Monthly Archives: April 2024

Today’s top gold news and opinion

4/16/2024

ISRAEL / IRAN & GOLD – MUCH ADO ABOUT NOTHING. (Metals Daily)

Scores of political leaders around the world are joining the chorus urging restraint…

Here’s What Higher for Longer Means for the Stock Market (WSJ)

Stocks are still trading near record levels, but some investors say further gains may be more difficult.

Gold firms despite stronger dollar as geopolitical concerns mount (Reuters)

The market now sees fewer than two 25-basis-point cuts by the year-end.

Today’s top gold news and opinion

4/15/2024

New Sanctions on Russia to Drive Even More Metals Sales to China (Bloomberg)

Shanghai becomes the only major bourse to accept Russian metal

China’s gold markets under strain as horde of new buyers hunts for stable investment (SCMP)

Standing out as one of the few bets considered safe in China at present – with stocks, property and banking having lost their lustre in an environment of heightened uncertainty.

Gold Climbs Toward Record After Iran’s Strike Against Israel (Bloomberg)

Bullion has risen almost 20% since the middle of February.

Daily Gold Market Report

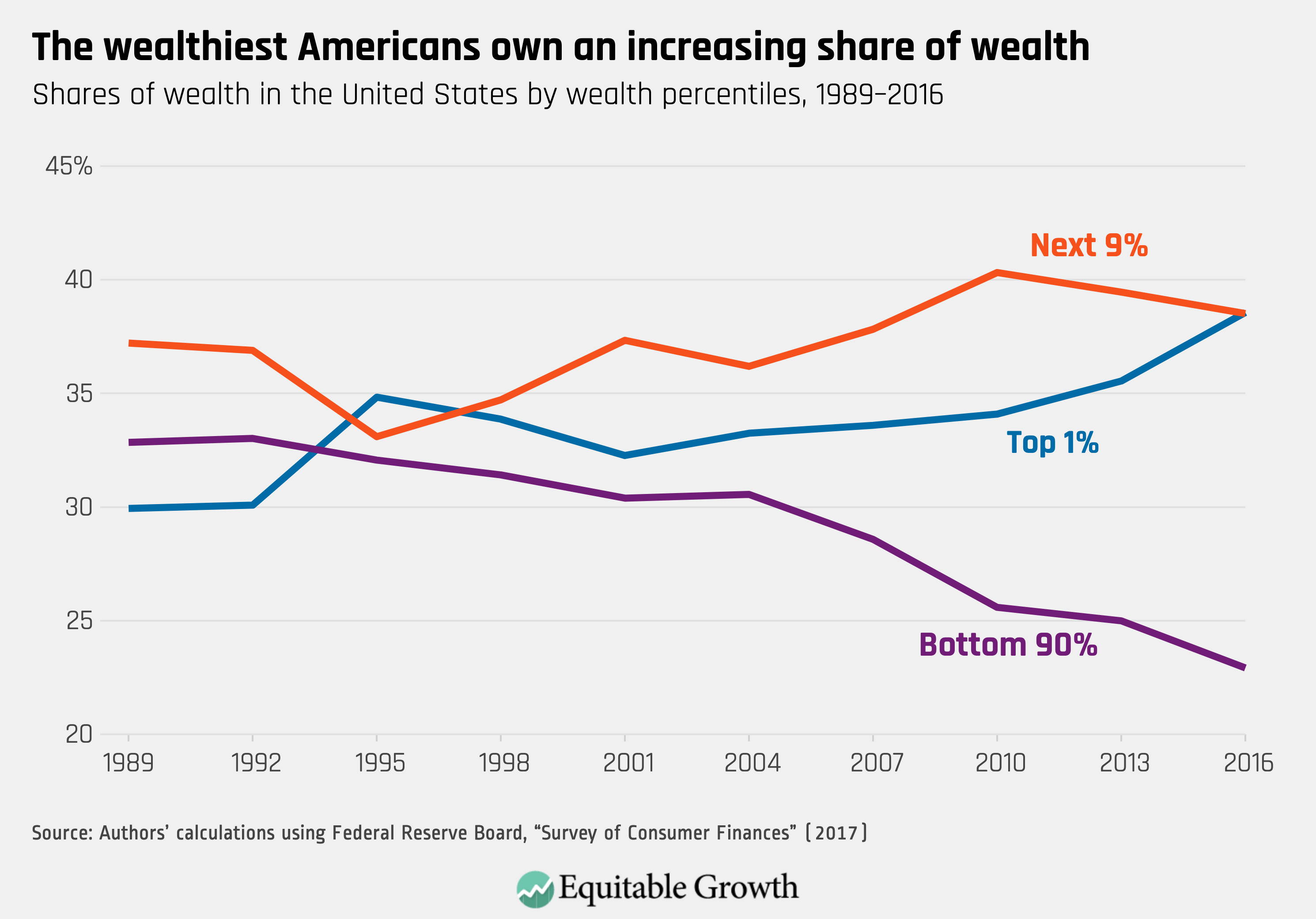

The Cantillon Effect in Action:

