Short and Sweet

“The first stop of $10,000 is actually not that far away.”

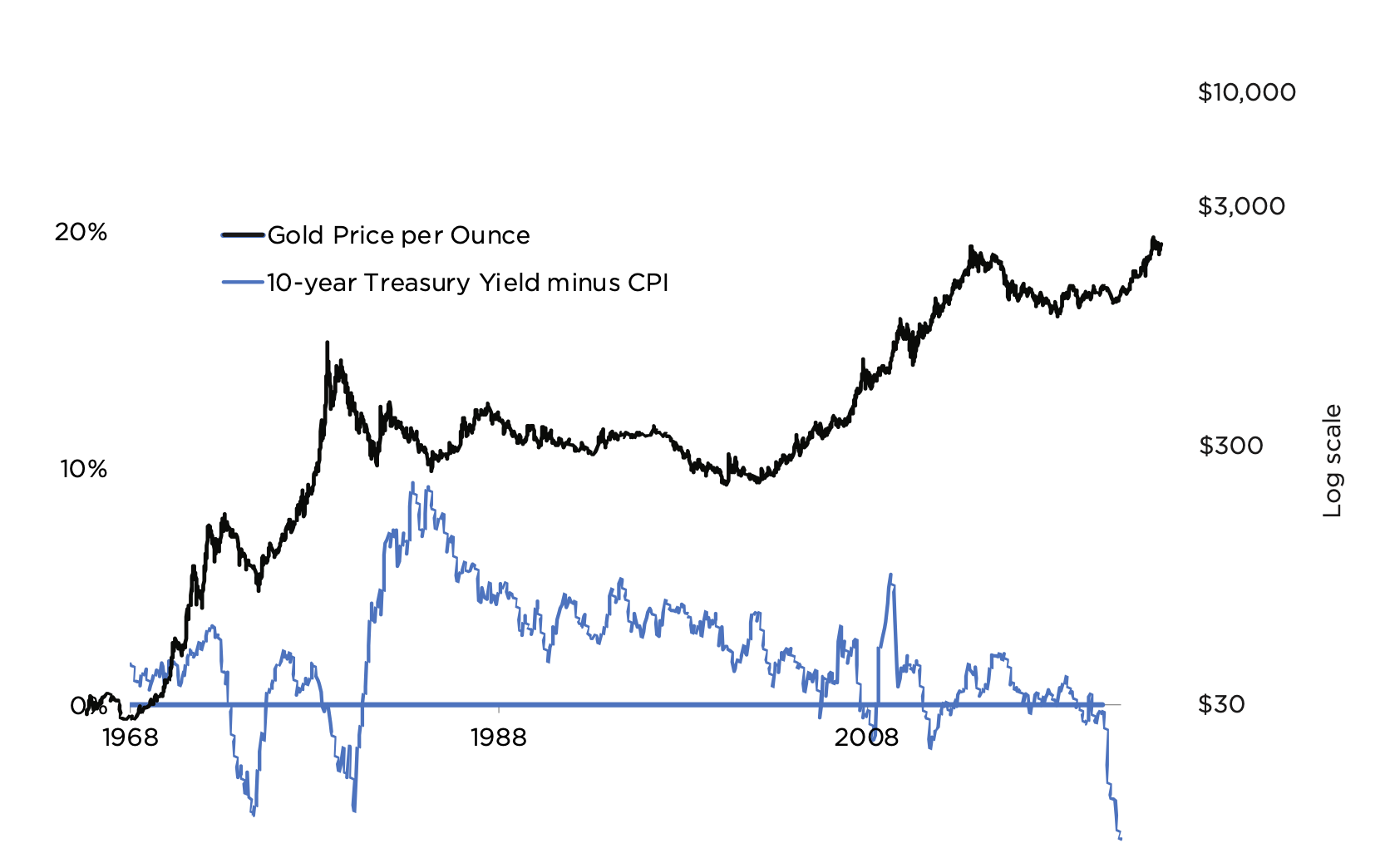

One of the more intriguing analyses of the gold market comes from Myrmikan Research’s John Oliver. He inquires into gold’s rangebound behavior under these extraordinary circumstances and concludes, “what propels gold into the multi-thousands of dollars per ounce—is sharply rising rates that destroy the value of the Fed’s assets and make further federal deficit spending impossible. Without a political reason to buy the dollar, it will seek out its economic value.” It’s all in the math, and more specifically, he says that when looking at gold, investors “are going to have to get used to logarithmic scales.” In early 2022, Myrmikan projected a gold price of $5000 per ounce at some point down the road to give one-third backing to the Fed’s balance sheet. Now, says Oliver, it would take a gold price in excess of $11,000 to achieve the same backing. Consulting projections on gold’s logarithmic chart, he says, “the first stop of $10,000 is actually not that far away.”

Gold and 10-year Treasury yield minus CPI

(Log scale)

Chart courtesy of Myrmikan Research

________________________________________________________________________

Do precious metals look undervalued to you?

DISCOVER THE USAGOLD DIFFERENCE

Reliably serving physical gold and silver investors since 1973