Gold attempts to stabilize above the $1800 mark after yesterday’s sharp decline

2021 – the year ‘things ran wild’

(USAGOLD – 1/4/2022) – Gold is attempting to stabilize at just above the $1800 mark after yesterday’s sharp $25 decline. It is up $2 in today’s early going at $1805. Silver is level at $22.96. A good many analysts and market luminaries ended 2021 puzzling over the disconnect between a troubling economic reality and Wall Street’s intractable euphoria. Doug Noland neatly summarized what others were thinking in the latest issue of his weekly digest, Credit Bubble Bulletin.

“Books will be written chronicling 2021,” he says. “I’ll boil an extraordinary year’s developments down to a few simple words: ‘Things Ran Wild’. Covid ran wild. Monetary inflation ran wild. Inflation, in general, ran completely wild. Speculation and asset inflation ran really wild. More insidiously, mal-investment and inequality turned wilder. Extreme weather ran wild. Bucking the trend, confidence in Washington policymaking ran – into a wall. … The year ends ominously. Omicron and Manias. Inflation and ever-widening wealth disparities. Anger, frustration and disillusionment. Irrepressible enthusiasm for stock market and economic prospects – for those fully consumed by the asset markets. A gambling mentality and wanton disregard for risk. Disheartenment for those surviving outside the Bubble, while those on the inside – wallowing in the monetary deluge – bask in the ‘Roaring Twenties.’”

Chart of the Day

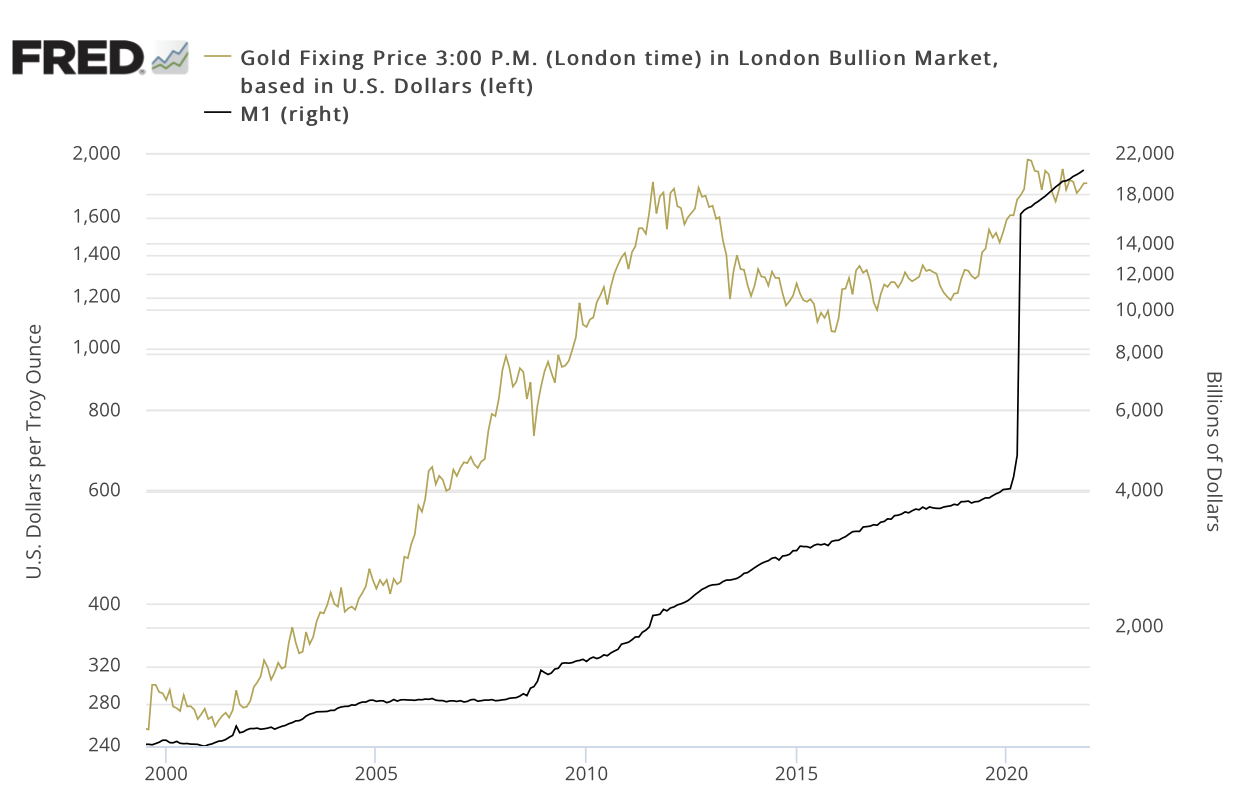

Sources: St. Louis Federal Reserve, Board of Governors of the Federal Reserve System (US), ICE Benchmark Administration

Chart note: There is a direct correlation on the longer-term overlay chart between the price of gold and growth in the money supply. Note the upward spike in the money supply since 2020 – a direct result of aggressive central bank stimulus. Gold, as you can see, has yet to fully respond to the stimulus.