The bubble is bursting and gold is strong

Myrmikan Capital/Daniel Oliver/1-18-2022

“Myrmikan has always held that the end game for the dollar—what propels gold into the multi-thousands of dollars per ounce—is sharply rising rates that destroy the value of the Fed’s assets and make further federal deficit spending impossible. Without a political reason to buy the dollar, it will seek out its economic value.”

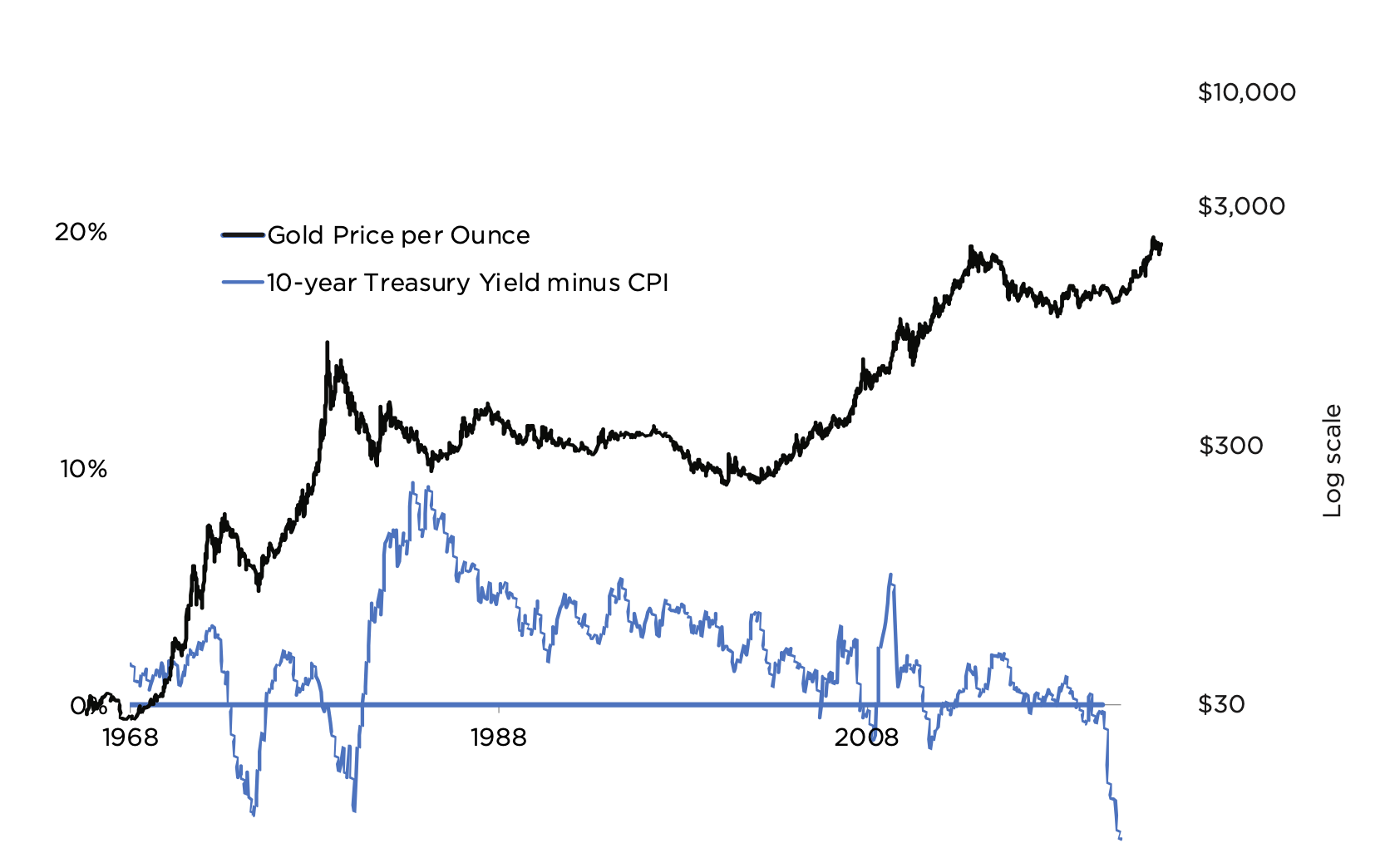

USAGOLD note: Myrmikan’s Dan Oliver offers one of the more bullish outlooks for gold in this study. Assessing what the price of gold would need to be to provide one-third backing for the Fed’s balance sheet, he comes up with $11,090 per ounce and $18,150 for 54% backing (the average level maintained by the Fed from 1914 to 1933). “The Fed’s balance sheet,” he says, “is sure to grow larger, increasing those figures further. It is difficult even for gold investors to imagine these prices. Yet they are what history and math suggest are coming. … [T]he first stop of $10,000/oz is actually not that far away: investors are going to have to get used to logarithmic scales.” We post the following chart with Mr. Oliver’s kind permission.

Gold price and real rate of return

(log scale)

Chart courtesy of Myrmikan Capital