Stagflation is raising the risk of ‘lost decade’ for 60/40 portfolio of stocks and bonds, Goldman Sachs says

MarketWatch/Vivien Lou Chen/3-18-2022

“Rising stagflation risks in the U.S. and Europe are raising the possibility of a ‘lost decade’ for the 60/40 portfolio mix of stocks and bonds, historically seen as a reliable investing choice for those with moderate risk appetites. Such a ‘lost decade’ is defined as an extended period of poor real returns, says Goldman Sachs Group Inc.”

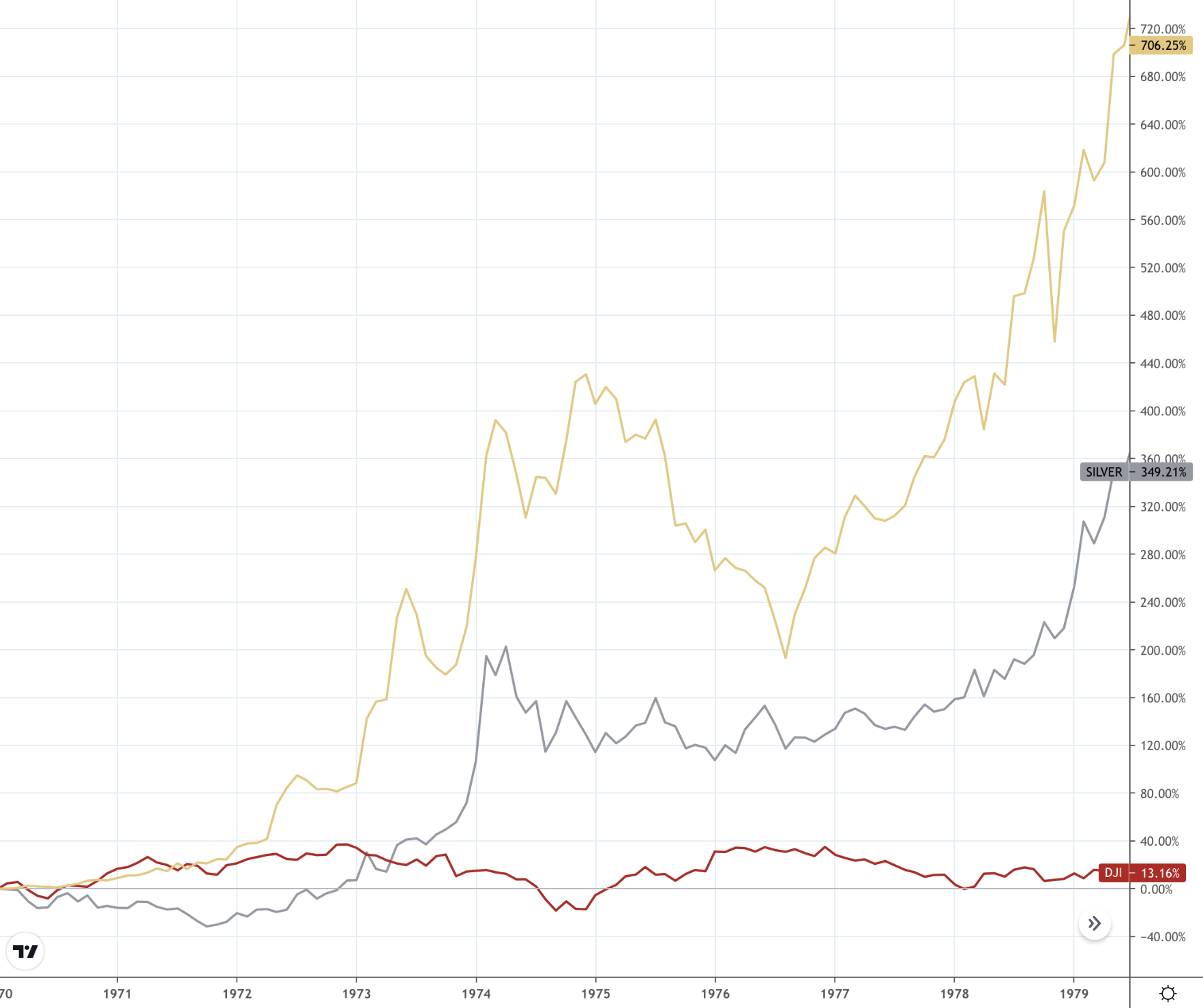

USAGOLD note: While stocks languished during the stagflationary 1970s rising about 13%, gold went on a tear rising over 700%.

Gold, silver and stocks during the stagflationary 1970s

Chart courtesy of TradingView.com

This entry was posted in Today's top gold news and opinion. Bookmark the permalink.