Gold gives up some of its war premium in volatile trading

Commodities on ‘tear this year,’ but gold could play ‘catch-up’ as year progresses, says WGC

(USAGOLD – 3/14/2022) – Gold gave back some of the war premium gained over the past few weeks after Ukraine’s president Zelensky reported “positive movement” on ceasefire talks with Russia. It is down $23 at $1969, with the market still exhibiting a high degree of volatility. Silver is down 50¢ at $25.46. Commodities, in general, are down sharply this morning despite bond market weakness and a declining U.S. dollar. The World Gold Council points out that commodities have been “a tear” this year, but if history is an indicator, gold could quickly play catch-up as 2022 progresses.

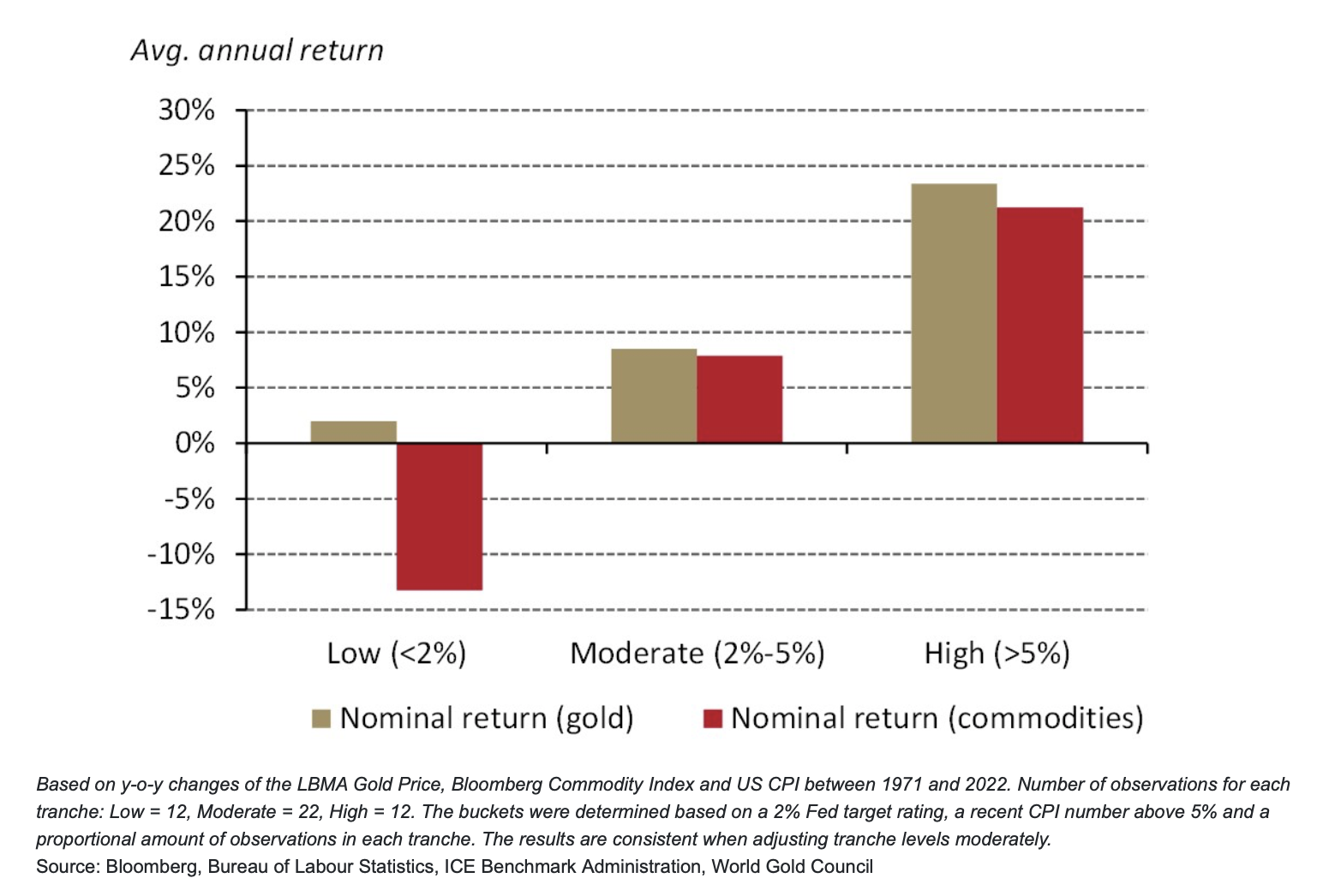

“While an inflationary environment is generally supportive for commodities,” it writes in a report released late last week, “gold has historically outperformed broad-based commodities. Historical analysis shows that gold returns averaged 25% in years when inflation was above 5%. Commodities have returned just over 20% – but that includes the strong commodity performance over the past 15 months. To put things into perspective, February’s US CPI showed a 7.9% y-o-y increase. Gold has historically lagged broader commodities in the preliminary stages of commodity reflationary periods, like the current one. Ultimately, it has tended to outperform, which could be replicated in the current case as it plays ‘catch-up’ in 2022.”

Gold versus commodity indices as a function of inflation

Chart courtesy of World Gold Council