Peak inflation? The new dilemma for central banks

Financial Times/Chris Giles, Colby Smith and Martin Arnold/12-17-2022

“Headline inflation has almost certainly peaked and will fall next year, but officials are far from certain that the underlying inflationary pressures will also disappear. Their worry is that inflation will take too long to fall back to their hoped-for 2 percent targets and might stick at a rate considerably higher.”

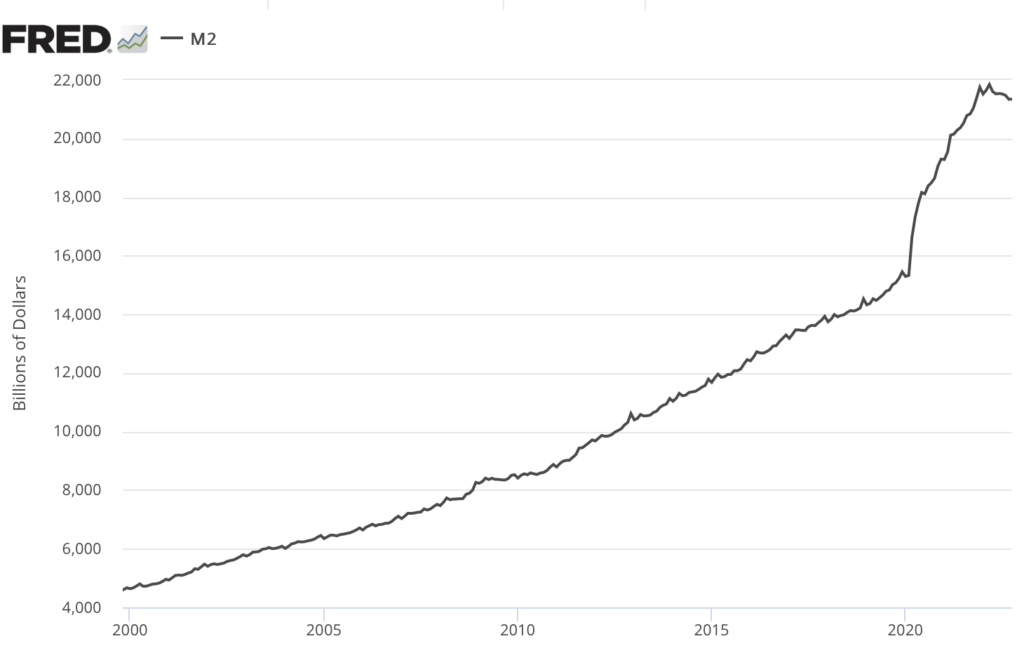

USAGOLD note: Given the fact that the financial press was caught completely off-guard when inflation rocketed higher last year, one wonders if it is being hasty by declaring it has already peaked. Goldman Sachs is calling for a 43% gain in commodity prices next year – much of it centered around energy and industrial metals. If the reality is anywhere near the prediction, it is likely to drive retail inflation much higher. Only the timing is in question. Peak anything in an inflationary environment is a pipe dream – including inflation itself. We should keep in mind that the current inflation is the product of the largest money-printing binge in history, and most, if not all, the global central banks participated. You can’t just wish that away.

United States Money Supply

(M2)

Sources: St. Louis Federal Reserve, Board of Governors of the Federal Reserve System