Gold drifts sideways ahead of tomorrow’s inflation data

Credit Suisse foresees the possibility of $2300 gold and ‘likely beyond’

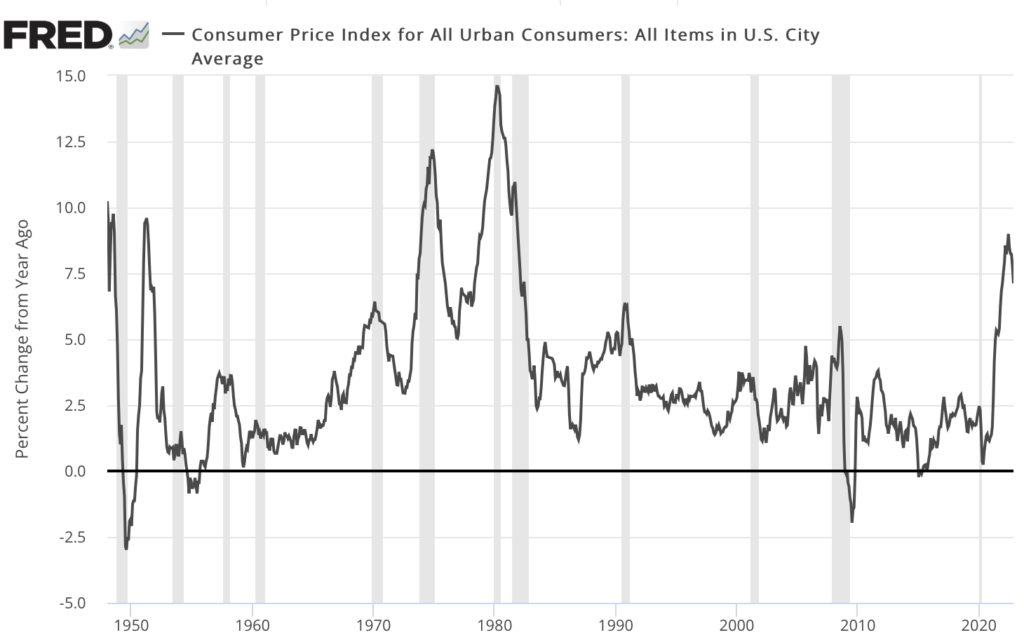

(USAGOLD – 1/11/2023) – Gold drifted sideways in early trading as investors awaited tomorrow’s Labor Department inflation data. It is up $1.50 at $1881. Silver is up 20¢ at $23.89. Trading Economics forecasts a 6.7% inflation reading for December – a sharp drop from November’s 7.1% and a number the markets would likely interpret as a dovish influence on the Fed. Technical analysts at Credit Suisse foresee the possibility of gold trading at $2300 in 2023.

“We look for further tactical gains to test the 61.8% retracement of the 2022 fall and June 2022 high at $1,876/96, which ideally caps for now,” says the bank In a report posted this morning at FXStreet. “Should strength directly extend though we see resistance next at the 78.6% retracement and April 2022 high at $1,973/1,998. Whilst on a big picture basis this strength is seen as a rally within a broader long-term sideways range, should the rally ever extend above the record highs from 2020 and 2022 at $2,070/2,075, this would be seen to mark a significant and long-term break higher, opening up we think $2,300 and likely beyond.”

Sources: St. Louis Federal Reserve [FRED], U.S. Bureau of Labor Statistics