Monthly Archives: June 2021

No DMR this morning. We may post an update later today at the Live Daily Newsletter page.

Gold begins the week on a quiet note

Still bucking summer slowdown, failure to hold above $1900 mark

(USAGOLD – 6/28/2021) – Gold began the week on a quiet note as both the dollar and bond yields were up marginally. The yellow metal is bucking headwinds of late, most notably having to do with its failure to hold ground taken above the $1900 price level and the arrival of the annual summer slowdown. It is down $5 at $1778 in early trading. Silver is down 2¢ at $26.14. Analysts and traders will be on the lookout this week for the effects, if any, of Basel 3 implementation in the Eurozone. The new rules go into effect today in the EU and in the U.S. on Thursday. Launch in London, where the bulk of bullion bank trading occurs, is not scheduled until January 2022.

Gold Newsletter‘s Brien Lundin sees reasons to be optimistic about a resumption of the precious metals bull market in the coming months. “Gold is continuing to trace out a very powerful cup-and-handle pattern,” he says in a note e-mailed Friday, “one that (as I’ve mentioned before) projects to prices in the $2,500 area. If that happens, we’ll be hard-pressed to remember what happened to gold last week……The question that every investor will have to answer for themselves is whether they actually expect the Fed to shut off the flow of monetary adrenaline upon which the financial markets have come to depend…or whether the Biden administration and Democratic-controlled Congress will suddenly discover fiscal prudence. My vote is no for the above…and yes for a continued gold bull market. So again, while the near-term is uncertain, the likelihood of much higher prices for gold and silver over the months and years ahead is very high indeed.”

