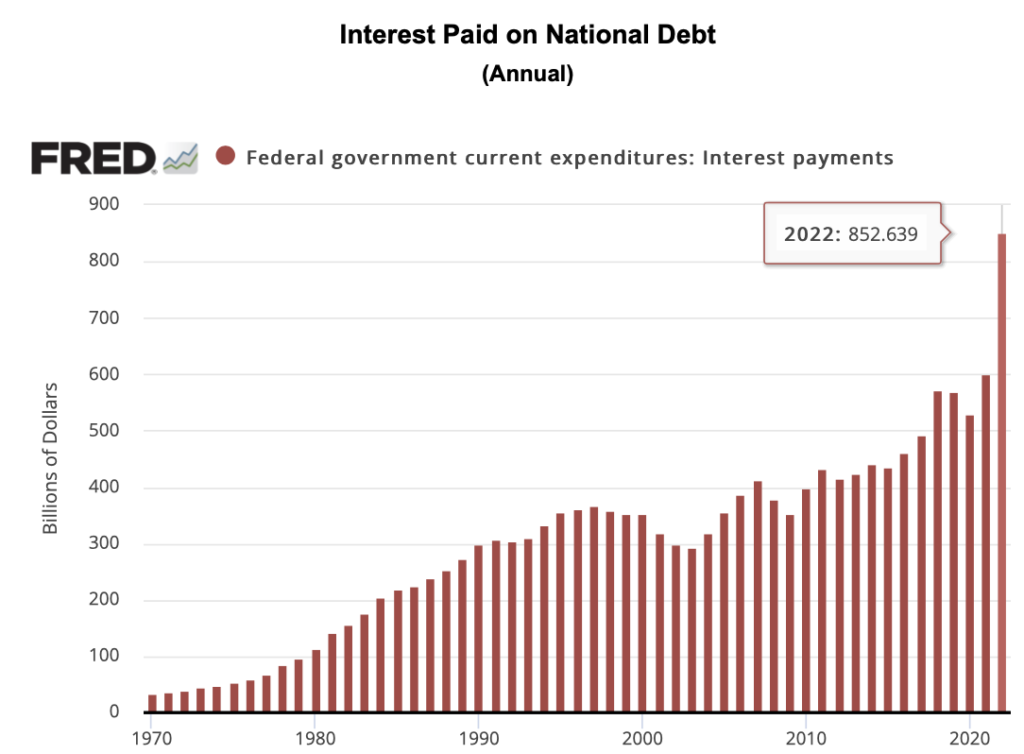

US annualized debt costs exceed $800 billion

ZeroHedge/Mark Cudmore/4-17-2023

“US yields have risen more than 20bps all the way out the curve. The costs are still rising almost parabolically, so expect headline excitement when the $1t figure is likely reached later this year.”

USAGOLD note: Though the interest paid on the national debt is a problem widely ignored by mainstream economists, we can be assured that both the Fed and the Treasury Department are acutely aware of it. The problem can be worsened in two ways. First, the federal government continues to pile up the debt. Second, interest rates could continue to rise. To add a little perspective, federal government tax receipts as of the end of 2022 stood at $3.2 trillion. Thus, interest payments were 26% of taxes collected. Mark Cudmore is a Bloomberg macro strategist.