Monthly Archives: January 2024

Today’s top gold news and opinion

1/17/2024

It Won’t Be a Recession—It Will Just Feel Like One (WSJ)

TThe bad news is that, for a lot of people, it is still going to feel like a recession.

Beijing tells some investors not to sell as Chinese stock rout resumes (FT)

TTraders say process of easing and then reimposing informal curbs is undermining market confidence first weeks of the new year.

Gold on steroids? Bitcoin, gold correlation surges in 2023 (Coin Telegraph)

Bitcoin and gold recorded strong performances in 2023 amid geopolitical uncertainties and rising interest rates

Daily Gold Market Report

2024 Housing Market Downturn:

Prices Fall and Buyers Hesitate

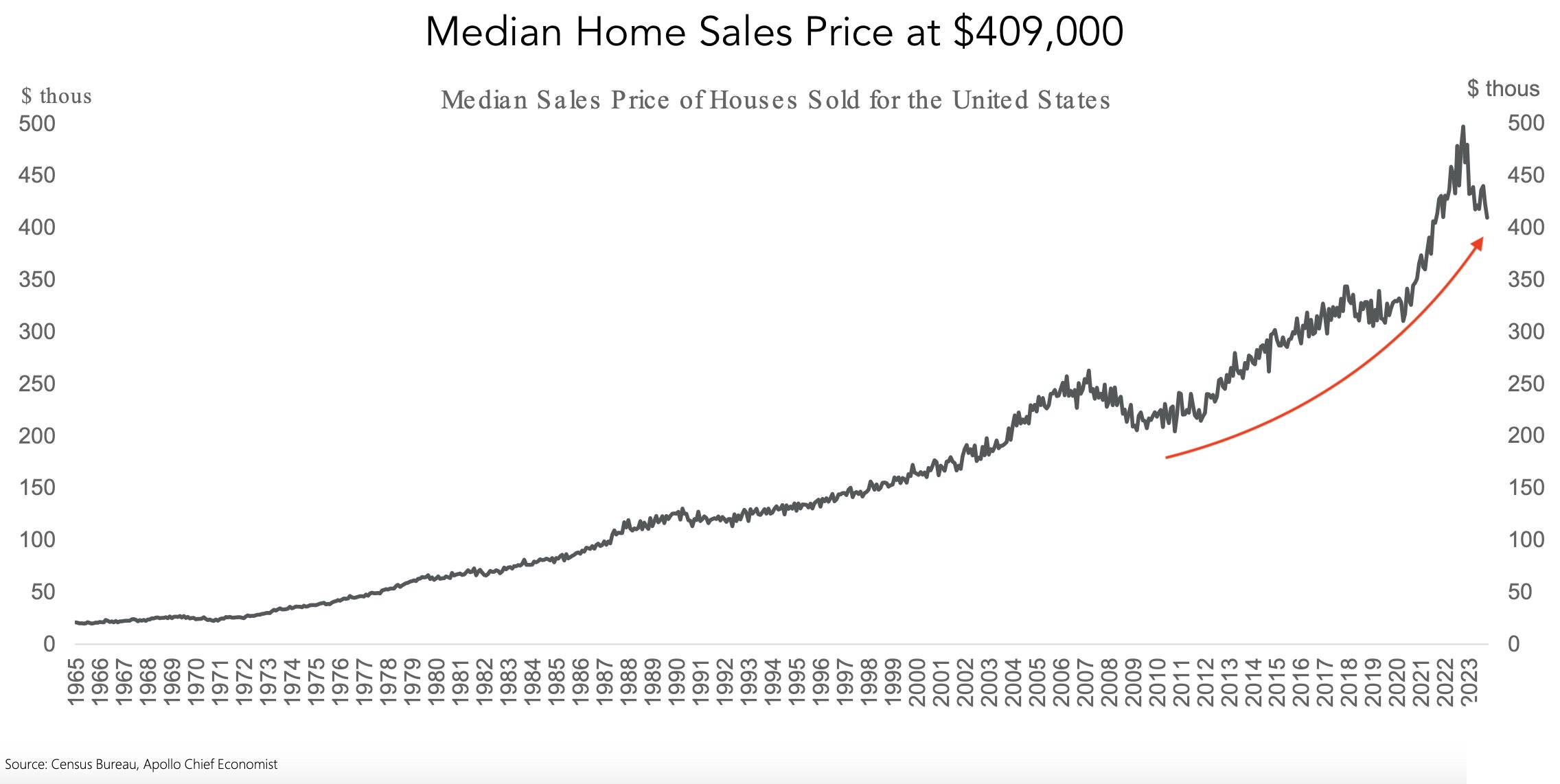

(USAGOLD – 1/17/2024) The gold market is facing challenges in gaining positive momentum, while robust consumption in December maintains support for healthy economic activity. Gold is trading at $2018.73, down $9.71. Silver is trading at $22.63, down 29 cents. Median house prices have fallen nearly 9% since June 2022, indicating a nationwide trend. Despite a decline to a median of $410,000, housing remains unaffordable for many, exacerbated by high mortgage rates. “Redfin’s homebuyer demand index paints a sobering picture for 2024, showing a 9% year-over-year decrease and a staggering 40% drop from 2022 levels. Google Trends data reveals that the search interest in “homes for sale” is at an index level of 47, nearly half of the levels witnessed in the peak pandemic home-buying boom of 2021,” Toni Grzunov of isoldmyhouse.com reports. Could the continued decrease in housing prices revive interest among buyers, or does it indicate deeper issues in the market? As homebuilders reduce prices aggressively, is it possible for their methods to guide traditional home sellers, or are new homes and existing homes on divergent paths? As 2024 unfolds, the real estate market stands at a pivotal point. It remains to be seen if the willingness of sellers to lower prices will create a more equitable and affordable market environment.

Today’s top gold news and opinion

1/16/2024

Goldman Sees India’s Rising Affluent Class Buy Up Premium Goods (Bloomberg)

The country’s affluent class is expected to nearly double to 100 million people within three years

Why the launch of bitcoin ETFs threatens the market for gold (Market Watch)

The bitcoin ETFs are a sign that a new asset class is “emerging into the public’s investable category in a compliant way, just like what gold did about 20 years ago”

Uranium prices hit 12-year high as governments warm to nuclear power (FT)