Federal Reserve Policies and the Widening Wealth Gap

(USAGOLD – 4/15/2024) Gold prices are higher this morning after geopolitical tensions surged in the Middle East over the weekend. Gold is trading at $2350.29, up $5.92. Silver is trading at $28.61, up 73 cents. The recent article “The Rich get Richer. Thanks to the Fed.” from Peter St. Onge, discusses the significant increase in wealth among America’s richest due to Federal Reserve policies, particularly during the pandemic. The wealth of the top 1% in the U.S. reached an all-time high of $45 trillion, a 50% increase from 2020, largely fueled by the Fed’s massive money printing efforts amounting to $6 trillion in two years. This influx of new money primarily benefited financial markets and the wealthy, as the Fed’s method of increasing the money supply involves buying financial assets and subsidizing lending, a process known as Quantitative Easing. The article explains the Cantillon Effect, where new money benefits the rich first, with inflationary effects trickling down to impact the rest of the population, particularly harming those on fixed incomes like social security and pensioners. He concludes by stating that the Fed’s actions inherently drive inequality, serving the interests of the wealthy at the expense of the broader population.

Daily Gold Market Report

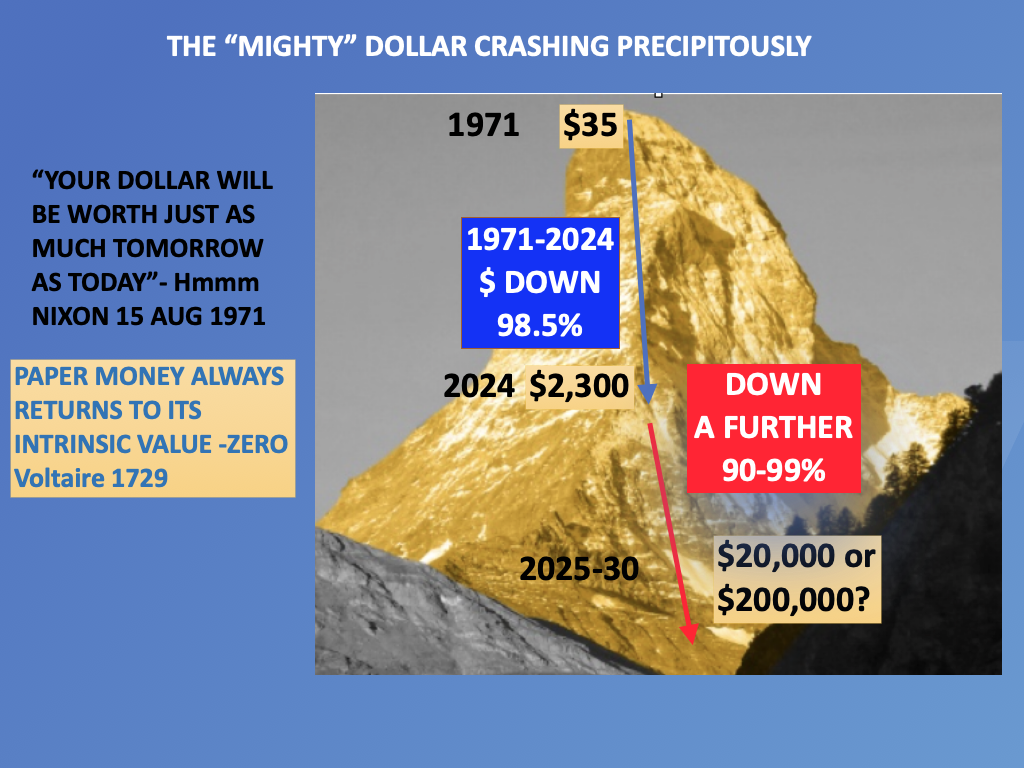

The Inevitable Decline of Fiat Currencies:

