The Great Gold Migration: How Asia is dominating the global gold landscape

Value Walk/Eric Gozenput/6-30-2023

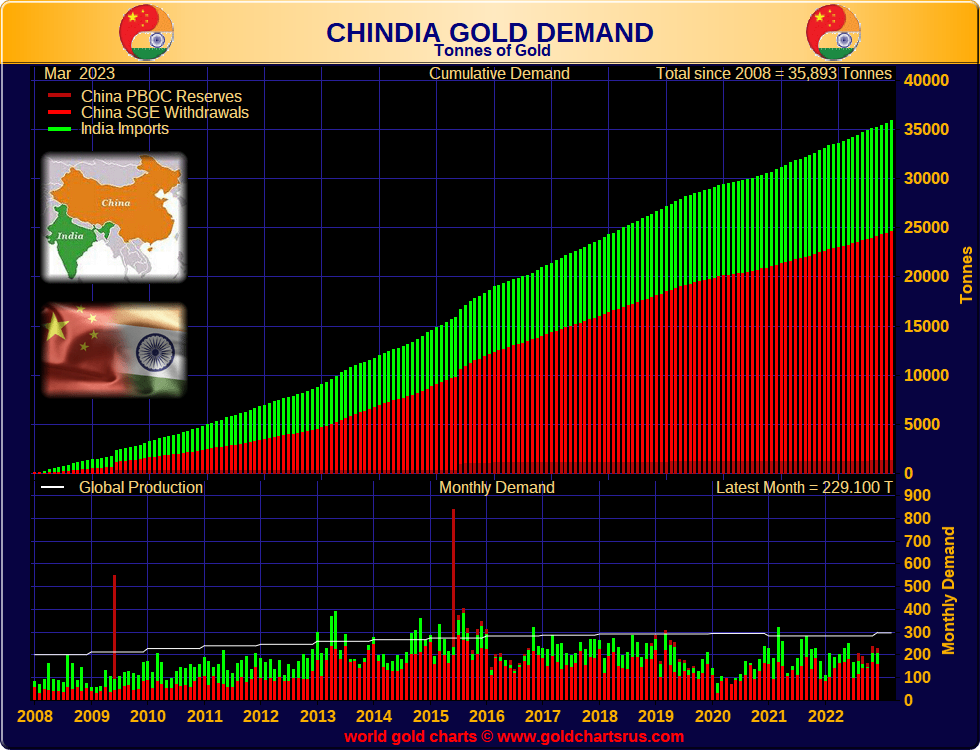

“The latter part of 2022 saw Western investors offloading bullion while their Asian counterparts capitalized on lower prices, buying jewelry, coins, and bars. This period saw more than 527 tons of gold leaving New York and London vaults, with Chinese gold imports peaking at a four-year high. In the East, gold is often the primary form of savings and wealth preservation. For millions, gold remains the ‘basic form of saving,’ an approach inherited from their ancestors, with the understanding that gold retains its purchasing power over time.”