Daily Gold Market Report

No DGMR today or tomorrow. Back Monday.

Below is yesterday’s report.

––––––––––––––––––––––––––––––––––

Gold marginally higher as Fitch downgrades US credit rating

Rating drop comes as the Treasury Department gears up for heavy debt issuance

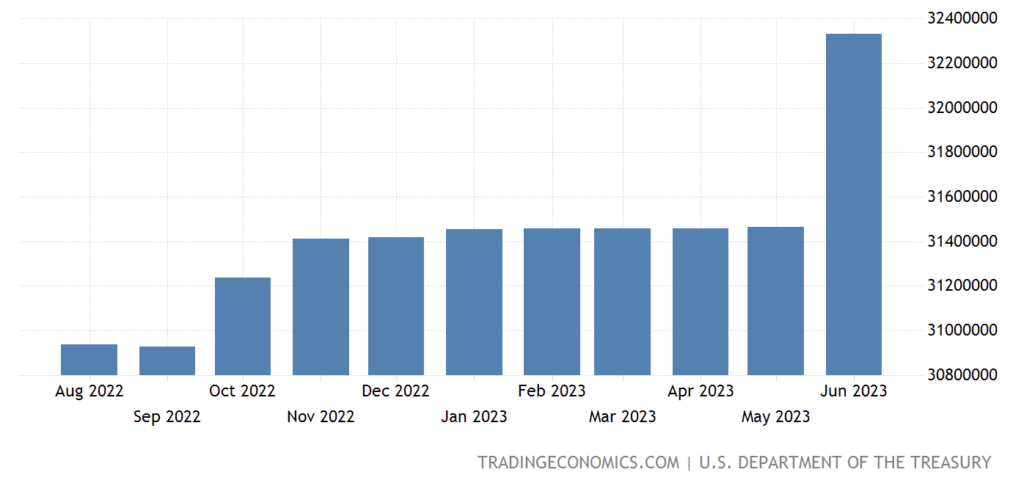

(USAGOLD – 8/2/2-23) – Gold was marginally higher in today’s early going as markets mulled over Fitch’s downgrade of US debt from AAA to AA+. The rating service cited tax cuts, greater fiscal spending, economic shocks, and continuing political gridlock as reasons for the rating demotion. Gold is up $2 at $1949. Silver is up 3¢ at $24.40. Fitch’s downgrade comes just as the Treasury Department gears up for a heavy debt issuance of $102 billion to replenish its coffers following the debt ceiling battle earlier this year. As shown in the chart below, the additions to the national debt in June were already notable.

“Last time S&P downgraded in 2011, the markets went nuts, although we are not seeing the same type of reaction in the early going, but things bear watching,” Marex analyst Edward Meir told CNBC this morning. Wells Fargo’s John LaForge told KitcoNews that “he expects growing debt in the U.S. to be a major bullish factor for gold that could support higher prices for at least the next three years.”

US Government Debt

Chart courtesy of TradingEconomics.com