Monthly Archives: November 2016

The Daily Market Report: Gold Retreats On Renewed Risk Appetite Ahead of Election

07-Nov (USAGOLD) — Gold gapped lower in Asian trading on Monday as focus remains squarely on this week’s U.S. election. The yellow metal extended lower during early U.S. trading, but last week’s low at 1271.00 remains protected at this point.

The market retraced a big chunk of last week’s gains after the FBI announced on Sunday that they had cleared presidential candidate Hilary Clinton again, following a review of more emails that came to light the week before last. “Based on our review, we have not changed our conclusions that we expressed in July,” wrote FBI Director Comey.

The U.S. stock market and dollar welcomed the news with renewed risk appetite. The DJIA is back above 18,000 and the S&P 500 appears poised to end its 9-session losing streak, the longest since 1980. While the dollar index has rebounded, less than half of the recent losses have been retraced.

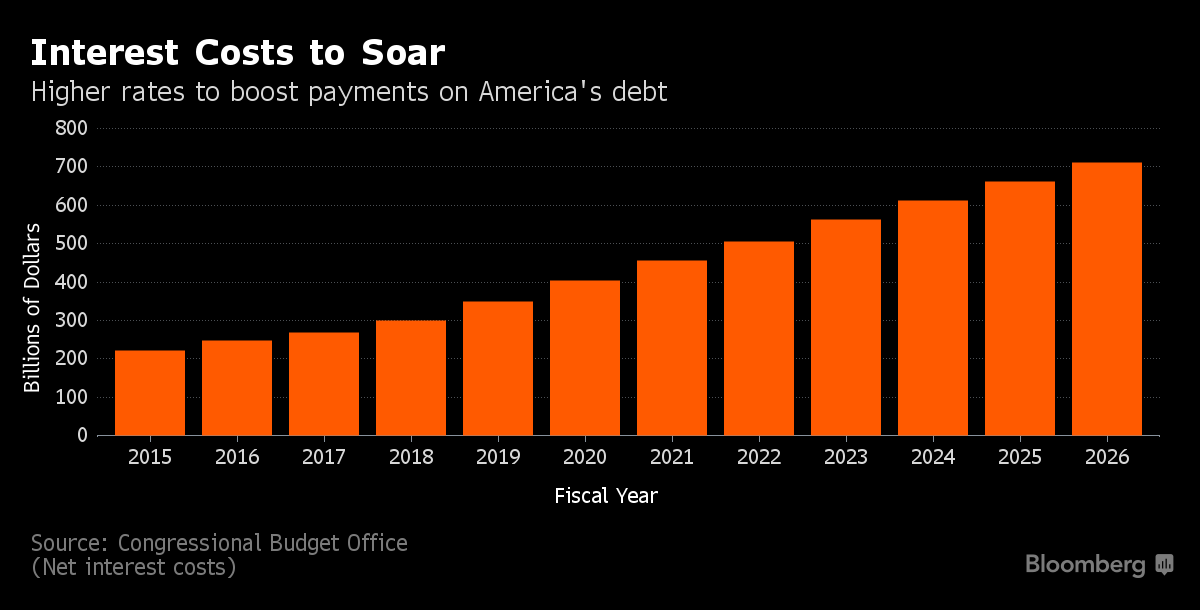

I agree with a Bloomberg article I posted earlier this morning, that whomever is the next President of the United States, they are likely to be hamstrung by our massive debt burden. The national debt is fast approaching $20 trillion. The budget deficit is expanding once again, “as overseas holdings of Treasuries are shrinking at the fastest pace since 2013.” Meanwhile, the persistent threat of Fed rate hikes has pushed Treasury yields to their highest levels in 5-years.

Warning that the U.S. is in the “early stages of inflation,” former Fed chairman Greenspan told Bloomberg TV this morning that the yield on the benchmark 10-year note could rise dramatically in the years ahead. “I think up in the area of 3 to 4, or 5 percent, eventually. That’s what it’s been historically,” said Greenspan. Imagine the implications for debt servicing costs if the 10-year yield hits even the low-end of Greenspan’s expectations!

Historically, there has been a strong correlation between the debt and gold. As the debt grows, the Fed is obliged to stoke inflation as a means to reduce the real debt burden. The Fed has been unsuccessful in doing so in recent years, hence to drop in gold relative to the continued rise in the level of debt.

However, if Greenspan is correct and we are on the verge of accelerating inflation, the yellow metal has a lot of catching up to do. This likely has contributed to Mr. Greenspan returning to his roots as a gold advocate in the years since his retirement in 2006.

