Gold’s back in plus column this morning

Saxo Bank says demand driven by inflation hedging, skepticism on central bank policies

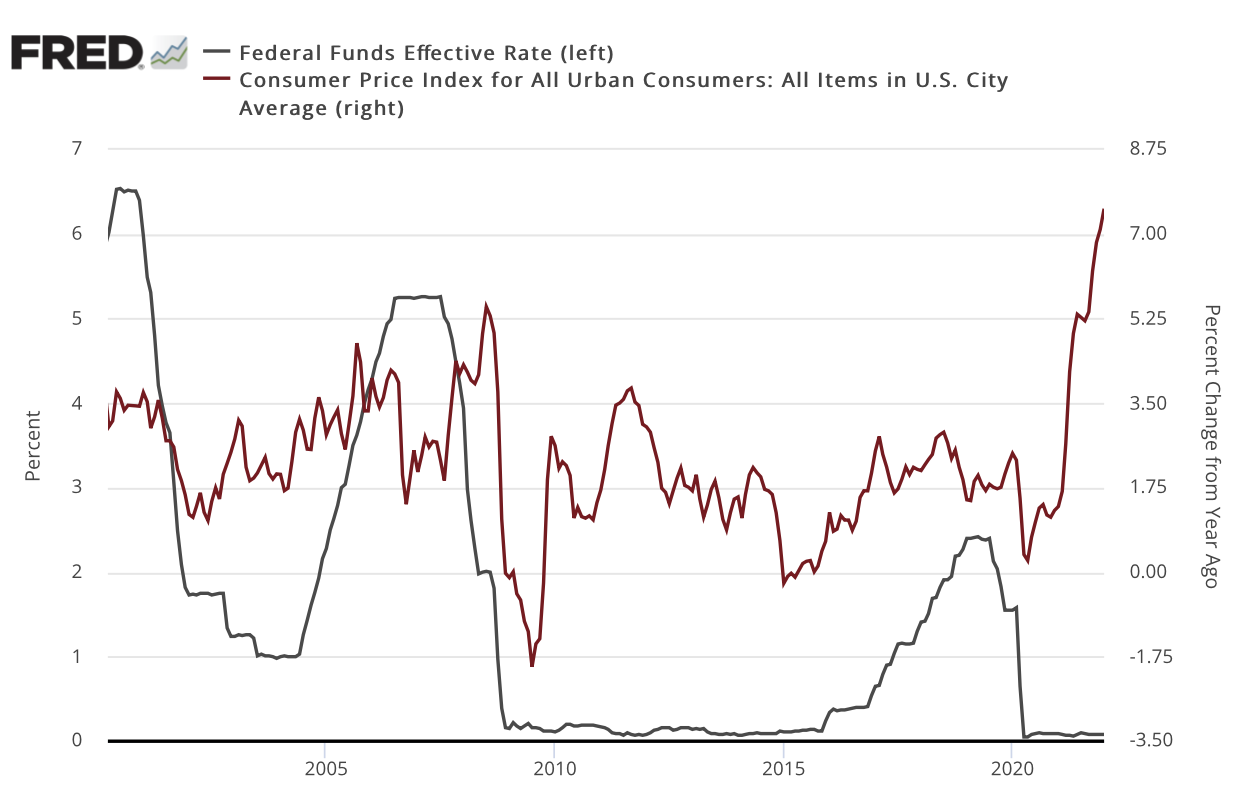

(USAGOLD – 2/11/2022) – Gold’s reaction to the big jump in inflation reported yesterday has been muted thus far. This morning it is back in the plus column though – up $5 at $1833. Silver is down 10¢ at $23.14. Some investors see surging inflation as providing leeway for the Fed to take a more hawkish stance – a negative for gold. Others see the signaled hikes, though seemingly hawkish on the surface, as too little too late. As shown in the chart below, not even a string of seven quarter-point hikes in the Fed funds rate, now running near zero, is likely to reel in a 7.5% inflation rate. In any case, real rates are likely to remain deeply in the negative, and in the past, that has been a reliable catalyst for gold demand.

Sources: St. Louis Federal Reserve, Bureau of Labor Statistics

“Gold’s ability to defy gravity amid rising US real yields,” says Saxo Bank’s Ole Hansen in an update posted this morning, “continues and so far, any weakness below $1800 has quickly attracted fresh buying. As the headline suggests we see part of the renewed demand for gold being driven by investors seeking a hedge against inflation and not least against the current optimistic view that central banks will be successful in bringing down inflation. Adding to this the recent turmoil in bonds and stocks as well as a general strong investment demand for commodities.”