Gold turns sharply to the downside

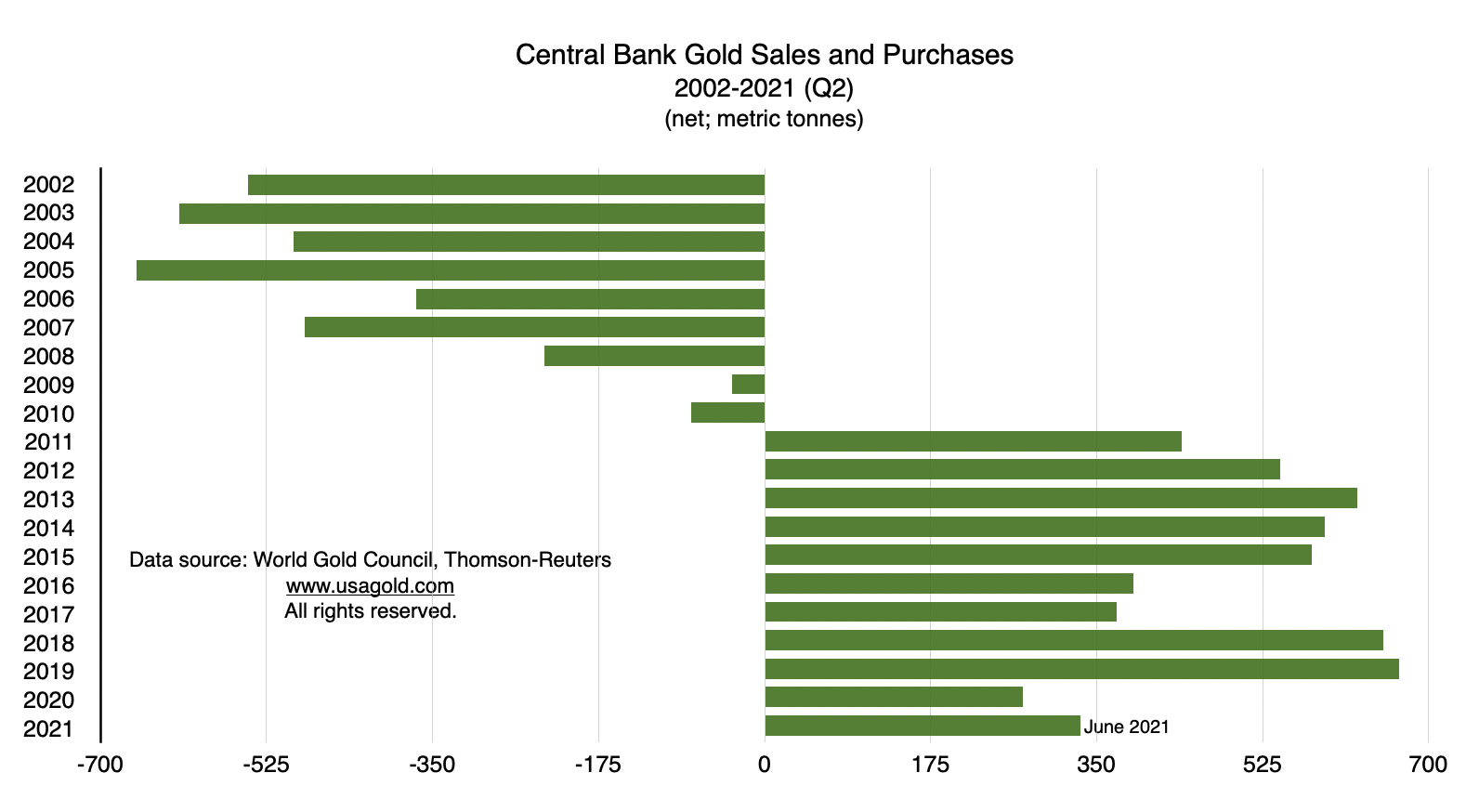

Will central banks put a floor under the gold price?

(USAGOLD – 9/16/2021) – Gold turned sharply to the downside in early trading as financial markets slipped into preparation mode ahead of next week’s Fed meeting. Expectations are mixed on the central bank’s direction, with some predicting it will advance the tapering agenda and others believing it is likely to continue treading lightly. This morning, at least, it seems the tapering view has the upper hand. The yellow metal is down $23.50 on the day at $1771. Silver is down 52¢ at $23.37. Expert opinion varies on which sector of the gold market will provide the strongest impetus in the years to come – Asian demand, the market for an inflation hedge, institutional investor interest, reduced mine production, etc. We found the following observations from CME Open Market’s Andrew Capon of more than passing interest on that score.

“Perhaps the biggest support of all for gold,” he said, “is likely to come from central banks. At the turn of the century, the U.S. dollar made up 73% of reserves in the IMF’s COFER database. That has fallen to less than 60%. The share of Chinese renminbi and the euro have grown modestly, but the strong capital preservation characteristics of gold enable reserve managers to sell their dollars while waiting to see if a true competitor to the U.S. dollar will emerge from the challenging pack. … This long-term support for gold prices from central bank buyers could provide a floor above $1700, given that new supply is highly constrained. If inflation remains stuck above policy targets, asset allocators will be forced to reconsider the traditional role of gold as a hedge. That would help gold regain its luster and could move prices higher.”

Chart of the Day

Chart note: The Reserve Bank of India purchased a record 29 tonnes of gold in June and almost 150 tonnes over the past year. The Central Bank of Brazil purchased 62.3 tonnes between May and July. The World Gold Council reports central banks as a group buying 333 metric tonnes of gold in the first half of the year. “Central banks,” it says, “are likely to continue buying gold on a net basis in 2021 at a similar or higher rate than in 2020, driven by a continued focus on diversification and risk management.”