Greenspan Sees Bond Yields Climbing as High as 5 Percent Again

07-Nov (Bloomberg) — Former Federal Reserve Chairman Alan Greenspan sees longer-term market interest rates increasing as inflation takes hold in the U.S.

“If the early stages of inflation, which are now developing, would take hold, you could get — fairly soon — a fairly major shift away from these extraordinarily low yields on 10-year notes, for example,” Greenspan said in an interview on Bloomberg Television on Monday. “I think up in the area of 3 to 4, or 5 percent, eventually. That’s what it’s been historically.”

The target range for the Fed’s main policy rate is 0.25 percent to 0.5 percent, and the yield on 10-year Treasuries remains below 2 percent. Greenspan reiterated his often-repeated point that such low rates are unsustainable in the longer run, and said that he sees nascent inflation as the possible end to the bond bull market.

“We’re moving into the very early stages of inflation acceleration,” Greenspan said. “That could be the trigger.”

[source]

Obama’s Successor Inherits Bond Market at Epic Turning Point

06-Nov (Bloomberg) — Barack Obama will go down in history as having sold more Treasuries and at lower interest rates than any U.S. president. He’s also leaving a debt burden that threatens to hamstring his successor.

Obama’s administration benefited from some unprecedented advantages that helped it grapple with the longest recession since the 1930s. The Federal Reserve kept rates at historically low levels, partly by becoming the single biggest holder of Treasuries. The U.S. could also rely on insatiable demand from international investors, led by China deploying its hoard of reserves. Global buyers added $3 trillion of Treasuries, doubling ownership to a record.

Now those tailwinds are turning around. The Fed is telegraphing more hikes at a time when interest costs on the nation’s bonds are already the highest in five years. The government’s marketable debt has more than doubled under Obama’s stewardship, to a record of almost $14 trillion. And the deficit is expanding again, after narrowing for four straight years, just as overseas holdings of Treasuries are shrinking at the fastest pace since 2013.

“We’ve really got ourselves into a pickle here,” said Edward Yardeni, president of Yardeni Research Inc. in New York, who’s been following the bond market since the 1970s. “All these years we’ve been kicking the can down the road, and suddenly we’re seeing a brick wall.”

[source]

PG View: With the national debt fast approaching $20 trillion, it becomes pretty clear that gold should remain underpinned whomever succeeds President Obama.

Bank of Italy says ECB considering extending QE, not tapering it

07-Nov (Reuters) — The European Central Bank is not considering reducing its bond-buying program known as Quantitative Easing, and is looking instead at how far to extend it after the current March 2017 deadline, the Bank of Italy said on Monday.

Luigi Signorini, a member of the Italian central bank’s executive board, was asked during testimony to parliament whether the ECB was looking at how to taper QE.

“There is no prospect of this,” Signorini replied. “The question is how much to extend the limits that were given.”

[source]

Gold slides as dollar and equities jump on Clinton boost

07-Nov (Reuters) — Gold prices tumbled on Monday as the dollar and stocks rallied on news Hillary Clinton would not face criminal charges related to her use of a private email server, boosting her chances of winning the U.S. presidential election.

Spot gold was down 1.2 percent at $1,288.21 an ounce by 1018 GMT after hitting a low of $1,283.12 earlier in the session. U.S. gold futures fell 1.2 percent to $1,288.8.

“It’s risk on after the FBI said it won’t be taking the email saga any further,” said Warren Patterson, commodity strategist at ING. “Polls are showing Clinton in the lead.”

The FBI said on Sunday it stood by its earlier finding that no criminal charges were warranted against Democratic presidential candidate Clinton.

Gold gained more than two percent last week on uncertainty related partly to the FBI saying on Oct. 28 it was looking into new emails that may be connected to Clinton.

The election is on Tuesday and the final result will be known on Wednesday.

[source]

Morning Snapshot: Gold drops with focus squarely on tomorrow’s election.

07-Nov (USAGOLD) — Gold came under pressure in overseas trading after the FBI cleared presidential candidate Hilary Clinton in the latest iteration of the email scandal. This triggered renewed risk appetite, pushing stocks and the dollar higher and weighing on gold accordingly.

Support marked by last Thursday’s spike low at 1284.80 was modestly exceeded, but last week’s low at 1271.00 remains protected at this point. While the market thinks there is some new-found clarity, tomorrow’s election results should still be interesting.

Gold lower at $1287.00 (-17.09). Silver $18.23 (-0.229). Dollar higher. Euro lower. Stocks called higher. U.S. 10-year 1.82% (+4 bps).