Why Gold Maintains Purchasing Power

(USAGOLD – 4/12/2024) Gold prices have hit another all time high this week of $2404/oz. The broader financial markets are exhibiting heightened uncertainty as we approach the weekend, with the recent escalation of geopolitical tensions fueling increased investor demand for safe-haven assets like gold and silver. Gold is trading at $2400.64, up $28.12. Silver is trading at $29.40, up 95 cents. The article titled “Gold and Silver Entering Exponential Phase” by Egon von Greyerz discusses the potential for gold and silver prices to rise significantly in the coming months and years, driven by a combination of technical and fundamental factors. He argues that gold maintains stable purchasing power over time, while fiat currencies inevitably decline in value. He suggests that gold and silver are currently undervalued relative to money supply and inflation, and that the financial system is on the verge of a major collapse. The article also touches on geopolitical tensions and the risk of global war, and recommends physical gold ownership as a form of wealth preservation and insurance against economic and political instability.

Credit: vongreyerz.gold

Today’s top gold news and opinion

4/12/2024

What Does the Gold Price Breakout Mean? (Sprott)

75% of investment advisors have less than 1% exposure to gold

From Transitory to Debasement (Bytetree)

Asset allocators have been selling gold to the tune of 12 million ounces in 12 months…

Record-breaking gold highlights silver and platinum’s potential (Saxo)

The fear of missing out has created a strong buy-on-dip mentality among precious metal traders and investors.

Today’s top gold news and opinion

4/11/2024

Why Gold Prices Continue to Break Records (Bloomberg)

HSBC Chief Commodities Analyst James Steel discusses the gold market’s latest surge, particularly in China and India.

WisdomTree Gold Monthly (Wisdomtree)

Gold remains highly sensitive to rate cut probabilities…

Markets slash rate cut bets after US inflation rises to 3.5% (FT)

Figures for consumer prices and core inflation exceed expectations.

Daily Gold Market Report

Bullion Bounces Back:

Gold Prices Defy Economic Headwinds and Central Bank Moves

(USAGOLD – 4/10/2024) Gold prices have recovered some ground Thursday. The latest economic data indicates that various components of producer price inflation in the U.S. economy have cooled down more than anticipated. Gold is trading at $2343.56, up $9.52. Silver is trading at $28.15, up 20 cents. Following the release of stronger-than-expected US CPI data yesterday, the gold market experienced a brief dip, losing $30, but quickly rebounded, demonstrating resilience even as the US dollar and treasury yields rose. This behavior suggests that gold investors are eager to buy on any dips, indicating a strong conviction behind the current rally. Despite initial expectations that the rally might be driven by options trading and associated delta hedging, the market’s response to adverse economic data suggests otherwise. The possibility of a major sovereign state purchase was considered but seems unlikely given the lack of changes in London vault stocks and the absence of transactions through the LBMA benchmark, pointing towards over-the-counter trades. The resilience of gold in the face of market headwinds suggests a higher path of least resistance, urging investors to hold onto their positions.

Today’s top gold news and opinion

4/10/2024

Silver may be even more exciting than the gold rally, says BNP Paribas Wealth Management (CNBC)

Edmund Shing, chief investment officer at BNP Paribas Wealth Management, discusses the outlook for gold and silver prices.

Gold Ignores Negative News: Bulls Overexuberant? (Investing)

Signals of a strong economy and inflation – highlight gold’s property of retaining value.

‘Gold Could Rush All The Way To $3000/Oz With Silver Following (Forbes)

CITI said the prospect of lower interest rates, combined with flat demand for alternatives, geopolitical hedging, and financial buying to catch up with robust physical demand, working in sync to push the bullion complex higher.

