Gold drifts sideways despite growing concerns

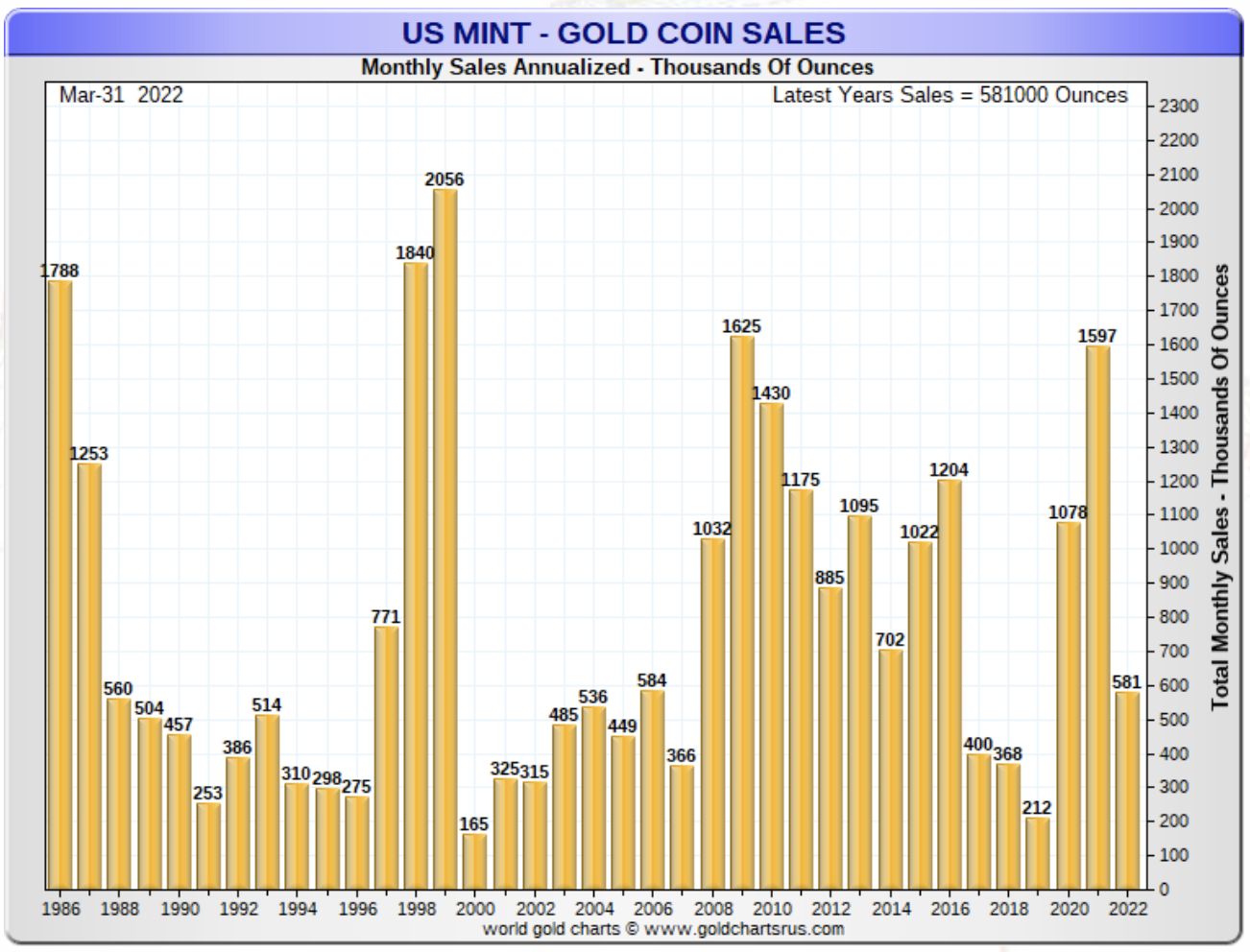

U.S. Mint experiences strongest demand for American Eagle gold bullion coins in 23 years

(USAGOLD – 4/5/2022) – Gold drifted sideways in early trading despite a selloff in bond markets globally, loud volleys in the ongoing economic war between Russia and the West, and escalating consumer concern about rapidly rising prices. It is down $2 at $1933. Silver is up 15¢ at $24.76. Though the price of gold has been rangebound over the past several weeks, demand for the physical metal continues unabated. Yesterday Kitco News reported the U.S. Mint experiencing the strongest quarterly demand for American Eagle gold bullion coins in 23 years.

“People increasingly realize that high inflation is not temporary but has come to stay – and most likely get even worse, especially in Europe,” said Thorsten Polleit, chief economist at Degussa, in that same report. “The war in Ukraine represents a huge risk for the eurozone. For instance, if the inflow of oil and gas and coal from Russia into Europe comes to a shrieking halt, a very severe recession with mass unemployment and the collapse of various industries would be most likely.” Saxo Bank’s Ole Hansen added that “physical as well as investment demand remains solid for the simple reason investors (retail and professional) see inflation everywhere.”