S&P 500 Falls for Ninth Session in Longest Losing Streak Since 1980

04-Nov (WSJ) — A late afternoon slump dragged the S&P 500 to its ninth consecutive decline, its longest losing streak in nearly 36 years.

October employment data signaling solid momentum in the labor market and a bounceback in biotechnology shares had buoyed stocks for most of Friday’s trading session. Ultimately, however, caution prevailed in the final hour of trading. The tight U.S. presidential election has dragged down stocks and pushed up Wall Street’s “fear gauge” since early last week.

The S&P 500 declined 3.5 points, or 0.2%, to 2085, putting its nine-day decline at roughly 3%. The last time the S&P 500 index fell for nine days in a row was the period ending Dec. 11, 1980—when it lost 9.4%.

…The election has unnerved many investors, causing them to either sit on the sidelines or move to products they perceive as less risky, such as gold or shorter-duration bonds, as polls have tightened between the candidates.

“There’s general market anxiety driven by the election,” said Megan Greene, chief economist at Manulife Asset Management. “In the past we talked about bulls and bears. Now I think there’s a big group of investors who are just unsure.”

[source]

The Deutsche Bank Downfall: How a Pillar of German Banking Lost Its Way

For most of its 146 years, Deutsche Bank was the embodiment of German values: reliable and safe. Now, the once-proud institution is facing the abyss. SPIEGEL tells the story of how Deutsche’s 1990s rush to join the world banking elite paved the way for its own downfall.

04-N ov (DerSpiegel) — Greed, provincialism, cowardice, unfocused aggression, mania, egoism, immaturity, mendacity, incompetence, weakness, pride, blundering, decadence, arrogance, a need for admiration, naiveté: If you are looking for words that explain the fall of Deutsche Bank, you can choose freely and justifiably from among the above list.

The bank, 146 years after its founding, has become the target for all manner of pejoratives, and not just from outside observers. All of the above terms were used in interviews held during months of reporting into the causes of the downfall of Germany’s largest financial institution. They popped up over the course of several hours of interviews with four Deutsche Bank CEOs, three former and one current. And they were uttered in interviews with eight additional senior bank managers and board members conducted over the course of several years, from the 1990s until today, and in meetings with captains of industry who know the bank well and during encounters with major stakeholders. More than anything, the disparaging words come up frequently in interviews with those who have worked or still work at the bank as customer service advisors, as branch managers or in positions lower down on the food chain.

What we have found in the course of these myriad interviews — combined with the hours spent analyzing bank balance sheets, thousands of pages of files, committee meeting minutes and archive material — is that the collapse of Deutsche Bank is the result of years, decades, of failed leadership, culminating in the complete loss of control of the company by top managers during the period between 1994 and 2012.

…The subject is vast and convoluted, given the many aspects and paradoxes that come with the decline of such a large financial institution. One of those is the fact that, even as Deutsche Bank is rapidly losing value, it is still seen today as the largest systemic risk for the global finance world.

[source]

PG View: That’s not what you want to read about your bank. Look for capital flight to escalate after this scathing critique. The fate of DB poses far greater risk to the global financial system than who winds up being the next President of the United States.

The Daily Market Report: Gold Remains Firm as Focus Now Squarely on U.S. Election

04-Nov (USAGOLD) — Gold remains well bid heading into the last weekend before the U.S. election. There was brief flurry of volatility off of the October jobs report, but the yellow metal settled back in just above $1300.

October nonfarm payrolls came in at +161k. While that was below expectations, the positive back-month revisions along with the continued rise in hourly earnings made the report neutral to positive. With the November FOMC meeting behind us as well, all attention is squarely on Tuesday’s election.

Uncertainty surrounding whom will end up being President-elect next week has reportedly been driving safe-haven demand this week. That may be true to a degree, but the underlying fundamentals that have driven gold higher throughout the year remain very much in place.

However the elections shake out, and whether the Fed hikes or not this year, there is nothing to suggest this trend is about to reverse anytime soon. James Steele of HSBC sees at least an 8% appreciation in the price of gold, no matter who wins next week. That would take gold to new highs for the year, and then some. At that point, we can start seriously thinking about at all-time high from from 2011 at $1920.

Gold, Swiss franc extend gains as risk appetite fades

04-Nov (FT) — US election jitters continued to chip away risk appetite as investors bought safe havens assets instead of making bets on the latest economic data.

Gold is up another 0.2 per cent to $1,305 per troy ounce, hitting a fresh one-month high and on track for its seventh straight day of gains.

