Gold remains subdued despite record food inflation, strong physical demand

Gold coin sales post second-highest first-quarter total since 1999

(USAGOLD – 4/8/2022) – Gold remained curiously subdued this morning despite reports of record highs in global food prices and a growing sense that the Fed will stay behind the curve on inflation. It is level at $1934. Silver is down 10¢ at $24.58. The U.N. reported a record high for its FAO Food Price Index overnight and a 33.6% gain over the past year. Next Tuesday, the Labor Department will release its reading on U.S. consumer inflation.

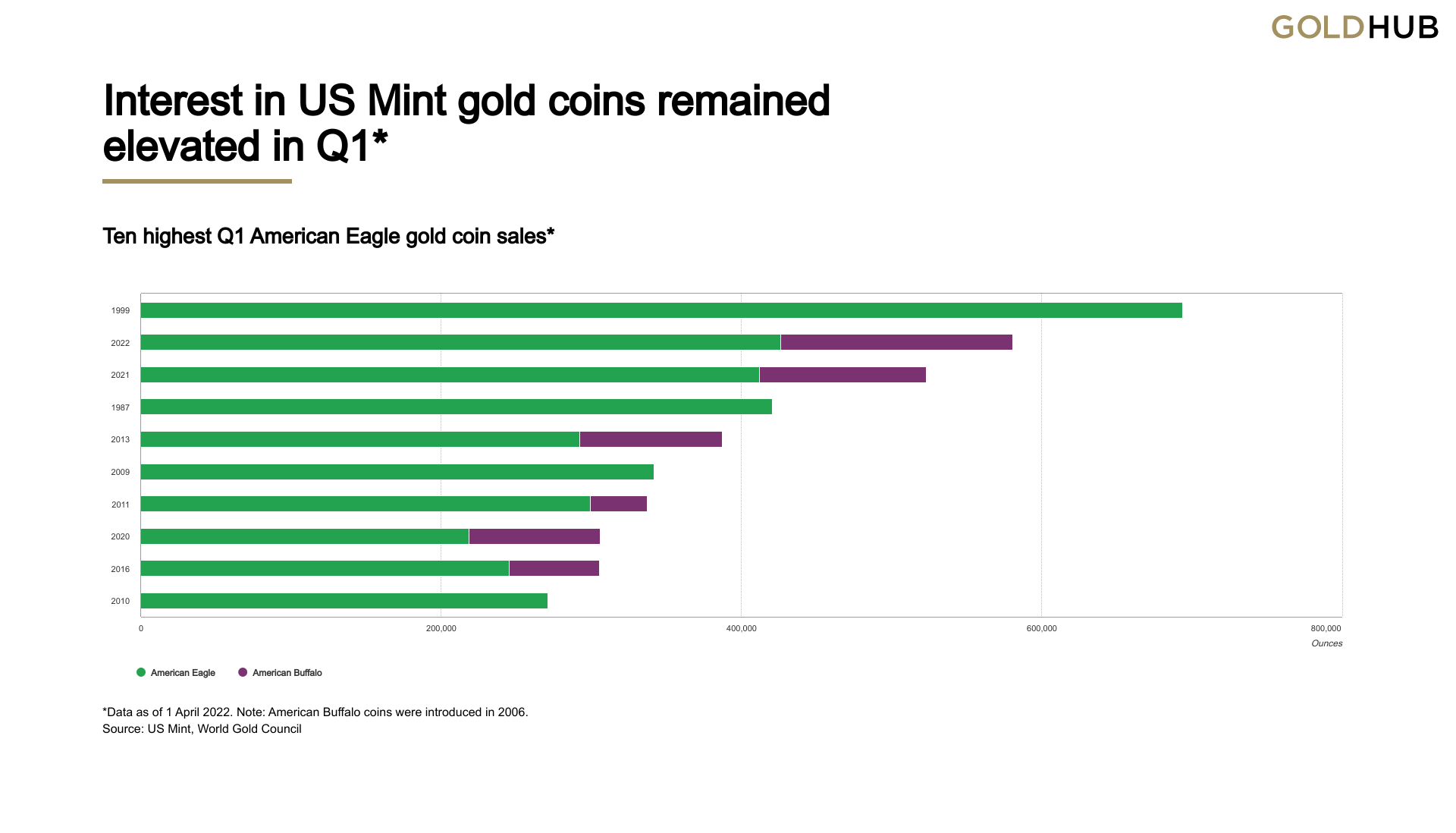

Physical demand for gold continues to run at impressive levels, with ETFs showing a substantial 350-tonne stockpile gain in the first quarter and coin and bullion sales continuing at a near-record pace. “U.S. Mint data,” reports the World Gold Council this morning, “shows that gold coin sales (American Eagle and Buffalo) totalled $427 million (220,000 oz) in March. This pushed Q1 total U.S. gold coin sales to over $1bn (518,000oz), the second-highest Q1 sales total in volume terms since 1999. This performance clearly shows that the strong retail interest in physical gold investment products from last year has continued into 2022.”

Chart courtesy of the World Gold Council-Gold Hub • • • Click to enlarge