Gold turns solidly to the upside on inflation, war and bond market concerns

Harvard paper projects a 40% probability of another financial crisis ‘within the next three years’

(USAGOLD – 4/11/2022) – Gold turned solidly to the upside this morning as investors worried about tomorrow’s consumer inflation report, an escalation in the Ukraine conflict, and the bond market’s deepening sell-off. It is up $17 at $1966. Silver is up 55¢ at $25.35. As we reported here last week, safe haven investors bought bullion coins and bars at a record pace in the first quarter, with the U.S. Mint reporting the strongest demand in 23 years. The interest in physical metal is not restricted to the United States alone. Bloomberg recently reported gold firms from “Vienna and Singapore to New York” being “swamped by demand” for the physical metal.

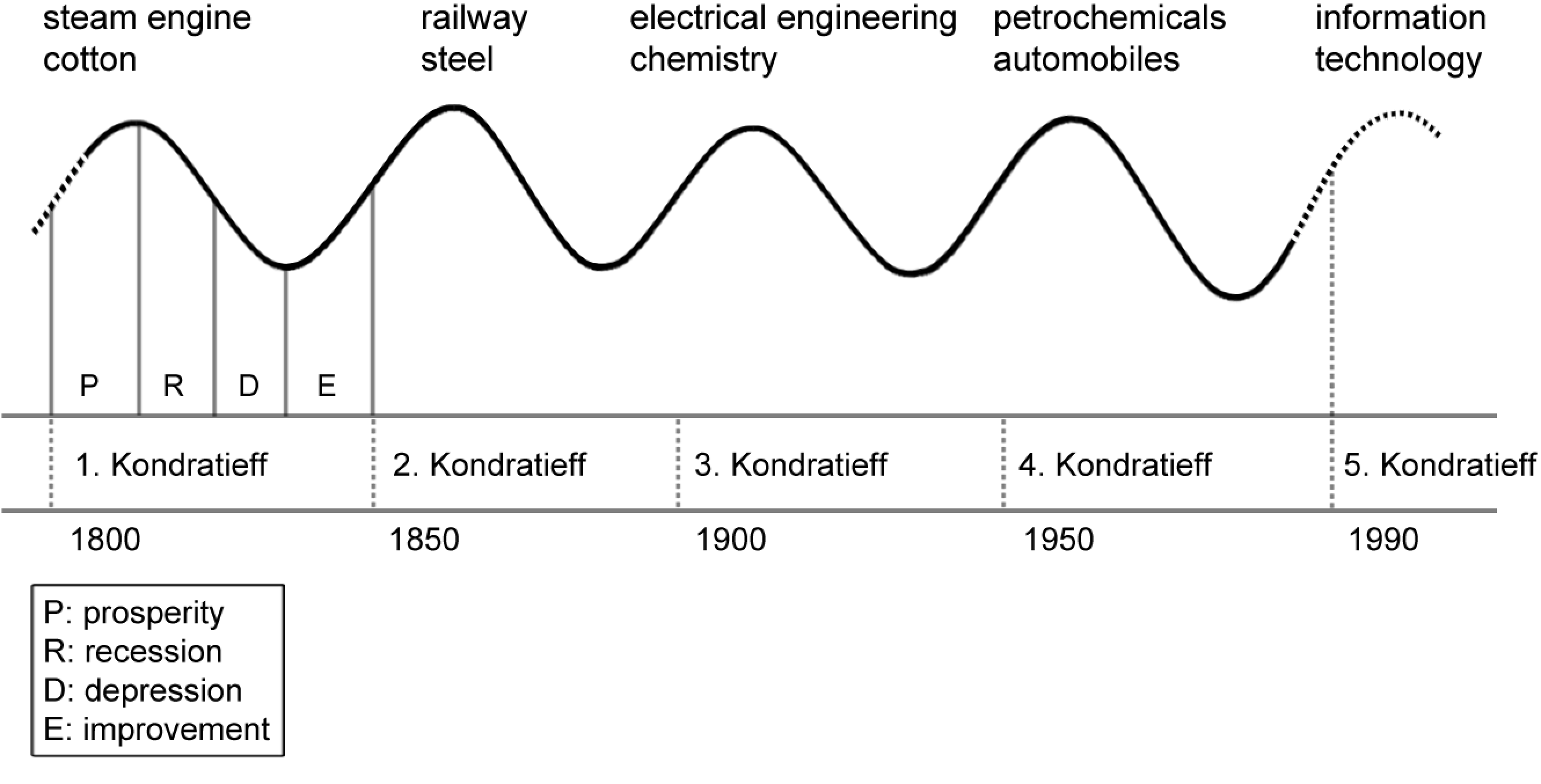

The 50-year Kondratieff Cycle

(Historical industry drivers included)

Along these lines, the Harvard Business Review published a faculty paper over the weekend likely to cause a stir in financial markets already standing on shaky ground. “The combination of rapid credit and asset price growth over the prior three years,” reads the abstract for the report, “whether in the nonfinancial business or the household sector, is associated with about a 40% probability of entering a financial crisis within the next three years. This compares with a roughly 7% probability in normal times, when neither credit nor asset price growth has been elevated. Our evidence cuts against the view that financial crises are unpredictable ‘bolts from the sky’ and points toward the Kindleberger-Minsky view that crises are the byproduct of predictable, boom-bust credit cycles.”

Image attribution: Kondratieff_Wave.gif: Internaszonalderivative work: Agmen [Copyrighted free use]