The Swiss franc also hit a fresh one-month high against the US dollar, rising 0.3 per cent to 0.97. The franc was rebounding ahead of the US jobs report, but came back down after the release, which showed that wage growth continued to accelerate.

[source]

Morning Snapshot

04-Nov (USAGOLD) — Gold remains generally well bid in the wake of this morning’s release of the all-important nonfarm payrolls report. There was a short-term flurry of volatility, but now that things have settled down a bit, the yellow metal continues to probe above $1300.

October NFPs came in at +161k, below expectations of +174k. However, there were 44k in positive back-month revisions and the jobless rate dipped back to 4.9%, so there likely won’t be any material impact on December rate hike expectations.

The short-term uptrend continues to dominate, which has returned credence to the longer-term uptrend that developed in the wake of last December’s rate hike. A breach of Wednesday’s high at 1307.99 — which has already been pressured — would be seen as encouraging.

Gold turns choppy in reaction to NFP miss, but now trading just above $1300

U.S. trade deficit narrowed to -$36.4 bln in Sep, inside expectations of -$38.7 bln, vs -$40.5 bln in Aug.

U.S. nonfarm payrolls +161k in Oct, below expectations of +174k, vs positive revised +191k in Sep; unemployment rate dipped back to 4.9%.

Gold easier at 1299.88 (-2.27). Silver 18.31 (-0.054). Dollar soft. Euro higher. Stocks called steady. U.S. 10-year 1.80% (-2 bps).

Dollar Posts Longest Losing Streak Since July on Election Angst

03-Nov (Bloomberg) — The dollar weakened for a fifth day, its longest stretch of losses in four months, and a gauge of currency volatility rose to near the highest in two months amid mounting anxiety over the outcome of the U.S. presidential election.

A JPMorgan Chase & Co. index of global currency swings rose to 10.39 Wednesday, the highest level since Sept. 14, as the race for the White House between Democratic nominee Hillary Clinton and Republican candidate Donald Trump tightened less than a week before Americans head to the polls. The greenback fell Thursday against the British pound, which surged the most since August after a U.K. court ruled the government must hold a vote in Parliament before starting the two-year countdown to Brexit.

“Politics is clearly asserting itself as the biggest driver in global markets,” said Alan Ruskin, global co-head of foreign-exchange research in New York at Deutsche Bank AG. Traders are either “selling the dollar or taking back long dollar exposure. It’s extraordinary how much the narrative has shifted.”

[source]

PG View: But, but U.S. interest rates are surely going higher before the end of the year . . . aren’t they?

Gold edges higher on U.S. election nerves

03-Nov (Reuters) — Gold edged higher on Thursday in response to a lower dollar and also uncertainty about the outcome of a tight U.S. presidential race.

Democrat Hillary Clinton maintained her narrow lead over Republican rival Donald Trump just days ahead of the Nov. 8 election, according to two polls released on Thursday.

This helped the dollar to recover from multi-week lows, although it remained 0.1 percent lower against a basket of six main currencies.

“Risk-off sentiment has helped gold above $1,300 yesterday … and as long as uncertainty around the outcome of U.S. elections continues, we can see support,” Saxo Bank head of research Ole Hansen said.

[source]

The Daily Market Report: Gold Rebounds from Intraday Selling Pressure

03-Nov (USAGOLD) — Gold turned choppy after pushing back above $1300 on Wednesday for the first time since early-October. The yellow metal corrected back to 1284.80 in Europe, where renewed buying interest surfaced. Gold is now back above $1300, nearly $20 off the intraday low.

Data this morning were mixed, but the bigger than expected jump in Q3 productivity lends some credence to a possible December rate hike. The Fed opted to hold steady yesterday, but the door is definitely open for a hike before year-end. Gold displayed good resilience, despite perhaps a slightly more hawkish than expected policy statement.

Tomorrow’s release of October jobs data will likely shed further light on the prospects of Fed action. If the labor market proves weaker than expected, that all-but-assured rate hike could fall right off the table once again.

Then of course there is the U.S. presidential election coming up on Tuesday. The recent rebound in the gold price has been attributed to the tightening in the polls, as renewed uncertainty drives demand for the ultimate of safe-havens.

“We expect that both the presidential and congressional elections results will be supportive of gold regardless of the outcome, given the high uncertainty in the direction of policy and the possibility that the results may be contested,” said the World Gold Council. They went on to add the following: “In our view, rising nationalist movements and political uncertainty around the world, as well as the prevalence ineffective monetary policies, make gold a valuable hedge and key component to investment portfolios long term.”