Daily Gold Market Report

Gold down marginally as future Fed policy keeps traders on hold

Lundin says gold may be emerging from summertime lull ahead of schedule

(USAGOLD –7/19/2023) – Gold is down marginally in early trading as future Fed policy kept traders on hold. It is down $3 at $1978.50. Silver is up 3¢ at $ 25.16. Financial Times reports this morning that big banks are turning more bearish on the dollar as expectations of a soft landing grow. In keeping with that sentiment, Gold Newsletter’s Brien Lundin sees signs that “gold may be violating the typical seasonal trend by rallying ahead of schedule.”

“If seasonality were the only factor in play for gold,” he says, “I would expect gold to languish another couple of weeks or longer. But seasonal trends join a long list of other factors – for gold and every other asset class – in being overwhelmed by the influence of Federal Reserve monetary policy.… But a funny thing seems to be happening, right now, on the path to Powell & Co.’s next promised rate hikes. With inflation falling according to plan, the markets are looking beyond the central bankers’ next over-reaction via continued hikes and considering the big picture.”

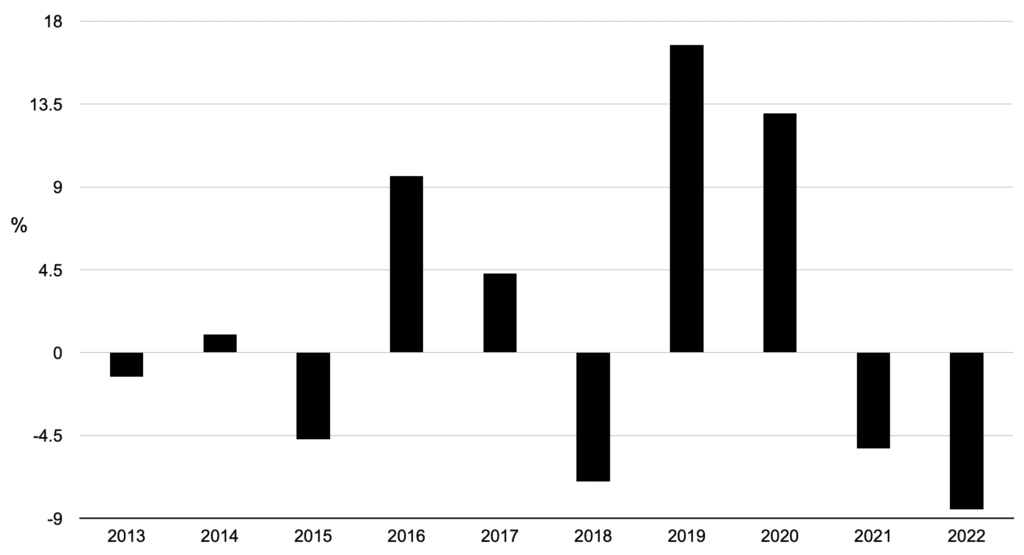

Editor’s note: Though summertime trading has a history of being sluggish, it doesn’t always mean the price will drop. Over the past decade, gold’s performance has been evenly split – five down years and five up years.

Gold’s price performance June through August

(2013-2022)

Chart by USAGOLD [All Rights Reserved]