Gold is attempting to stabilize this morning just below the $1800 mark

‘It is time to be bullish on gold.’

(USAGOLD – 1/7/2022) – Gold is attempting to stabilize this morning just below the $1800 mark following yesterday’s Fed-related sell-off. It is down $1 at $1791.50 as we close out the first week of the year. Silver is off 4¢ at $22.20. Gold’s rangebound trading continues to perplex investors and analysts alike, but UK-based analyst Charlie Morris sees it as a passing phase. “It is time,” he says, “to be bullish on gold.”

“Just as investors were confused by gold’s weak 2021,” he predicts in his Atlas Plus newsletter, “they will be surprised by its buoyant 2022. Too many have written it off, which is ridiculous when you come to think of it. Hundreds of years of human economic history, yet investors get bored when it takes a short break. … I mean, who would bother owning gold when there’s a boom in growth stocks?” he asks. “The point here is that booms eventually come to an end, and the last time this happened in March 2000, gold enjoyed one hell of a run thereafter.”

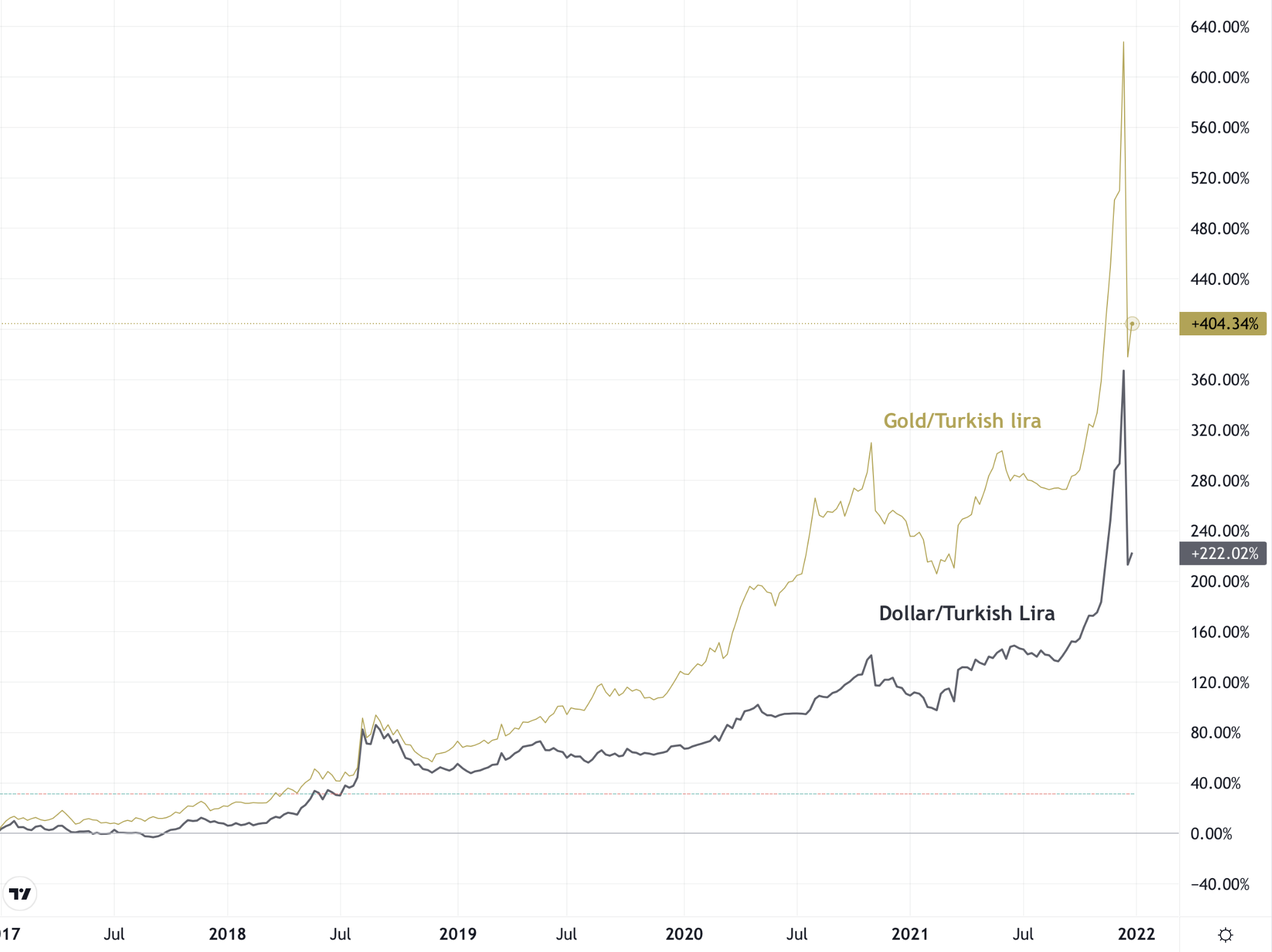

Chart of the Day

Gold and the U.S. Dollar in Turkish Lira

(%, 2017-2021)

Chart courtesy of TradingView.com

Chart note: The ill-fated Turkish lira has received a great deal of attention in the financial press of late. In Turkey, the government has introduced a series of measures “to persuade millions of Turks to turn their backs on dollars and gold and put their savings in lira,” according to a recent report in Financial Times. One Turkish analyst quoted in that article asks the essential question: “Why would you hold Erdogan dollars when you can hold real dollars?”……..Or even better, as the chart above shows, real gold. Over the past five years, gold is up over 400% in the Turkish lira, and the dollar is up almost 225%.