Monthly Archives: April 2020

ABN Amro leaves gold investors empty handed

USAGOLD note: The ABN Amro situation illustrates with a high degree of clarity why it is important to own metal in hand rather than in some paperized version of gold ownership subject to the whim of the institution managing the account. In this particular case, we cannot help but note that ABN Amro’s closure of paper gold fund comes at a time when bullion is in short supply and owners of the fund are likely to have a stronger than average desire to take delivery of the position. Investors of the fund were forced to sell their positions at a time when it is very difficult to acquire a replacement in the open market. A bird in hand, as the old saying goes, is worth two in the bush.

Repost from 3-26-2020

No DMR today – 4/7/2020.

Gold price rises sharply as retail investors move to physical precious metals

(USAGOLD – 4/6/2020) – Gold rose sharply overnight in a move that began during Asian trading hours and gathered pace in Europe. It is up $35 at $1663*. Silver is up 18¢ at $14.61. Investors are moving to the refuge of physical precious metals largely in response to the deflation scare coursing through financial markets. The burgeoning retail demand, in turn, is putting additional pressure on already limited supplies of bullion and reinforcing stubbornly high premiums on coins and bars.

“Normally it would be troubling from a contrarian’s perspective for retail participants to be the leading buyers of gold bullion,” says analyst Clif Droke in his regular Seeking Alpha column. “But as was the case in the wake of the 2008 financial crisis, the public’s unmitigated level of fear over a very uncertain economic future will be intense and unrelenting. Further, when the public is ‘all-in’ on a given asset, that asset’s price can move higher in an explosive fashion over a period of several months or even years. This was the case not only for gold in 2009-2011, but also for equities in 1997-1999. With that said, look for increasing demand for physical gold among individual investors in the coming months as the coronavirus crisis continues to boil.”

Note: In keeping with the physical gold market’s use of the April COMEX contract for pricing coin and bullion products and settlement purposes, we will use it from today as the spot price quote in our Daily Market Report. This is the same spot price posted at our Online Order Desk and is roughly $20 higher than the price you see quoted in the menu bar above.

Chart of the Day

Chart note: Gold has held its own under difficult economic circumstances. Year to date it is up – albeit marginally – while other major assets like stocks, commodities and even silver have fallen sharply in value. Gold’s upward bias has been restrained by the deflationary bias running through financial markets while safe-haven demand globally for physical coins and bullion, as well as in futures markets, has acted as baseline support.

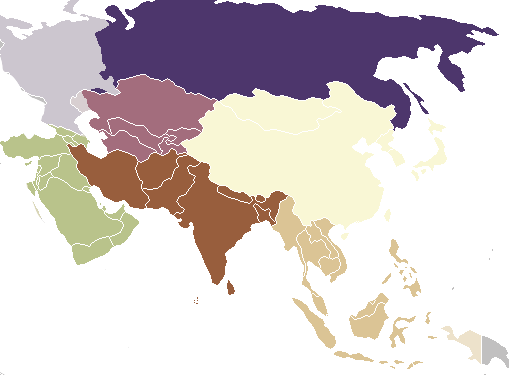

Gold demand soars in some Asian hubs, lockdowns, supply woes hit others

Reuters/Arpan Varghese and Rajendra Jadhav/4-3-2020

USAGOLD note: Bottom line. Where people can get out and buy gold in Asia, they are doing it. Where they are in quarantine or lockdown they have others things on their minds.