Prices for the commodity dubbed “yellowcake” have jumped about 12 per cent to $65.50 per pound over the past month

Daily Gold Market Report

Turning Crisis into Opportunity:

Banks Exploit Fed’s Rate Cuts for Profit

(USAGOLD – 1/16/2024) Gold and silver prices are down in early trading Tuesday, coming out of the holiday weekend. Gold is trading at $2038.78, down $17.77. Silver is trading at $22.92, down 30 cents. The Wall Street Journal recently reported on how banks are exploiting the Federal Reserve’s Bank Term Funding Program (BTFP), initially created during the 2023 banking crisis. While intended for emergency lending, banks are now using it for profit, borrowing at low rates and earning higher returns on overnight deposits. This situation arose due to market predictions of Federal rate cuts, which lowered the BTFP’s borrowing costs. The program’s usage increased significantly, not due to new financial stresses but due to this favorable rate differential. The Fed’s vice chairman suggests the program, which is set to expire soon, might not be extended. This situation illustrates banks’ ability to utilize monetary policy changes for financial gain.

Today’s top gold news and opinion

1/12/2024

Why “Inflation Hedge” Gold is Falling, Despite Hot US CPI (City Index)

Both the long- and shorter-term technical pictures for gold remain constructive for a retest or break of $2075 resistance.

Indiana Bill Would Treat Gold and Silver as Legal Tender (Tenth Admendment Center)

Exempt both from assessment and taxation under Indiana’s property tax statute and from the state gross retail tax..

The Periodic Table of Commodity Returns (2014-2023) (Visual Capitalist)

In a departure from other commodities, gold jumped over 13%, driven by investor demand and central bank purchases.

Daily Gold Market Report

Navigating Investment Waters:

Gold’s Enduring Legacy in the Era of Bitcoin ETFs

(USAGOLD – 1/12/2024) Gold and silver prices are sharply up in early trading Friday, on safe-haven buying following news of U.S.-British air strikes against Houthi rebels in Yemen. Gold is trading at $2062.01, up $33.10. Silver is trading at $23.45, up 70 cents. The SEC approved 11 Bitcoin spot ETFs that began trading today with a record $4.6 billon exchanging hands. Charlie Morris of ByteTree highlights how gold ETFs transformed the gold market, the rise of Bitcoin ETFs, and the comparative flows between gold and Bitcoin. The question of gold versus bitcoin is set to become more prominent, and in light of this important occasion, examining Graham Tuckwell’s responses to this query, as outlined in his article in the Alchemist, is merited:

