No DMR today.

The following is yesterday’s report.

Gold pushes deeper into $1900s as Russia steps up Ukraine attack

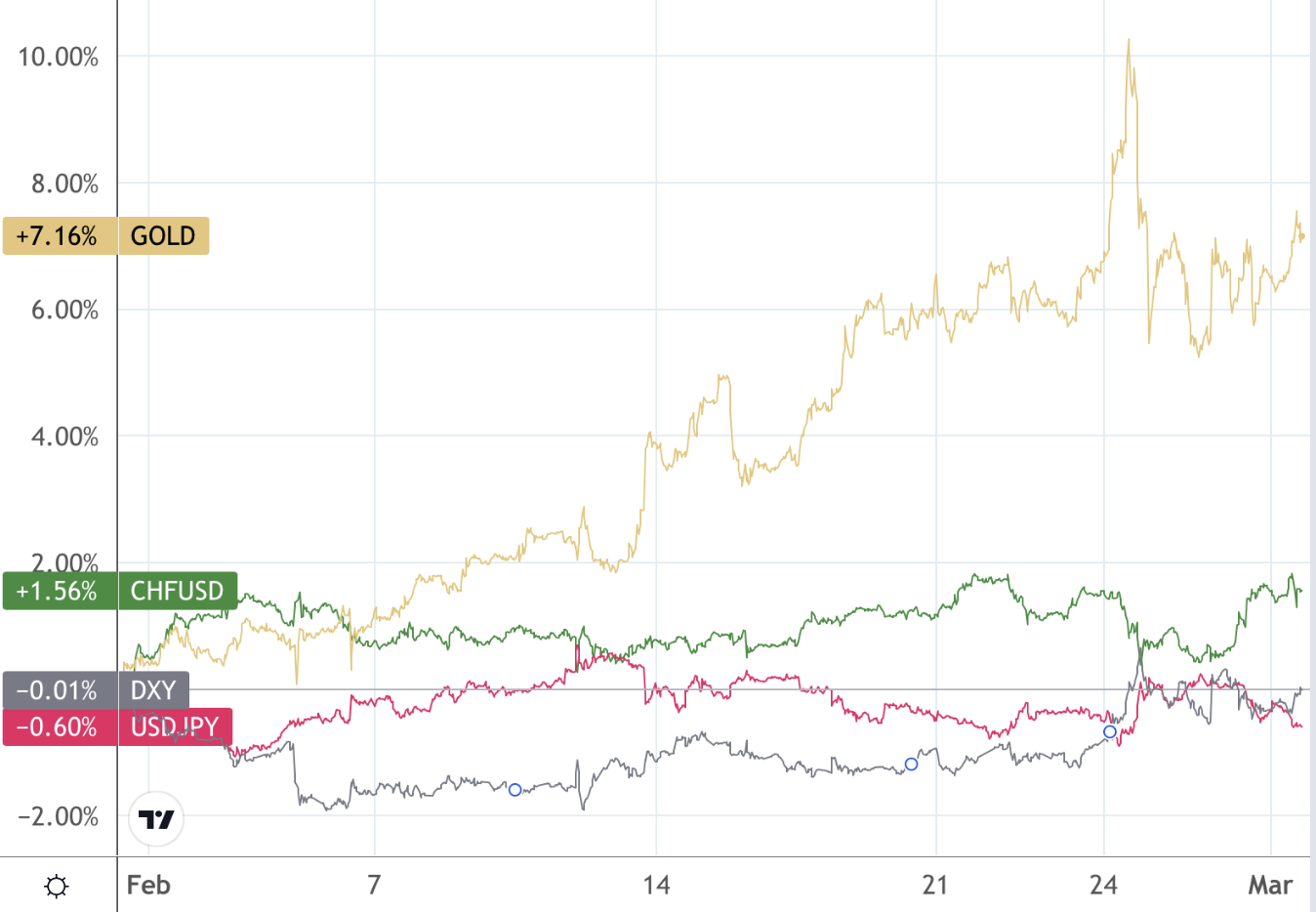

Gold now the ‘safe-haven of choice’ outperforming the yen, Swiss franc and US dollar

(USAGOLD – 3/1/2022) – Gold pushed deeper into the $1900s this morning as Russia stepped up its Ukraine attack and investors globally scrambled to buy safe-havens. It is up $12 at $1922 and now at a 13-month high. Silver is up 19¢ at $24.69. Calling gold the “safe haven of choice,” Bloomberg reported Sunday that it had gained more than bonds, the Swiss franc, and Japanese yen in the wake of the Ukraine invasion.

“The whole crisis has gone to a level that we couldn’t have believed, and investors are no longer saying we’ll buy some defensive stocks or bonds,” Global CIO’s Gary Dugan told Bloomberg. “It’s now about buying gold especially against the backdrop of inflation risks that have been made worse by the conflict.” IG Asia’s Jun Rong added that inflationary pressures were “a tailwind” contributing to the yellow metal’s appeal.

Gold, Japanese yen, Swiss franc, and U.S. dollar

(%, one month)

Chart courtesy of TradingViews.com