Chart of the Day

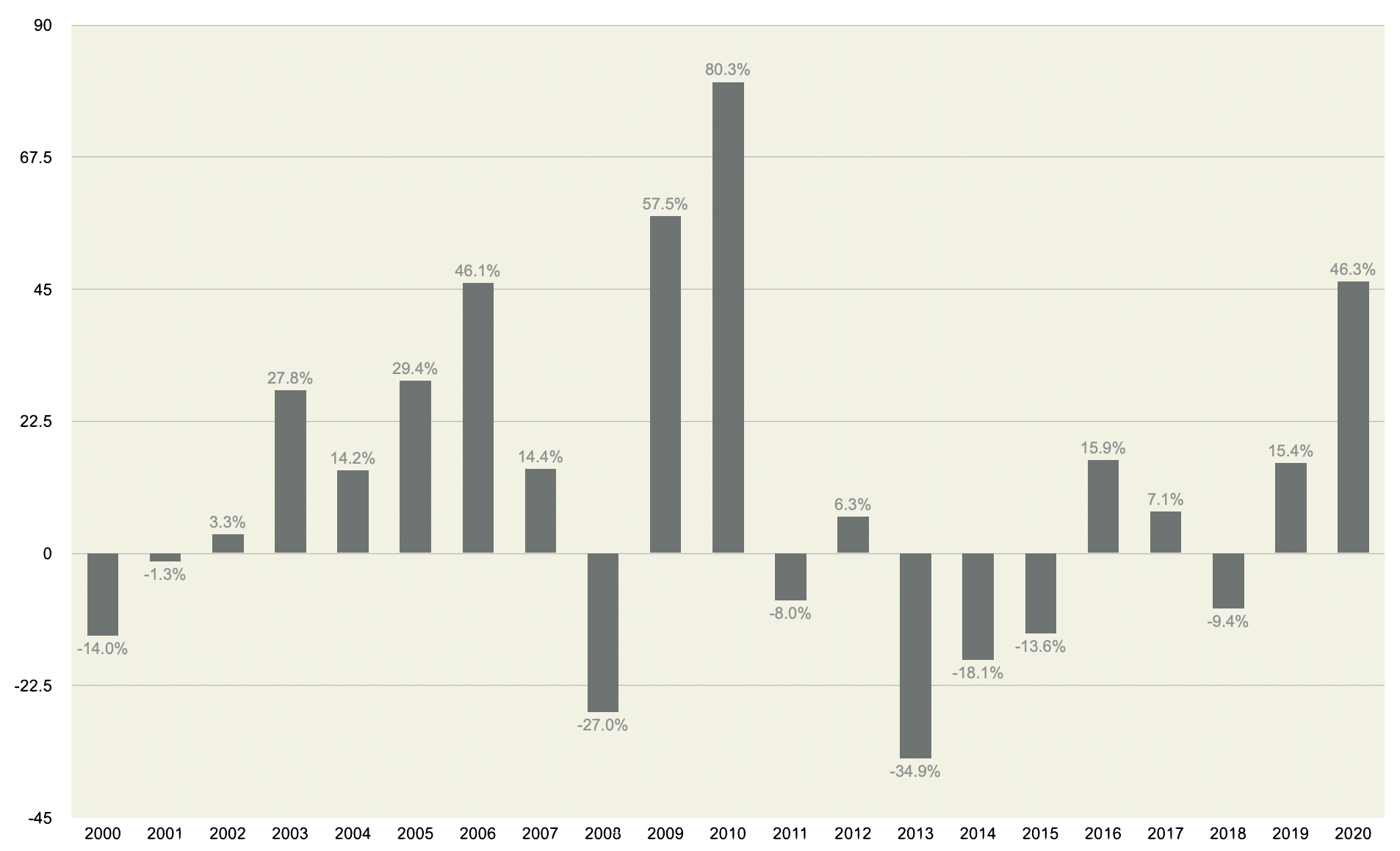

Silver Price

Percent increase or decrease over the prior year

2000-2020

Data source: macrotrends.net • • • Chart by USAGOLD.com • • • Click to enlarge

Chart note: In 2020, silver recorded its best percentage gain in a decade – 46.3% – and posted its third-largest gain over the 20 year period. It has posted gains – sometimes significant – in twelve of the last twenty years. So far in 2021, silver is down about 4%, as of Friday’s close.

No DMR today (6/15/2021)

Will update later though at the Top Gold News and Opinion page if anything of interest develops.

Gold drops sharply in early trading

Fed conclave, summer doldrums loom

(USAGOLD – 6/14/2021) – Gold dropped sharply in early trading with this week’s Fed conclave looming, the summer doldrums settling in, and the latest assault on $1900 having run out of momentum. It is trading at $1852 down $27 on the day. Silver is down 34¢ at $27.67. Even with today’s weakness taken into account, gold is still up almost 11% from March’s double bottom; silver is up almost 16%. Adrian Day, the long-time, widely-followed market commentator, sees two major factors driving gold during the past few months – inflation expectations and the new Basel 3 banking rules to be implemented by the end of the year.

“Inflation is positive for gold,” he says in an advisory posted at the Investor Ideas website,” but even more positive is an inflation that the Fed refuses to acknowledge and will not fight. Another major factor potentially contributing to higher gold prices the last few months has been buying from banks ahead of the implementation of the Basel III rules…The implementation of these rules is bullish for gold, though many commentators have, in my view, wildly exaggerated the potential impact…Since banks have until the end of the year to come into full compliance, this buying could continue, and once this bullion is purchased, it will not be readily sold.”

Chart of the Day

Gold price performance in top global currencies

(Five year, in percent)

Chart note: The collapse of fiat currencies’ purchasing power, writes market commentator Alasdair Macleod in a detailed analysis posted at Gold Eagle, “is unlikely to echo the great European inflations of the 1920s, because to a large degree commerce subsisted on the alternative of gold-backed dollars, instead of local currencies. Today, the collapse of the dollar will mean there is unlikely to be any alternative currency available, because they are all tied to the dollar.” Gold’s strong, synchronous performance in the world’s top currencies over the past five years supports Macleod’s point. It is up 44.56% in U.S. dollars, 57.8% in India rupee, 47.14% in British pounds, 40.35% in Chinese yuan, 34.65% in European euros, and 52.23% in Japanese yen. In the event of a global breakdown in fiat currencies, concludes Macleod, “anyone who does not plan to get hold of some physical gold and silver with a high degree of urgency could end up sinking with nothing but valueless fiat currencies.”

No Daily Market Report today (6/3/2021). Will update later today if anything of interest develops.

Gold drifts higher on mix of market signals

World Gold Council reports strong inflation-driven gold coin and bar demand in Germany

(USAGOLD –6/2/2021) – Gold drifted higher in early trading on a mix of market signals, i.e., a stronger dollar, a moderate decline in yields, and accelerating wholesale inflation in the European Union driven mainly by a surge in oil prices. The yellow metal is up $3 at $1905. Silver is up 3¢ at $28.05. That wholesale price report out of Europe is likely to elevate concern on this side of the Atlantic in that a sustained increase in the price of oil could feasibly boost inflation levels planet-wide. At 7.6% annualized, the jump is not a minor event. In Germany, the rush for gold coins and bars continues unabated largely inspired by rising inflation, according to the World Gold Council’s senior markets analyst, Louise Street.

“In our extensive 2019 consumer research survey,” she writes in a report posted at Gold Hub yesterday, “64% of German retail investors agreed that gold is a good safeguard against inflation/currency fluctuations and 61% felt that it would never lose its value over the long term. Almost half of the investors that owned gold bars or coins said that the main role of the investment was to protect their wealth. While negative rates continue to plague Germany savers, investors may continue allocating their wealth to gold and property, rather than see it eroded.” A more recent survey, she adds, suggests that German investors and savers will go further than simply holding on to what they already have. “[O]f those retail investors who had bought gold in the past, 40% said they were likely to buy more over the subsequent 12 months as a direct result of the coronavirus pandemic.” [Emphasis added.]

