Monthly Archives: July 2021

No DMR today 8/2/2021

Gold takes a breather after yesterday’s solid gains

Hecht says silver could be setting up for a repeat of 2020’s explosive rally

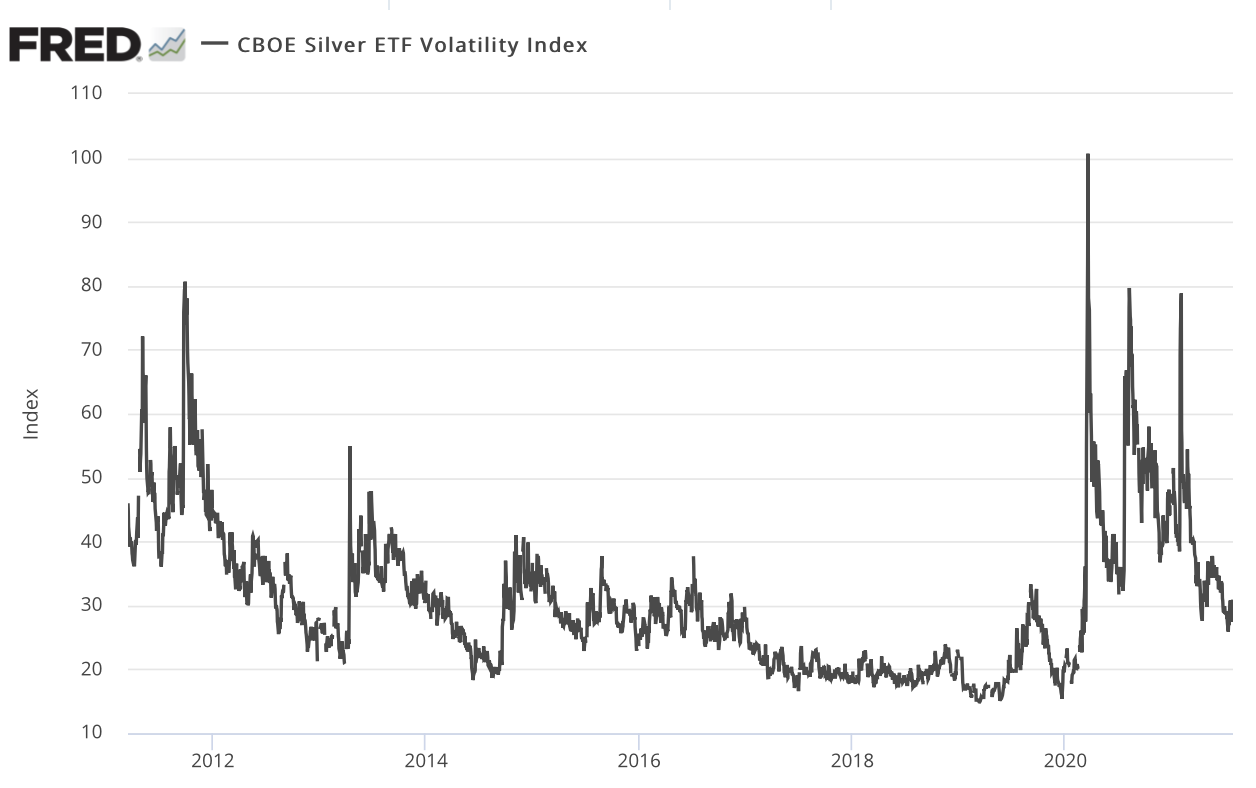

(USAGOLD – 7/30/2021) – Gold looks to be taking a breather after yesterday’s solid gains. It is down $2 at $1827.50. Silver is down 4¢ at $25.55. The yellow metal is up 4% on the month and 1.75% on the week. Silver is down 1.3% for the month of July, but up 1.3% on the week. Silver’s snapback performance yesterday after its unexpected steep decline Wednesday is a reminder of the metal’s volatility. Commodity analyst Andrew Hecht, whose experience in the silver market stretches back to the 1970s as a trader with Salomon Brothers, is well aware of the metal’s long history of radical ups and downs.

“Silver volatility,” he writes in a recent Seeking Alpha article, “can be explosive. Meanwhile, the price action can also be coma-like, lulling market participants into a false sense of security for long periods. Silver’s history is full of false technical breakouts and breakdowns…Silver is a unique metal as it is part industrial, part investment asset. It experiences long periods of coma-like price action, but when it moves, as the price did not 2020, few commodities compare to the precious metal when it comes to percentage moves.” Hecht reminds readers of silver’s performance in 2020 when “bearish price action gave way to an explosive rally.” (Silver went from the $12 level in March to $29 by early August.) He goes on to say that “[t]he recent price dynamics could be setting up for a repeat performance given the rising level of inflation across all markets.”

Chart of the Day

Silver Volatility Index

Sources: St. Louis Federal Reserve [FRED], Chicago Board Options Exchange

Chart note: Please see today’s Daily Market Report for long-time silver trader Andrew Hecht’s comments on the metal’s volatility.