SVB collapse forces rethink on interest rates

Financial Times/Katie Martin and George Steer/3-13-2023

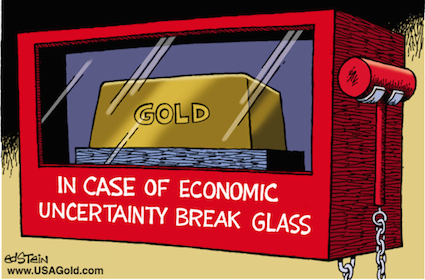

USAGOLD note: Sunday’s rescue package created a 180 degree reversal in rate prospects, inflation expectations, and market outlook. The suddeness of the change reinforces our long-standing advice to diversify with gold and silver for asset preservation purposes and stay diversified.