Are gold and bitcoin similar?Yes, in some ways. They have a near fixed supply, earn no return, are cheap to hold and are not fiat currencies.Will gold go more electronic and bitcoin more mainstream?Yes. They are coming from opposite ends of the spectrum and there will be some convergence and overlapping.Will bitcoin replace gold as a safe-haven investment?No. Institutional investors have always wanted allocated gold in their ETFs as it is more secure, and they want to be able to see it is there in the vault. It cannot just be wiped out on a computer screen.Will both gold and bitcoin be sought after?Yes, whilst yields remain low to negative and, better still, if interest rates rise and bond prices fall. Maybe a bet on both gold and Bitcoin will work, but for security, a gold ETF for me please.

Daily Gold Market Report

Rising Debt Delinquency

Millennials and Gen Z Struggle with Debt Payments Across Major U.S. Cities

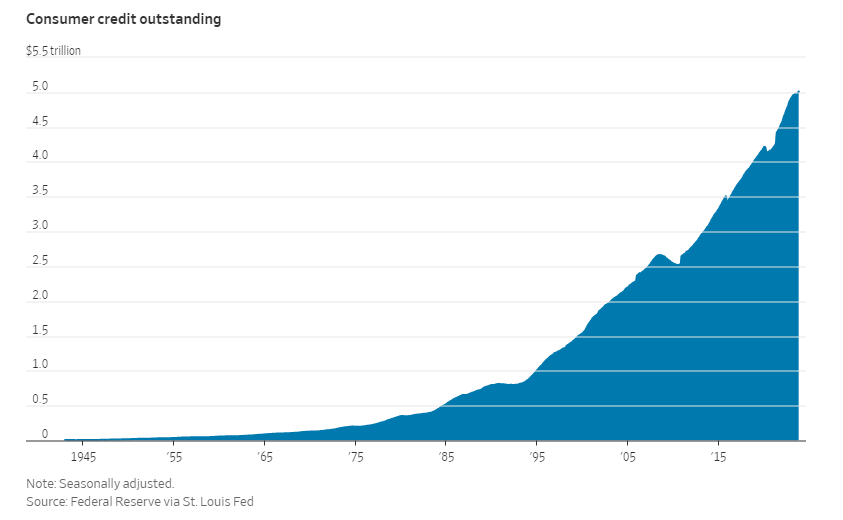

(USAGOLD – 1/11/2024) Gold and silver prices strengthened in early trading on Thursday, but retreated from their daily peaks after a U.S. inflation report was released, which was slightly higher than anticipated. Gold is trading at $2029.33, up $4.92. Silver is trading at $22.91, up 7 cents. LendingTree researchers analyzed the anonymized credit reports of about 310,000 users on the LendingTree platform from July 1 to Sept. 30, 2023, and found that nearly 30% of Americans in the 100 largest metropolitan areas were behind on their debt payments as of late 2023. This includes various debts, such as credit cards, auto loans, personal loans, mortgages, and student loans. Debt delinquency is notably higher in Southern cities, with McAllen, Texas; El Paso, Texas; and Baton Rouge, Louisiana, having the highest rates of late payments. Additionally, the study reveals that millennials and Gen Zers are significantly more likely to be behind on debt payments compared to older generations. Moreover, MarketWatch reports that total consumer credit exceeded $5 trillion for the first time ever.

Today’s top gold news and opinion

1/11/2024

2023 Commodities Report: Winners And Losers In The Global Market (Forbes)

Gold was the number one commodity and only one of two that finished the year in the black, copper being the other commodity

To the Governor: New Jersey Passes Bill to Remove Sales Taxes from Gold and Silver (Tenth Admendment Center)

“In effect, states that collect taxes on purchases of precious metals are inherently saying gold and silver are not money at all.”

