Gold traders attempt to sort things out following this morning’s inflation jolt

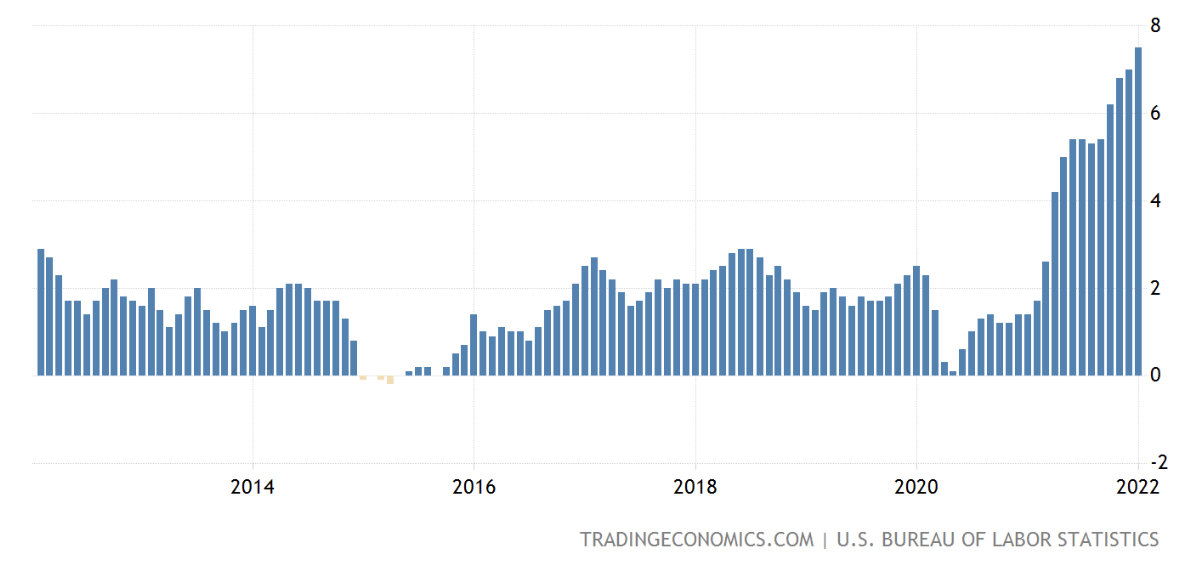

7.5% print well over expectations, highest in 40 years

(USAGOLD – 2/10/2022) – Gold traders are attempting to sort things out in the wake of this morning’s inflation jolt. The BLS reported prices rising at 7.5% clip annualized – a number well over expectations and the highest inflation print in 40 years. (Inflation in the mountain states is running at 9%, nearly double-digit levels.) More importantly, perhaps, it is well above anything Fed policymakers conceptualized even six months ago – a situation that could ultimately damage public confidence in the central bank’s ability to stay ahead of the inflation curve. The yellow metal is down $4.50 at $1830 in the early going, but we caution that the initial reaction to a data shock is not always the true reaction. Silver is up 2¢ at $23.39.

U.S. Inflation Rate

Chart courtesy of TradingEconomics.com

“[T]here are two periods in the past twenty years where the Fed hiked the fed funds rate to the point of financial market near-collapse,” says Sprott Money’s Craig Henke in an analysis posted at Seeking Alpha. “Conventional wisdom holds that the Fed is about to embark upon this trip again, and the generalists out there are convinced that gold is about to fall. But is it? What does history show? … As fed funds rose from 2004-2007, the price of COMEX gold rallied 75% from $400 to $700. As fed funds rose from 2015-2019, the price of COMEX gold rallied 40% from $1050 to $1450. … I hope this post helped you to realize that there is NOT an inverse relationship between fed fund rate hikes and gold. There just isn’t. And now that you know this, perhaps you won’t be caught flat-footed as gold moves back toward its 2020 highs later this year and then to new all-time highs shortly thereafter.”