Daily Gold Market Report

Gold up marginally as investors mull over a historical oddity

HedgeNordic cites gold’s 7.7% annual return since 1971

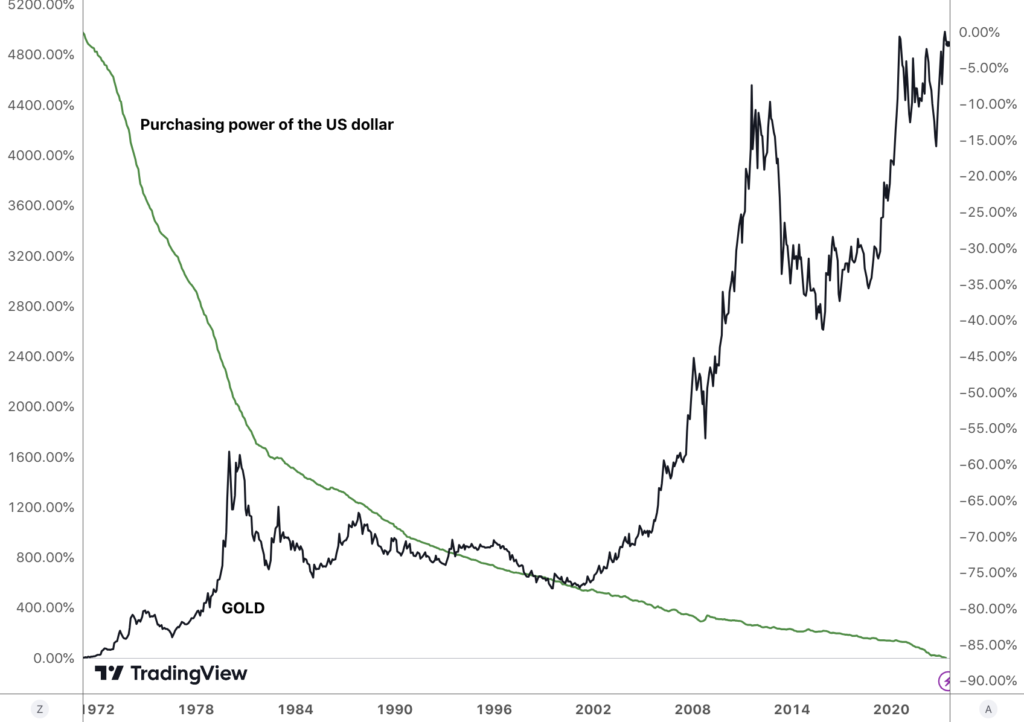

(USASGOLD – 6-20-2023) – Gold is up marginally this morning as investors mulled over the historical oddity of a Fed signaling higher rates to a financial community that believes it can’t or won’t follow through. It is up $3.50 at $1955. Silver is down 20¢ at $23.87. There is justification for the skepticism given the Fed’s long history of addressing crises with easy money policies – policies, Sweden’s HedgeNordic points out, that have undermined the purchasing of the dollar since 1971 and driven gold higher.

“Gold,” It says in a recently published advisory, “has delivered an annual return of about 7.7 percent in U.S. dollar terms since August 15, 1971, the day U.S. President Richard Nixon removed the U.S. dollar from the gold standard. Eric Strand, a precious metals specialist who manages the fund boutique AuAg Funds, offers a different perspective on this development. At an annual rate of 7.7 percent, ‘the U.S. dollar has experienced a cumulative devaluation of 97 percent relative to gold since the historic date of August 15, 1971.’ Strand considers gold as the unchanging benchmark and measures the development of fiat currencies in relation to gold.”

Gold and the purchasing power of the US dollar

(%, 1971 to present)

Chart courtesy of TradingView.com • • • Click to enlarge