Chart of the Day

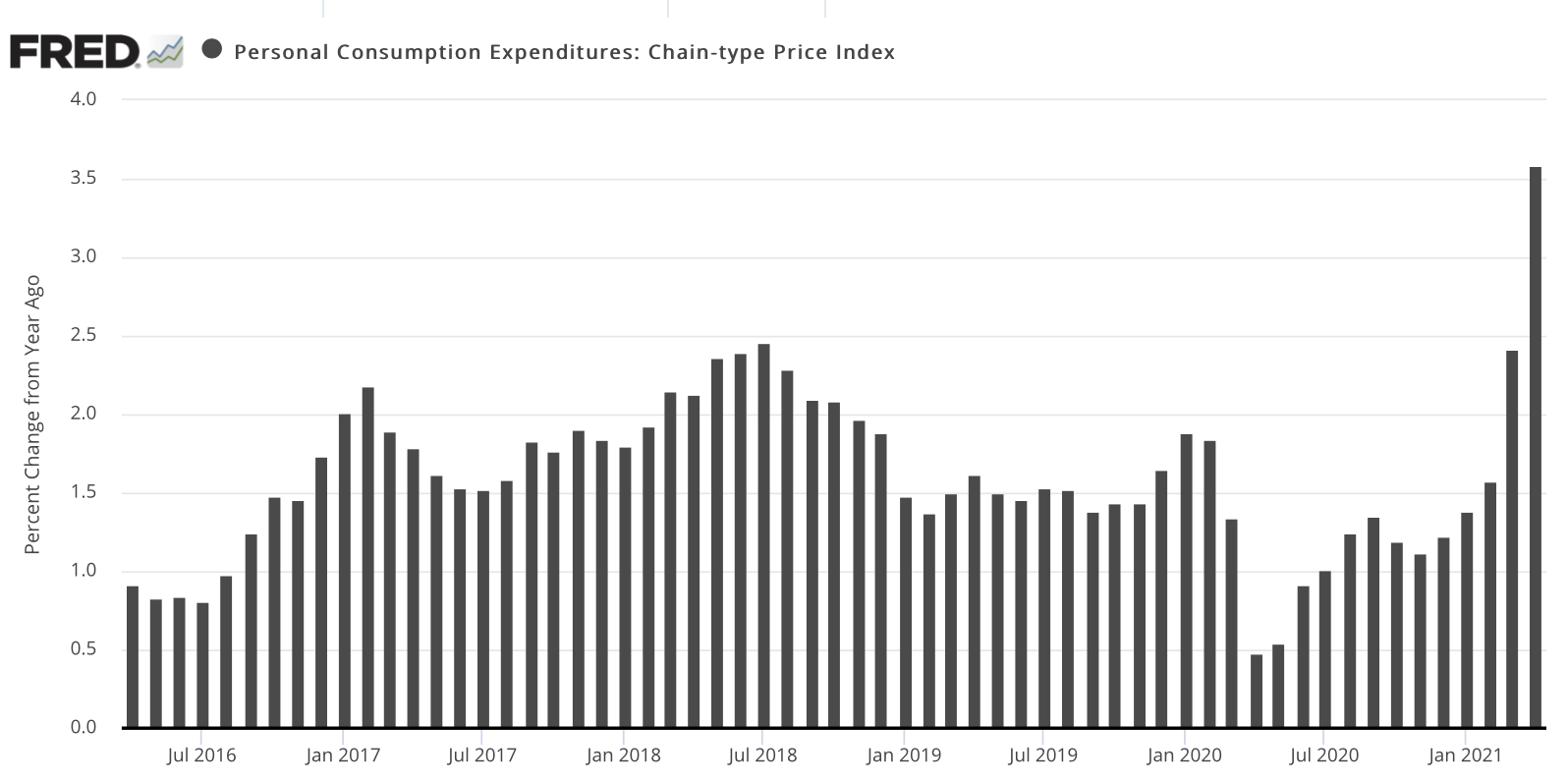

Personal Consumption Expenditure Price Index (PCE)

Sources: St. Louis Federal Reserve [FRED], U.S. Bureau of Economic Analysis

Chart note: Analysts generally registered surprise at the surge in the PCE index – the inflation measure preferred by Federal Reserve policymakers. The 3.6% gain announced on Thursday is well above the Fed’s 2% target and the 1.9% gain reported for March. It was the highest monthly print since 2008.