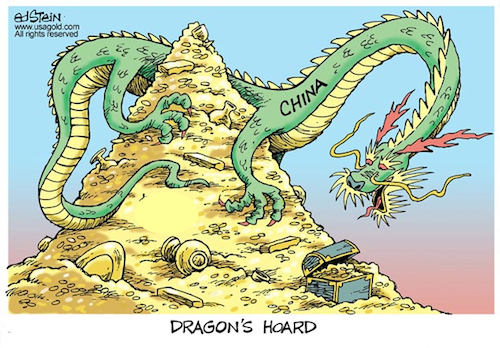

China extends gold buying with 30 tonne addition to holdings

Bloomberg/Sing Yee Ong/1-6-2023

“China reported an increase in its gold reserves for a second straight month, topping up holdings again after its first reported purchase in more than three years.”

USAGOLD note 1: Some gold market analysts believe that China’s true gold reserves are far higher than what is reported by the Peoples Bank of China. The Perth MInt’s Bron Suchecki believes the PBOC’s true holding is closer to 2400 metric tonnes with commercial banks holding another (state accessible) 2060 metric tonnes. He estimates 6490 tonnes in the hands of private buyers. (Source) It is interesting to note, though, that China would actually announce succeessive 32-tonne and 30-tonne purchases in November and December. The question is why? Is it signaling an interest in official gold ownership to other nation-states?

USAGOLD note 2: Preceding gold’s secular bull market rise in the 1970s, European central banks went on a gold-buying tear, similar in psychological impact, if not scope, to what emerging central banks are in the process of executing now. It preceded the formal devaluation of the dollar and the severance of the link between the dollar and gold. When central bank buyers are asked now why they have chosen to add gold to their reserves the answer usually comes back “as a diversification away from the dollar.”

USAGOLD note 3: Though the PBOC is mum on its rationale, Bloomberg suggests in its subhead the “move may be part of PBOC plans to diversify away from dollar.” To achieve the level of diversification that would actually impact its very large holding of US Treasuries, it would take considerably more real money than 62 tonnes – or 4460 tonnes (Suchecki’s number) for that matter, or its current holdings would need to be priced at a much higher level per ounce.