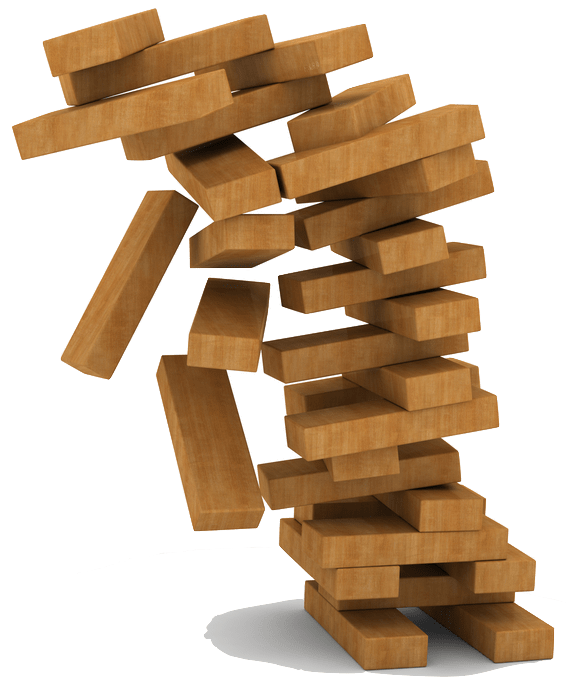

Market crashes: what happens when investors believe the impossible

Money Week/Merryn Somerset Webb/2-1-2022

USAGOLD note: Inevitably, believing the impossible goes hand in hand with believing that this time is different, but as Rogoff and Reinhart so presciently pointed out in “Eight Centuries of Financial Folly”, it is always the same. The excesses always meet their day of reckoning. We will add that when financial history comes calling, the wise investor will be the hedged investor. Too, says Webb, “as long as the Fed holds this line, [stock investors] should surely not buy the dips, but sell the rallies.”