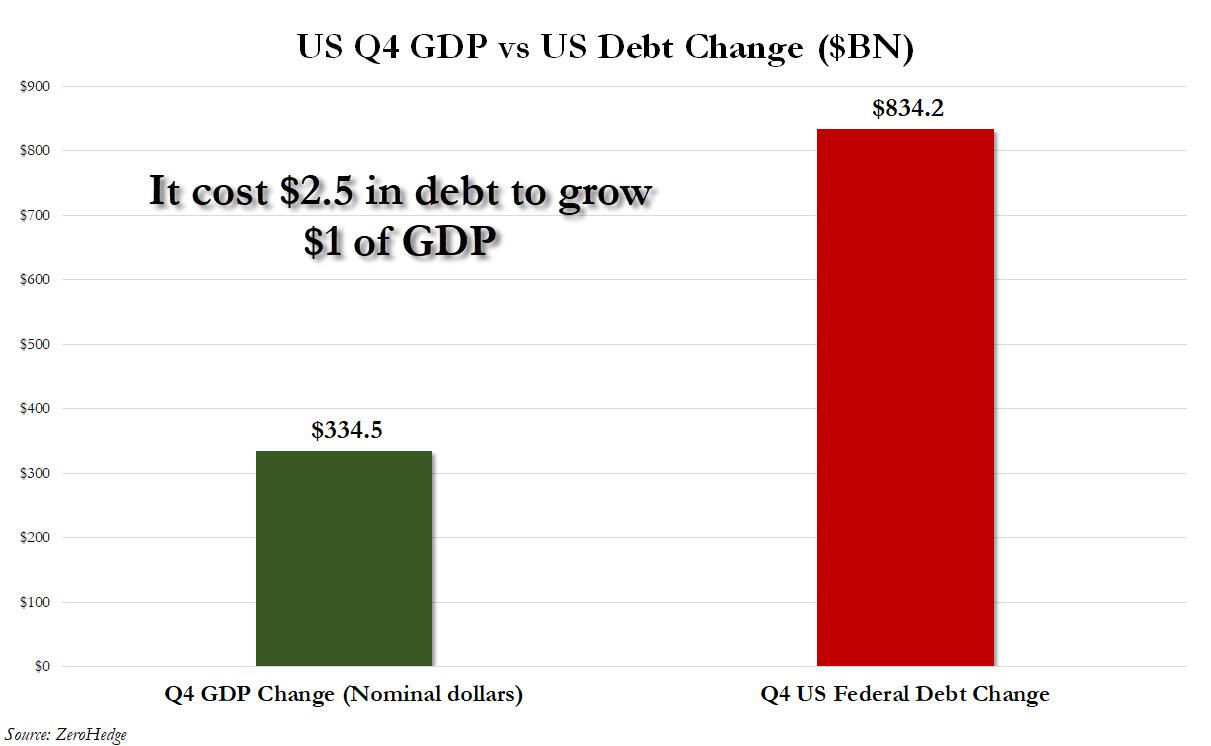

(USAGOLD – 2/29/2024) Gold and silver prices are higher in early trading Thursday, with gold hitting a three-week high, in the aftermath of an important PCE inflation report that came in lower than expected. Gold is trading at $2046.56, up $12.01. Silver is trading at $22.67, up 21 cents. The first revision of the Q4 2023 GDP figures released by the Biden administration’s Bureau of Economic Analysis, indicates a 3.2% growth rate, slightly down from the initial 3.3% estimate and below the consensus estimate of 3.3%. This growth was primarily driven by increases in consumer spending, exports, and state and local government spending, despite a rise in imports which negatively impacts GDP calculations. The revised figures show higher than expected growth in personal consumption, fixed investment, and government spending, although there was a notable decrease in the change in private inventories. Additionally, the figures highlight the substantial increase in national debt, indicating that the economy’s growth was significantly leveraged by borrowing, with $2.5 in debt incurred for every $1 in GDP growth, suggesting an unsustainable financial strategy.