No Daily Market Report today (6/3/2021). Will update later today if anything of interest develops.

Gold drifts higher on mix of market signals

World Gold Council reports strong inflation-driven gold coin and bar demand in Germany

(USAGOLD –6/2/2021) – Gold drifted higher in early trading on a mix of market signals, i.e., a stronger dollar, a moderate decline in yields, and accelerating wholesale inflation in the European Union driven mainly by a surge in oil prices. The yellow metal is up $3 at $1905. Silver is up 3¢ at $28.05. That wholesale price report out of Europe is likely to elevate concern on this side of the Atlantic in that a sustained increase in the price of oil could feasibly boost inflation levels planet-wide. At 7.6% annualized, the jump is not a minor event. In Germany, the rush for gold coins and bars continues unabated largely inspired by rising inflation, according to the World Gold Council’s senior markets analyst, Louise Street.

“In our extensive 2019 consumer research survey,” she writes in a report posted at Gold Hub yesterday, “64% of German retail investors agreed that gold is a good safeguard against inflation/currency fluctuations and 61% felt that it would never lose its value over the long term. Almost half of the investors that owned gold bars or coins said that the main role of the investment was to protect their wealth. While negative rates continue to plague Germany savers, investors may continue allocating their wealth to gold and property, rather than see it eroded.” A more recent survey, she adds, suggests that German investors and savers will go further than simply holding on to what they already have. “[O]f those retail investors who had bought gold in the past, 40% said they were likely to buy more over the subsequent 12 months as a direct result of the coronavirus pandemic.” [Emphasis added.]

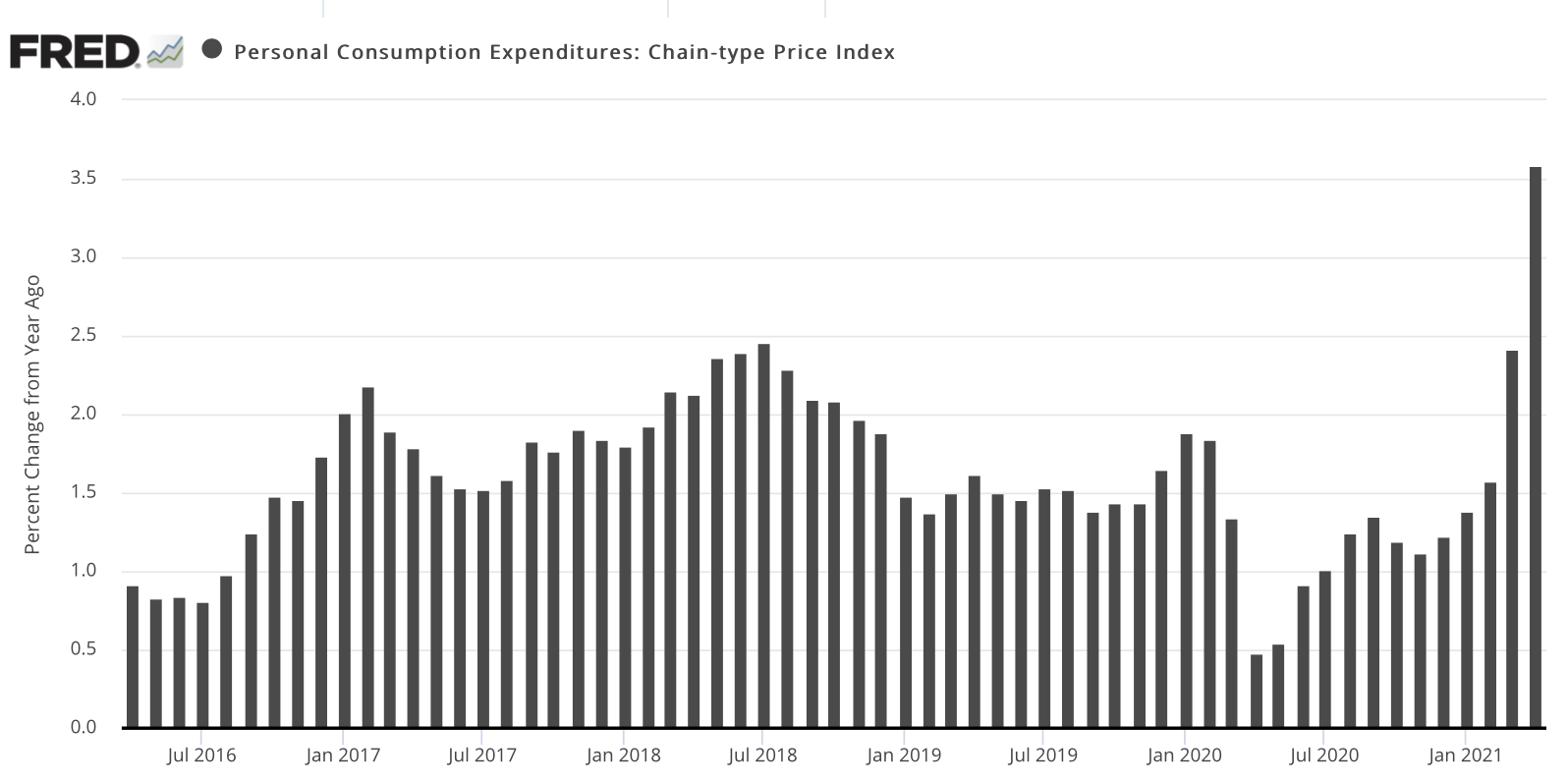

Chart of the Day

Personal Consumption Expenditure Price Index (PCE)

Sources: St. Louis Federal Reserve [FRED], U.S. Bureau of Economic Analysis

Chart note: Analysts generally registered surprise at the surge in the PCE index – the inflation measure preferred by Federal Reserve policymakers. The 3.6% gain announced on Thursday is well above the Fed’s 2% target and the 1.9% gain reported for March. It was the highest monthly print since 2008.