Daily Gold Market Report

Gold is off to a quiet start after last week’s strong showing

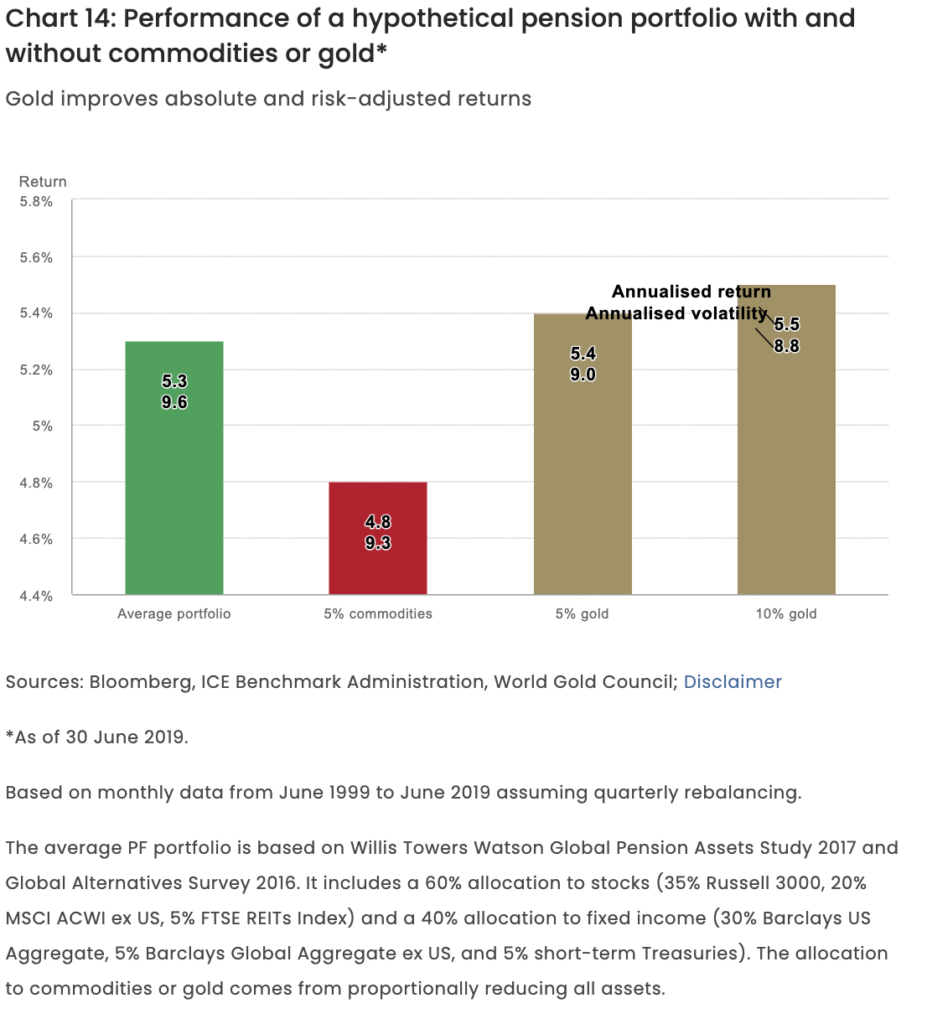

MarketWatch’s Arends says a portfolio that owns gold performs better than one that doesn’t

(USAGOLD – 7/17/2023) – Gold is off to a quiet start after last week’s strong showing. It is up $2.50 at $1960.50. Silver is down 12¢ at $24.91. MarketWatch columnist Brett Arends says that so far this year, you would have been better off in a portfolio that included a 10% gold diversification than one that didn’t. Moreover, it has outperformed the traditional 60/40 portfolio consistently for a very long time. He goes on to say that it isn’t so much that gold is a “great long-term investment on its own” but that it tends to do well when stocks and bonds don’t.

“The first thing is that over the past century,” he says in a recent column, “including some gold in your portfolio alongside stocks and bonds has genuinely added value. It has produced higher average returns, less volatility and fewer of those disastrous ‘lost decades’ where your portfolio ended up whistling Dixie.… The portfolio including 10% gold has beaten the traditional 60/40 by an average of 0.4 percentage point a year since President Richard Nixon finally killed the gold standard in 1971.”

Chart courtesy of the World Gold Council