Gold on the mend this morning, back over the $2000 mark

Goldman’s Currie sees gold going to $2500 on ‘strongest physical demand we’ve ever seen’

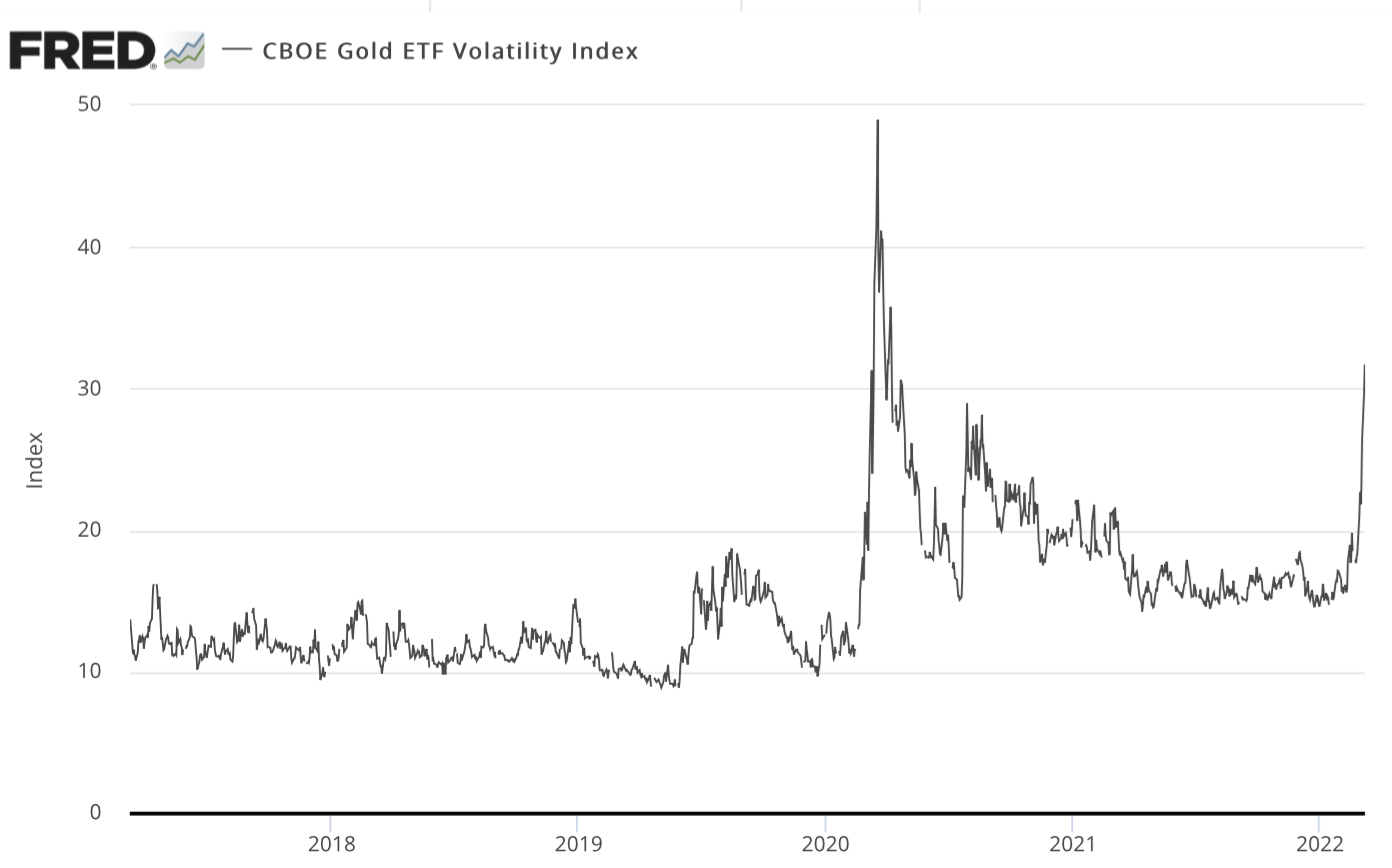

(USAGOLD – 3/10/2022) – Gold is on the mend this morning ahead of today’s all-important inflation report due later this morning. It is up $14 at $2010. Silver is up 12¢ at $25.99. Gold is being helped along by a recovery in commodity pricing led by oil, stonewalling at initial talks between Ukraine and Russia, and ongoing safe-haven capital flows. A combination of profit-taking and short-covering has led to a level of gold volatility not seen since the early days of the pandemic in 2020. The chart and circumstances suggest it may have a ways to go before things settle down.

“It’s a perfect storm for gold,” says Goldman Sachs commodities analyst Jeff Currie in a Bloomberg interview, “There’s three legs to the story. One, you have really strong investor demand for gold over concerns about inflation, recessions, downturns. The second leg of it is central bank buying. … And finally, you can’t forget demand for gold from places like China and India … You put it all together; it’s the strongest demand from all three channels that we’ve ever seen.” Currie goes on to say that Goldman’s target for gold is $2500.

Gold volatility

Sources: St. Louis Federal Reserve [FRED], Chicago Board of Options Exchange