Bank of Canada files for ‘digital dollar,’ other related trademarks (Toronto Sun)

In Dec. 13 and Dec. 19 filings, the bank asserted ownership of “digital dollar,” “digital Canadian dollar” and “central bank digital currency”

Daily Gold Market Report

Projecting Silver’s Future

Industrial and Jewelry Sectors Lead Global Demand Growth by 2033

(USAGOLD – 1/10/2024) Gold and silver prices are steady in early trading Wednesday as investors await the December consumer price index report on Thursday and the December producer price index report on Friday. Gold is trading at $2029.32, down 32 cents. Silver is trading at $22.86, down 13 cents. The Oxford Economics report, “Fabrication Demand Drivers for Silver“, predicts significant growth in silver demand across industrial, jewelry, and silverware sectors by 2033. Industrial silver, particularly in electrical and electronics, is expected to grow by 46%, with major consumption in China. Jewelry sector output is forecasted to increase by 34%, with a market shift towards China from India. The silverware sector is projected to grow by 30%, mainly in India, though its global market share may decline.

The report emphasizes the importance of long-term demand forecasting for better-informed supply and resource allocation decisions in the silver industry. It also acknowledges challenges in forecasting, such as the possibility of technological changes in manufacturing processes that could alter silver usage. The overall analysis provides valuable insights for stakeholders in the silver industry, highlighting where and how demand for silver as an intermediate input is likely to evolve over the next decade.

Today’s top gold news and opinion

1/10/2024

The Bond Market Rally Is Overlooking a Soaring $2 Trillion Debt Problem (Bloomberg)

Over the next several weeks, governments from the US, UK and the eurozone will start flooding the market with bonds at a clip rarely seen before

SEC Blames Hack for Incorrect Post About Bitcoin ETF Approval (WSJ)

“It’s a hack,” a spokeswoman for the SEC said.

China’s forex, gold reserves expected to increase in 2024 (China Daily)

The country’s official reserves in gold surged by the largest amount in eight years in 2023.

Daily Gold Market Report

Election Year Surge

How Political Changes Could Boost Gold Prices

(USAGOLD – 1/9/2024) Gold prices are moderately higher and silver near steady in early trading Tuesday. Gold is trading at $2036.40, up $8.33. Silver is trading at $23.09, down 2 cents. Heraeus’ recent Precious Appraisal discusses the potential positive impact of global elections on gold prices, particularly focusing on the US and India. The US faces a potential recession, and the Federal Reserve might cut rates in response, possibly weakening the dollar and boosting gold prices. Over 50% of the world’s population will participate in elections in 76 countries this year, significantly influencing gold demand. The US, undergoing a presidential election, and India, with its price-sensitive gold market, are key players.

Today’s top gold news and opinion

1/9/2024

COT: Weakest commodities conviction since 2015 (SAXO)

Hedge funds holding the smallest end of year net long across 24 major commodities since 2015

Palladium price falls as concern EVs will destroy demand returns to the fore (Mining)

Palladium prices fell by 3% on Thursday as concern the take-up of electric vehicles will destroy long-term demand

Sustainability 101: The Advantages of Recycling Over Mining (Noble6)

Sam Sabin is currently spearheading the development of Sabin Metal Corporation’s sustainability program, focusing on responsible processing for critical metals.

Daily Gold Market Report

Central Banks’ Appetite for Gold

44 Tonnes Added in November

(USAGOLD – 1/8/2024) With no significant new fundamental developments to begin the trading week, gold prices have fallen in early Monday trading, reaching a three-week low. Gold is trading at $2019.75, down $25.70. Silver is trading at $22.96, down 23 cents. In November 2023, central banks globally increased their gold reserves by a net 44 tonnes, with gross purchases of 60 tonnes significantly surpassing gross sales of 15 tonnes, the World Gold Council reports. This trend reflects the sustained momentum in central bank demand for gold. Major buyers were predominantly from emerging markets, with the Central Bank of Turkey leading the acquisitions by adding 25 tonnes, followed by the National Bank of Poland and the People’s Bank of China. Throughout 2023, the People’s Bank of China was the largest gold purchaser, with emerging market banks being the primary drivers of both purchases and sales. Interestingly, the Monetary Authority of Singapore was the only developed market bank adding gold to its reserves, aside from the ECB’s addition due to Croatia joining the eurozone.

Today’s top gold news and opinion

1/8/2024

Perth Mint’s gold and silver sales hit four-year low in 2023 (NASDAQ)

Yearly sales of gold coins and minted bars fell to 665,889 ounces in 2023, down 40% compared to 2022, while silver sales were down 36% from 2022 levels at 14.9 million ounces.

