Daily Gold Market Report

Gold trades cautiously to the downside ahead of inflation reports, bond sales

World Gold Council reports solid coin and bar demand for Q2-2023

(USAGOLD – 8/7/2023) – Gold is trading cautiously to the downside as it begins a week that includes the all-important consumer and wholesale inflation reports. It is down $7 at $1939. Silver is down 21¢ $23.50. Also on the agenda is a massive offering of Treasury notes and bonds, sure to be closely monitored by bond market participants.

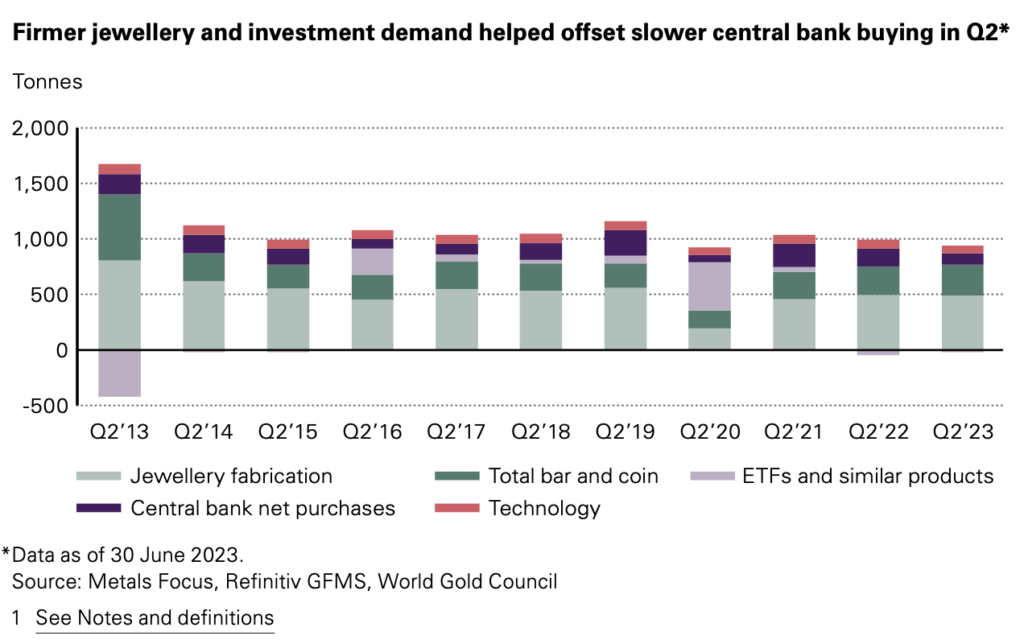

The World Gold Council reports a net deceleration in central bank purchases during the second quarter (year over year) but a solid increase in bar and coin demand (+6%). Despite the decline in central bank demand from above-average in last year’s second quarter, WGC still sees it as “resolutely positive.” Total demand is up 7% over the same quarter last year.

Chart courtesy of the World Gold Council • • • Click to enlarge