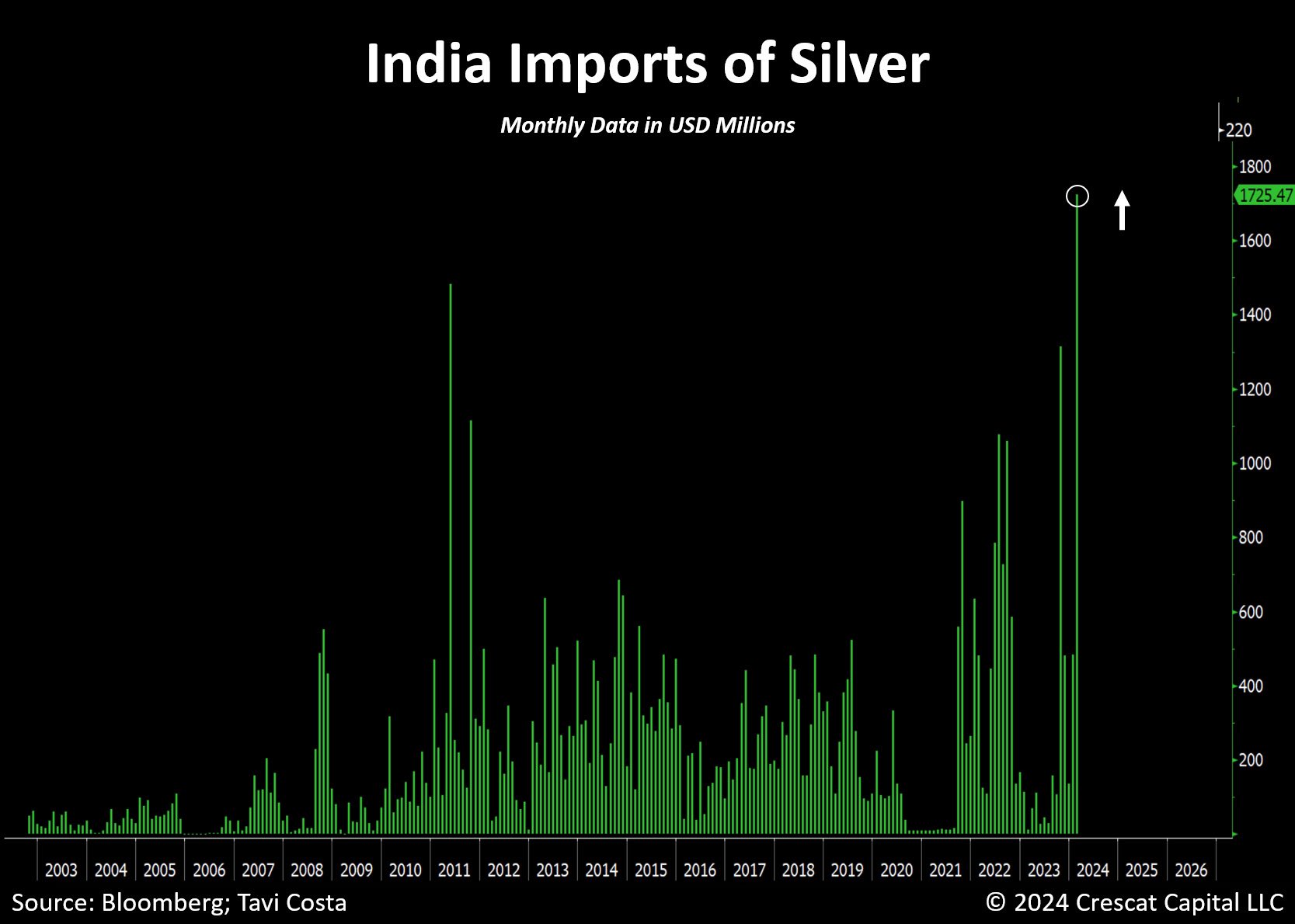

Daily Gold Market Report

Surge in Silver:

India’s Imports Hit Record Levels with Increased Demand from UAE

(USAGOLD – 4/10/2024) Gold prices are lower in early trading Wednesday and sold off over 1% following another U.S. inflation report that came in higher than expected. Gold is trading at $2327.87, down $24.91. Silver is trading at $27.70, down 45 cents. In February 2024, India’s silver imports reached a record high, with a 260% increase compared to the previous month, largely due to lower import duties and significant purchases from the UAE. The country, which is the world’s largest silver consumer, imported 2,295 metric tons of silver in February alone, with 939 tons coming from the UAE. This surge in imports is expected to contribute to a 66% increase in silver imports for the year, potentially supporting global silver prices. The high volume of imports in early 2024 has led to an oversupply that pushed local prices into a discount, causing banks to reduce imports in March. Industry experts suggest that the cyclical nature of India’s silver imports, which saw a decline in 2023 after a record high in 2022, indicates a potential increase in 2024, with estimates reaching 6,000 tons. This demand is driven by the fabrication and solar industries, as well as investment purposes, with silver being seen as potentially offering higher returns than gold.