Gold Fever At Dubai Airport Amid Record Sales For Its Biggest Retailer (Forbes)

The main duty-free retailer at the world’s busiest international airport, Dubai International, has reported a new all-time revenue record with sales in 2023 reaching 7.885 billion UAE dirhams ($2.16 billion)

Gold glitters amidst geopolitical uncertainty (LGT)

A further rise in geopolitical risk could fuel an increase in gold prices from current levels

Today’s top gold news and opinion

1/5/2024

Gold steadies as traders await jobs data for Fed cues (NASDAQ)

Fed meeting released on Wednesday showed officials were convinced inflation was coming under control

Will Gold Dazzle or Disappoint in 2024? (ETF)

Investors confront compelling cases both for and against gold and related ETFs.

Whether It’s Solid Gold or an ETF, Tokenizing Assets Demands Interoperability (NASDAQ)

Tokenized gold and other precious metals are a logical asset class for tokenization

Daily Gold Market Report

Decade of Stability

Gold’s Consistent 4% Q1 Performance Over 10 Years

(USAGOLD – 1/5/2024) The gold market is flat as the U.S. labor market remains robust, generating a higher number of jobs than anticipated in December. Gold is trading at $2042.06, down $1.59. Silver is trading at $23.04, up 2 cents. Over the past decade, gold has demonstrated a consistent yet moderate performance, yielding an average return of approximately 4% in the first quarter of each year. This steady increase reflects its enduring status as a safe-haven asset, particularly in times of economic uncertainty. Despite fluctuations in the market and changes in global economic conditions, gold’s 10-year performance in Q1 underscores its appeal to investors seeking a reliable store of value and a hedge against inflation and currency devaluation. Its behavior during this period reinforces its role in diversifying investment portfolios and preserving wealth over the long term.

Daily Gold Market Report

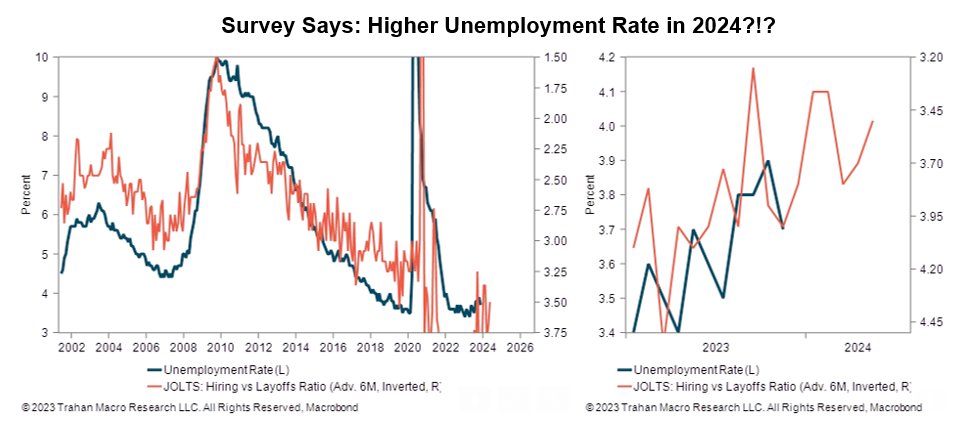

Bracing for Impact

Navigating Layoffs, AI Disruption, and the Unsteady Job Market

(USAGOLD – 1/4/2024) Gold prices dropped lower this morning as the count of U.S. workers filing for initial unemployment benefits significantly decreased in the final week of 2023. Gold is trading at $2039.98, down $1.51. Silver is trading at $22.76, down 23 cents. As the stock market fails to stage a “Santa Claus rally” in a rough start to 2024, reality is starting to set in. The Resume Builder survey forecasts mass layoffs in 2024, with nearly half of companies affected, primarily due to anticipated recessions and the rise of AI. “In the survey, nearly four in 10 companies said they are likely to have layoffs in 2024, prompting increased fears of a recession around the corner. More than half of companies also said they plan to implement a hiring freeze in 2024,” Suzanne Blake of Newsweek reports.

Today’s top gold news and opinion

1/4/2024

The Hottest Property in Gold Mining Is Copper (WSJ)

Gold miners recently celebrated the precious metal fetching its highest price ever and they are reinvesting much of that windfall in copper.

Royal Mint sees 7% uptick in investors (Portfolio Advisor)

Investors used a variety of methods to enter the precious metal market, with 77% using either the Mint’s digital platform, DigiGold, or purchasing fractional coins and bars.

