Daily Gold Market Report

Gold stuck in rangebound trading

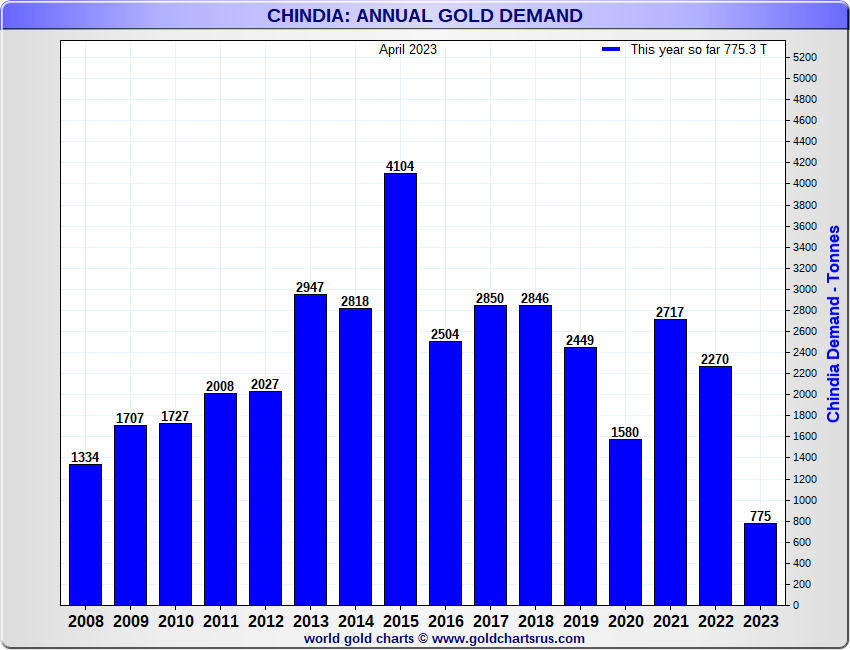

China and India account for 50% of annual gold demand

(USAGOLD – 7/5/2023) – Gold is marginally higher in quiet, rangebound trading, still dominated by rate and inflation concerns. It is up $3 at $1930. Silver is down 13¢ at $22.89. The “Great Gold Migration” from West to East has been a foundational element in gold’s strong showing over the past several years. Asia’s share of annual global demand has gone from 45% to 60% over the past three decades. China and India, the two largest consumers of physical gold, now account for almost 50% of global demand.

“The steady eastward migration of gold over the last three decades,” says Eric Gozenput in an article published last week at Value Walk, “underlines Asia’s growing economic prowess and its long-held belief in gold as an unwavering store of value. As the world moves into an increasingly uncertain future, this trend serves as a valuable lesson in financial resilience and the timeless value of gold.”

Chart note: According to the World Gold Council, the gold supply was 4,755 tonnes in 2022. Mine production was 3,612 tonnes.