Today’s top gold news and opinion

4/9/2024

The gold market hunts for answers behind bullion’s sudden surge (Yahoo)

Chinese consumers are worried about wilting returns in other assets and a depreciating currency.

Gold to surge to $2500, UBS predicts (Proactive Investors)

The “usual” ETF buyers have even remained net sellers.

‘They can’t get it wrong again’: Economists are increasingly uncertain about Fed rate cuts this year (CNBC)

The U.S. Federal Reserve is determined not to reduce interest rates too soon — and some economists say recent data has pushed a summer cut completely off the table.

Daily Gold Market Report

China’s Gold ETF Trading Halts:

Record Demand and Market Frenzy

(USAGOLD – 4/9/2024) Gold prices continue to hit all time highs, overnight reaching $2365.30/oz. Increasing numbers of traders across various markets are now joining the optimistic trend for gold and silver, indicating further potential for price increases in the short term. Gold is trading at $2355.39, up $16.46. Silver is trading at $28.30, up 45 cents. The China Gold-Buying Frenzy has led to significant disruptions in the trading of a gold company ETF, marking the second suspension in a week due to unprecedented demand. The ChinaAMC CSI SH-SZ-HK Gold Industry Equity ETF, managed by China Asset Management Co., saw its trading halted overnight after its price surged over 40% in four sessions, only to drop 10% upon resumption. This action was taken to safeguard investor interests as the ETF’s premium over its underlying assets soared beyond 30%. The frenzy reflects Chinese investors’ desperation for investment alternatives not tied to the struggling domestic economy, with gold ETFs attracting nearly $600 million in global net inflows in just the past week. Analysts suggest that the surge in gold and gold ETF demand is driven by investors seeking to diversify with commodities and foreign ETFs amidst China’s economic challenges, including property market woes and volatile stock markets.

Today’s top gold news and opinion

4/8/2024

How Much Are the Ultra Wealthy Really Investing in Gold? (Yahoo)

The average UHNWI holds about 2% of their net worth in gold.

Gold’s Stealthy Bull Market Confuses Even Its Fans (Bloomberg)

There was a time when every record high for gold was greeted with huge excitement from the “goldbug” community.Now? It’s sort of shrugged off.

The end of the gold standard and the beginning of the recovery from the Great Depression (CEPR)

2024 marks the 80th anniversary of the Bretton Woods conference, which led to a major shift from the operation of the gold standard in the interwar years.

Daily Gold Market Report

The East Rises in Gold Markets:

A Shift in Global Pricing Power

(USAGOLD – 4/8/2024) Gold prices once again hit an overnight all time high of $2354.04/oz but has since faded back this morning. Gold is trading at $2327.44, down $2.09 cents. Silver is trading at $27.64, up 14 cents. Henry Johnston of RT discusses the significant shift in the gold market, highlighting how the control of gold pricing is moving from the West to the East, particularly due to increased demand in China and central bank purchases. He outlines the historical context of gold as a store of value and its transition from being part of the Bretton Woods system to becoming a traded commodity through futures contracts. The breakdown of the correlation between U.S. real interest rates and gold prices, especially noticeable since the Ukraine conflict in 2022, indicates a profound change in the gold market dynamics. Western institutional investors have been net sellers, while Eastern demand, especially from China and central banks, has surged, driving gold prices to new highs. This shift is seen as part of a broader “hidden dedollarization” and a move towards gold as a neutral reserve asset amidst geopolitical tensions and financial instability.

Today’s top gold news and opinion

4/5/2024

Zimbabwe to launch ‘gold-backed’ currency to replace collapsing dollar (FT)

Many in the southern African country prefer to keep their money at home..

With palladium oversold and platinum’s attractive fundamentals, both metals have upside (CME Group)

The fall in the palladium price has closed the differential with platinum, with the sister metals now priced near parity for the first time since 2018.

Einhorn Bets Big on Gold Amid Inflation, Eyes Value Stocks (Super News)

David Einhorn warns inflation may be reaccelerating, doubting the Federal Reserve will cut rates more than twice this year, if at all..