An insight into Russia’s view on gold (Macleod Finance)

Golden rouble 3

Daily Gold Market Report

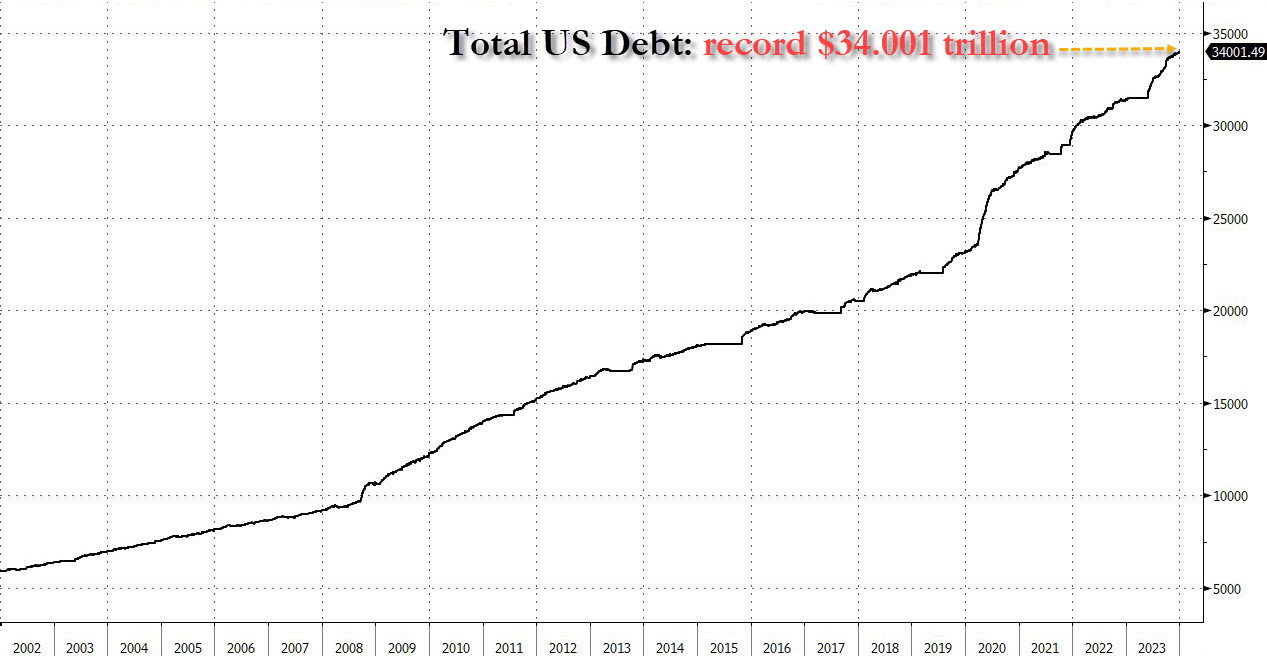

U.S. Debt Hits Record $34 Trillion as Congress Faces Crucial Funding Deadlines

3 Months After We Hit $33 Trillion…

(USAGOLD – 1/3/2024) Gold and silver prices are sharply lower in early trading. Traders are starting to look ahead to Friday’s U.S. employment situation report for December. Gold is trading at $2034.82, down $24.14. Silver is trading at $23.00, down 66 cents. The U.S. public debt has surpassed $34 trillion, marking a concerning milestone as Congress prepares for imminent funding debates. The rise in debt is attributed to increasing federal deficits, driven by lower tax revenues and higher expenditures. As Congress reconvenes, it faces deadlines to resolve spending for the fiscal year, with Republican calls for reduced discretionary spending and discussions over emergency aid for Ukraine and Israel. The potential failure to pass spending bills risks a government shutdown, and the upcoming elections further complicate negotiations. Maya MacGuineas of the Committee for a Responsible Federal Budget highlighted the gravity of the situation, urging for decisive actions to mitigate the escalating debt through measures like tax increases, spending cuts, or the formation of a fiscal commission.

Today’s top gold news and opinion

1/3/2024

Gold begins new year restrained by stronger dollar (Reuters)

Rate cuts could lift gold to record highs

Gold in 2024 (Goldmoney)

It is hardly surprising, bearing in mind that gold is legal money and currencies are credit with counterparty risk.

Americans Understand Inflation (Daily Reckoning)

Gold ‘Cheap’ at $2050