Liquidity risks

Credit Bubble Bulletin/Doug Noland/6-24-2023

Selected quotes:

“The historic scope of policy responses took perceptions of ‘whatever it takes’ market guarantees to a whole new level. While concerns grew that monetary policy tightening could jeopardize the central bank liquidity backstop, those fears were quickly allayed. The BOE in September hastily restarted QE to thwart a bond market crash, and then the Fed in March expanded its balance sheet by almost $400 billion over a few weeks to thwart a systemic run on bank deposits. With banking system stability in the crosshairs, markets understandably assume the ‘Fed put’ is as big and even more reliable than ever.”

. . . . . . . . . . . . . . . . . .

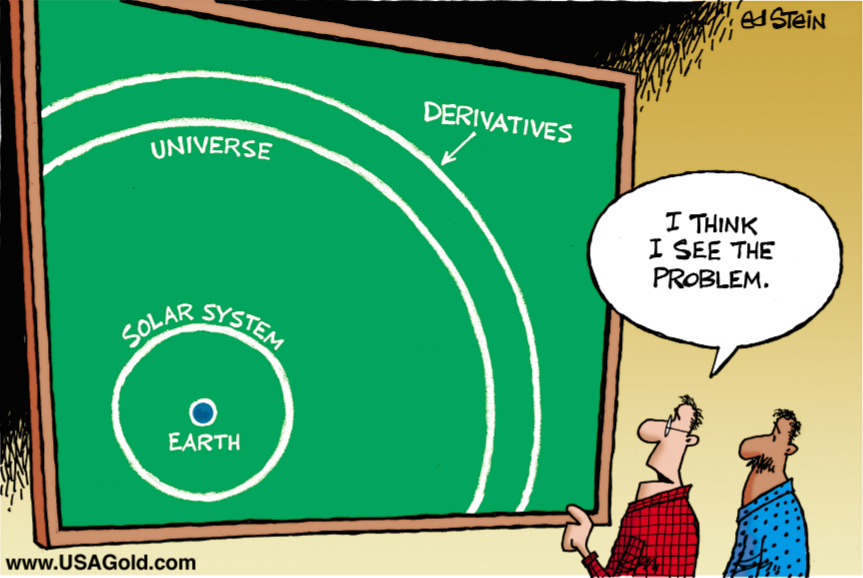

“The upshot is distorted pricing and availability of derivatives risk ‘insurance.’ This has worked to promote risk-taking and speculative leverage, both of which have exacerbated market liquidity excess. In particular, the Fed/FHLB market liquidity bailout came after the risk markets rally had already attained momentum. A speculative Bubble then took hold among the big technology stocks, pushing the ‘A.I.’ Bubble into dangerous manic excess.”

. . . . . . . . . . . . . . . . . .

“As they tend to do, the liquidity injection turned self-reinforcing. A powerful short squeeze and unwind of risk hedges stoked FOMO and performance-chasing flows into the risk markets. And with the big tech stocks’ favorite derivatives targets within a marketplace enamored with options trading, the market melt-up added Trillions of market capitalization – along with enormous amounts of speculative leverage. As an analyst of Credit and Bubbles, the first sentence from a December 6, 2022, Reuters article (Marc Jones) is etched in my memory: ‘Pension funds and other ‘non-bank’ financial firms have more than $80 trillion of hidden, off-balance sheet dollar debt in FX swaps, the Bank for International Settlements (BIS) said.’”