Daily Gold Market Report

No DGMR today. Back tomorrow – 7/27/2023

Below is yesterday’s report

______________

Gold trades higher in run-up to Fed rate decision, press conference

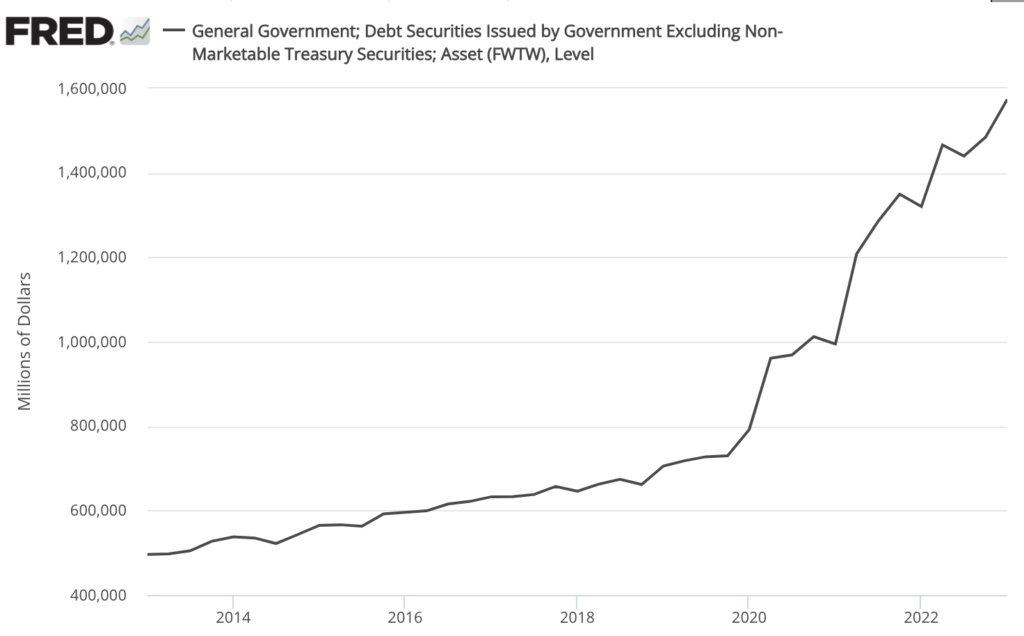

Crescat predicts a powerful new wave of gold demand driven by a flood of government debt

(USAGOLD – 7/25/2023) – Gold is trading higher in the run-up to tomorrow’s Fed rate decision and press conference. It is up $7 at $1964. Silver is up 32¢ at $24.75. Crescat Capital’s Kevin Smith and Tavi Costa believe that the United States is immersed in a mounting debt problem that is weakening the dollar and creating an environment that will divert capital away from Treasuries and into gold.

“We believe a powerful new demand wave for gold is coming in the short term from both institutional and retail investors,” they say in a recent analysis posted at Zero Hedge. “In aggregate, global central banks are already ahead of the curve as they have been accumulating the monetary metal recently as a reserve asset in preference over USTs. Gold is a haven asset that can provide an inflation hedge while also offering strong absolute and relative real return potential in the stagflationary hard-landing environment that our models are now forecasting.”

Sources: St. Louis Federal Reserve [FRED], Board of Governors Federal Reserve