Short and Sweet

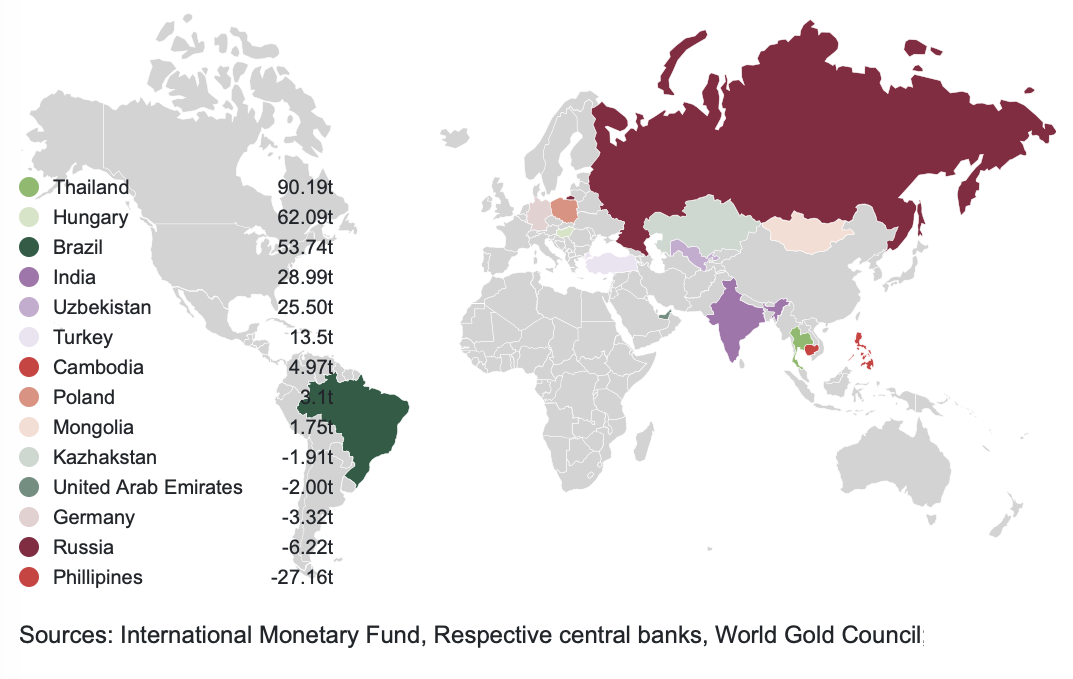

Central banks are buying the dips in gold prices

Map courtesy of the World Gold Council

A Bloomberg report last summer on burgeoning official sector gold demand received scant attention among gold analysts. What makes it a matter of better than casual interest, though, is that the central banks appear to be buying the dip in prices this year – a preference that, if it continues, could carry longer-term implications for gold market fundamentals. Most notably, Brazil – the world’s ninth-largest economy – announced purchasing a hefty 41.8 tonnes of the metal in recent years. Similarly, Poland has made plans to add 100-tonnes of gold to its coffers “over the course of a few years.”

Credit Suisse’s global equity analyst Andrew Garthwaite takes note of the trend in a recent report reviewed at ZeroHedge and offers a glimpse of the rationale behind the purchases. “Gold is a hedge against extreme financial deleveraging,” he says. “The level of government debt, deficit, and corporate debt is extreme. We continue to believe that if the TIPS yield gets much above zero, that would start to cause the markets to worry about a debt trap and that in turn could lead to a major risk-off trade. This could then prompt a Fed response driving down real yields (and debasing money).… We think this will also cause central banks to buy more gold (as currencies are being debased). Central banks account for 12% of gold demand. If all central banks had a minimum of 10% in gold, then gold demand would increase 1.6x, on our calculations.”

––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––––

Time to buy the dip?

DISCOVER THE USAGOLD DIFFERENCE

ORDER DESK: 1-800-869-5115 x100/[email protected]