Daily Gold Market Report

The Bullish Case for Gold:

Central Banks, Rate Cuts, and Investment Strategies

(USAGOLD – 4/5/2024) Gold prices are under pressure testing initial support at $2,300 an ounce as the U.S. labor market remains red hot. Gold is trading at $2291.05, up 10 cents. Silver is trading at $26.67, down 25 cents. Bob Haber of Forbes recently wrote an article that discusses the current state and future prospects of gold investment, drawing an analogy between the unpredictability of March Madness brackets and the stock market. Despite the unpredictable nature of both, the article argues that asset allocation in investing, unlike sports betting, is based on solid mathematical principles. It highlights the recent breakout of gold prices to new all-time highs above $2,300 per ounce, despite no significant geopolitical crises or Federal Reserve rate hikes, which are typically drivers of gold price surges. Non-US Central Banks are now major buyers of gold, significantly increasing their purchases to mitigate dependence on the US Dollar. He suggests that the Federal Reserve’s indication of halting interest rate hikes and the commitment to cutting rates before inflation hits 2% could be the catalyst for the recent gold price surge.

Today’s top gold news and opinion

4/4/2024

Gold plows to record high after Powell’s remarks (Yahoo)

Powell’s customary cautious approach doesn’t worry gold bulls..

Central banks bolster gold reserves further in February, albeit at a slower pace (WGC)

Demand continues to be driven by emerging market banks, such as China and India

Gold Volatility Surges Higher on Upside Call Demand (CBOE)

GLD 1M implied vol jumped over 2 pts to 13.4% as gold prices surged to a new all-time high.

Daily Gold Market Report

Precious Metals Rally:

Gold Breaks $2,300, Silver Climbs Over $27 as Investors Seek Stability

(USAGOLD – 4/4/2024) Gold prices hit another all time high last night of $2304.95 but has since faded this morning. Gold is trading at $2275.44, down $5.23. Silver is trading at $26.53, up 39 cents. Gold breaking over $2,300 per ounce and silver surpassing $27 per ounce are significant events in the precious metals market, indicating a strong demand for these assets as safe-haven investments amid economic uncertainty. The surge in gold prices to record highs is driven by a combination of factors, including a weakening dollar, anticipation of interest rate cuts by the U.S. Federal Reserve, and robust central bank buying. Silver’s price movement, while also influenced by similar macroeconomic factors, benefits from its industrial applications and its correlation with gold, with forecasts suggesting a continued positive trajectory.

USAGOLD Comment: These price milestones reflect investor sentiment seeking stability in the face of geopolitical tensions, inflation concerns, and a volatile financial landscape, positioning gold and silver as attractive options for portfolio diversification.

Daily Gold Market Report

Silver on the Verge:

Technical and Supply Dynamics Set Stage for Price Breakout

(USAGOLD – 4/3/2024) Gold prices hit another all time high last night of $2288.33 but has since faded this morning. Demand for safe haven assets has surged as an earthquake strikes Taiwan and geopolitical tensions in the Middle East escalate this week. Gold is trading at $2275.44, down $5.23. Silver is trading at $26.53, up 39 cents. Silver is nearing a breakout based on technical analysis. Investing Haven highlights a bullish pattern on silver’s price chart, with a significant rise in 2020 followed by a period of consolidation. For a breakout to be confirmed, silver needs to sustain a price above $26.20 USD/oz for 5 to 8 days. The analysis also points to a potential breakout on both daily and weekly charts, with a key confirmation point at $26 USD/oz. April could mark a significant movement in the silver market, potentially reaching a target of $34.70 if it surpasses $28.

Today’s top gold news and opinion

4/3/2024

Is The Silver Market Breaking Out? (Investing Haven)

If silver rises above 26.50 USD/oz, and stays there for 5 to 8 consecutive days, silver’s breakout will be confirmed.

It makes sense to hold up to 20% of your portfolio in gold – State Street’s Milling-Stanley (KITCO)

“A portfolio can benefit from a long-term strategic allocation between 2% and 10%. And if you are experiencing or anticipating exceptional volatility in markets, then it makes sense financially to double your allocation to gold”

China eases restrictions on gold imports (Mining)

Around 1,500 tonnes of metal worth some $60 billion – equivalent to one-third of the world’s total supply – entering the country last year.

Today’s top gold news and opinion

4/2/2024

Gold Hits Another High—Despite A Strong Stock Market And Economy. Here’s Why. (Forbes)

$3.3 trillion. That’s the amount of gold held by investors, according to JPMorgan Chase.

Gold rallies, stocks ease as rate cut optimism fades (Reuters)

CPI, PPI and PCE – show improvement has leveled off, leading to questions about when and by how much the Fed cuts.

Commodities will rally when the U.S. Federal Reserve cuts rates: commodity strategist (Bloomberg)

In months before and after the start of easing cycles, raw material prices typically have positive returns.