No DMR today (12-9-2021). We will update later at the Top Gold News & Opinion page if anything of interest develops.

Gold traders exercise caution ahead of next week’s Fed meeting

‘Goodbye to Groundhog Day $1800?’

(USAGOLD – 12/8/2021) – Gold drifted marginally lower in quiet trading as traders exercised caution ahead of next week’s Fed meeting. It is down $1 at $1784.50. Silver is down 12¢ at $22.42. Sprott’s Paul Wong believes gold’s nearly two-year correction is about to end after a “bumpy” November.

“We believe the end of gold bullion’s consolidation is near (goodbye to Groundhog Day $1,800 at last?),” he writes in an analysis posted Monday. “Since gold’s August 2020 peak, the metal has been consolidating the breakout from the multi-year base pattern…. Though the past year has seen many price swoons and exhausting trading, gold was never in danger, technically, of breaking its secular bullish pattern. As we wind down 2021, we see several elevated markers of macro risk that the market will not likely be able to ignore for much longer – risks that we believe to be in the regime-changing category.”

Chart of the Day

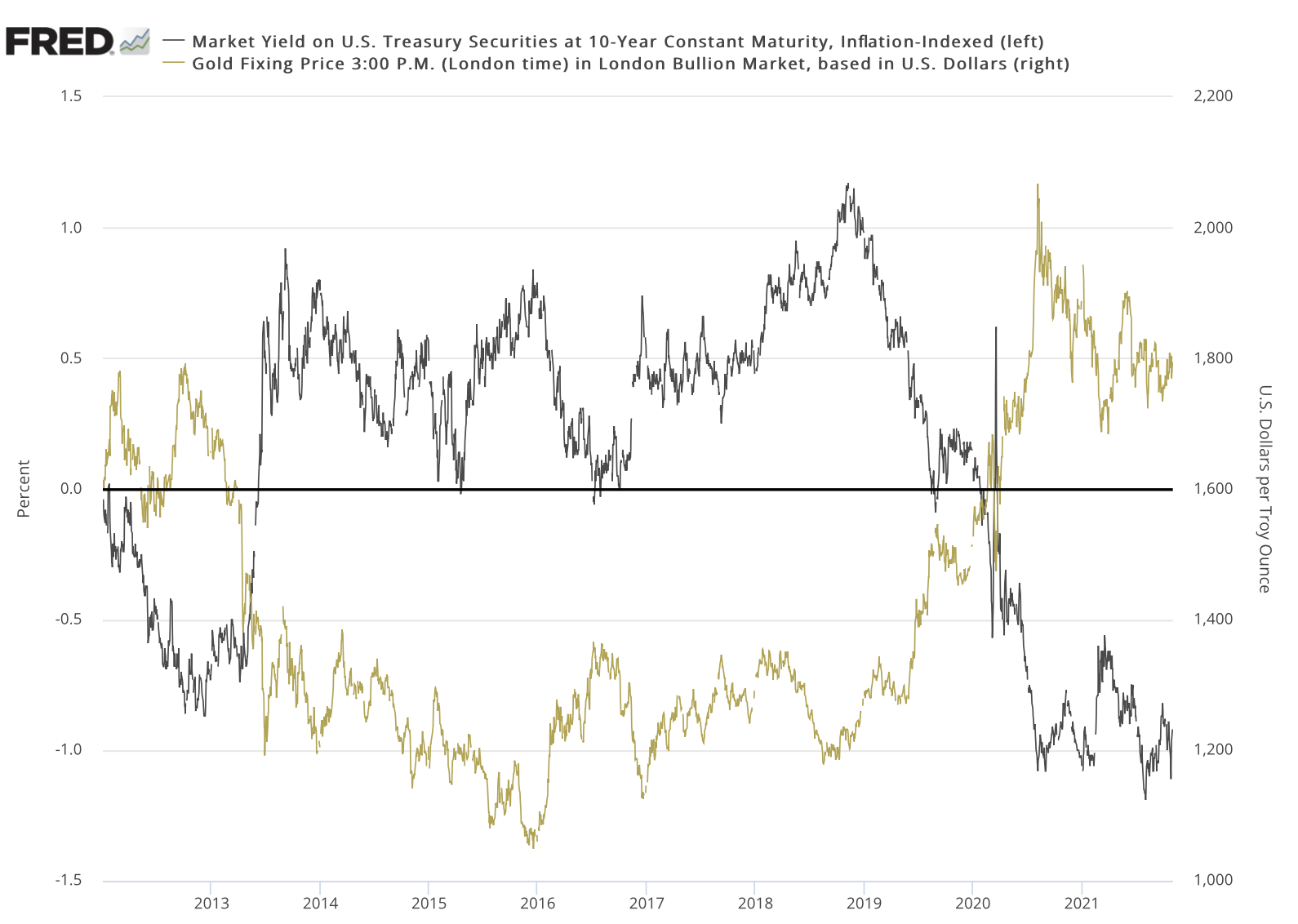

Gold price and the yield on 10-year inflation-indexed security

Sources: St. Louis Federal Reserve [FRED], Federal Reserve Board of Governors, ICE Benchmark Administration

Click to enlarge

Chart note: As you can see in this chart, declining real rates have had a direct effect on the price of gold, particularly noticeable in the period after the 2007-2008 credit collapse and the pandemic-induced economic crisis that began in early 2020. The inflation-indexed real rate of return on the 10-Year TIPS is fluctuating around the minus 1% level. With inflation on the rise, the negative real rate of return will accelerate unless the Fed and/or bond market pricing push yields higher at an equivalent rate.