Monthly Archives: September 2015

U.S. personal income +0.3% in Aug, below expectations of +0.4%, vs positive revised +0.5% in Jul; PCE +0.4% on expectations of +0.3%.

Wealth Insurance: The Case for Owning Gold

An interview with John Hathaway

Gold is a unique asset: monetary but lacking counterparty risk, with its liquidity much more easily available than that in other high-value physical assets. John Hathaway, an elder statesman in the metals investment field, thinks that exposure to gold should be a part of everyone’s portfolio, not because he predicts a coming monetary apocalypse, but for far more present reasons. In this interview, he explains his short- and long-term outlooks as well as the structural forces arguing for gold ownership.

Octavian Report: What’s your the- sis on gold generally and what are your short- and long-term outlooks?

John Hathaway: The thesis is that throughout history gold has outper- formed paper currency. You can go back thousands of years and prove that. Paper currency is just an instrument of public policy and is basically backed by political promises, which tend to be such that they’re in excess of what can be supported by the value of the currency in any given moment, and so there’s going to be debasement in some (usually sneaky) form over time.

So one should always have some exposure to gold. It’s the only monetary asset or quasi-monetary asset that doesn’t have counterparty risk, and it has liquidity that you can’t get with Picassos and Rembrandts. If you wanted to dispose of any of these collectible, one-of-a-kind pieces of art or exotic cars and all that kind of thing it would be a huge bid-ask. And you can’t mobilize the wealth that that represents in a short space of time. Gold is the one asset that’s outside of the banking system that’s a form of wealth that can be liquefied immediately, within 24 hours — no exceptions to that, for whatever reason.

If you have some percentage of your wealth in effect insured by a position in physical metal, you really shouldn’t care about the day-to-day price fluctuations measured by one currency or another. What you know is you have a secure asset so that when some opportunity comes along — let’s say the S&Ps are trading at three times earnings, for whatever reason — and you want to back up the truck, gold would be a way to do that, and there’s probably nothing else that you can say that about. That’s the real reason to own gold.

Too many investors think of it as a way to make money. I’m not saying that that’s completely wrong, but it really isn’t the fundamental reason for owning gold. The fundamental reason for owning gold is insuring financial wealth and having buying power for the kinds of events that we saw in 2008, events we may well see again once or twice within our lifetimes.

[source]

Gold falls as U.S. rate outlook weighs, platinum at 6-1/2 year low

28-Sep (Reuters) — Gold fell for a second session on Monday, as the dollar stood close to a five-week high ahead of a key U.S. jobs report later in the week, which could boost bets the Federal Reserve will hike interest rates this year.

Platinum fell almost 3 percent to a 6-1/2 year low of $916.50 an ounce on Monday.

It posted its biggest weekly drop since July last week on fears that the Volkswagen emissions scandal could dent demand for diesel cars, where it is used in catalysts.

“Platinum must continue to fall in the short term because of the lack of clarity in the Volkswagen scandal…it is a very complicated situation involving carmakers, regulators and governments,” Societe Generale analyst Robin Bhar said.

[source]

Gold lower at 1129.15 (-16.79). Silver 14.59 (-0.509). Dollar higher. Euro lower. Stocks called lower. US 10yr 2.15% (-1 bp).

The Daily Market Report: Gold Eases as Yellen Continues to Jawbone Rate Hike

25-Sep (USAGOLD) — Gold retreated modestly on Friday, retracing a portion of Thursday’s solid gains. However, the yellow metal appears poised to notch a second week of gains.

Gold was weighed somewhat after Fed chair Yellen said late on Thursday that a rate hike this year may still be appropriate. Equity investors were encouraged, seemingly believing that if the Fed still sees potential for tightening, the economy must be doing okay. The slight upgrade to Q2 GDP provided some additional credence to that scenario.

However, the economy appears to have slowed markedly in Q3. The Atlanta Fed’s GDPNow model projects the July-September quarter growth at just 1.4%. Those expectations, along with weak inflation, provides little incentive for the Fed to act.

In Japan, the economy contracted by 1.6% in Q2. While Japan is presently expected to avoid recession, growth is expected to be weak in Q3. Nonetheless, S&P downgraded Japan last week.

Today Japan announced that core inflation for August was -0.1%. That’s the first deflationary indication since April 2013 and comes after massive efforts on the part of the Abe government and the BoJ to stimulate both growth and inflation.

Clearly those efforts have failed thus far, but rather than write-off the Abenomics experiment, it’s time to double down again. Abe pledged to grow the economy by 20% to ¥600 trillion. “From today Abenomics is entering a new stage,” said Prime Minister Abe.

He didn’t say exactly what he meant by that, but presumably more quantitative and qualitative easing is in the offing. Analysts widely expected the BoJ to ease further before year-end, possibly as soon as October. Given that ZIRP, QE and QQE haven’t worked in successive previous efforts, surely it will work this time!

Circling back to the Fed, the Japanese experience has not gone unnoticed by Janet Yellen:

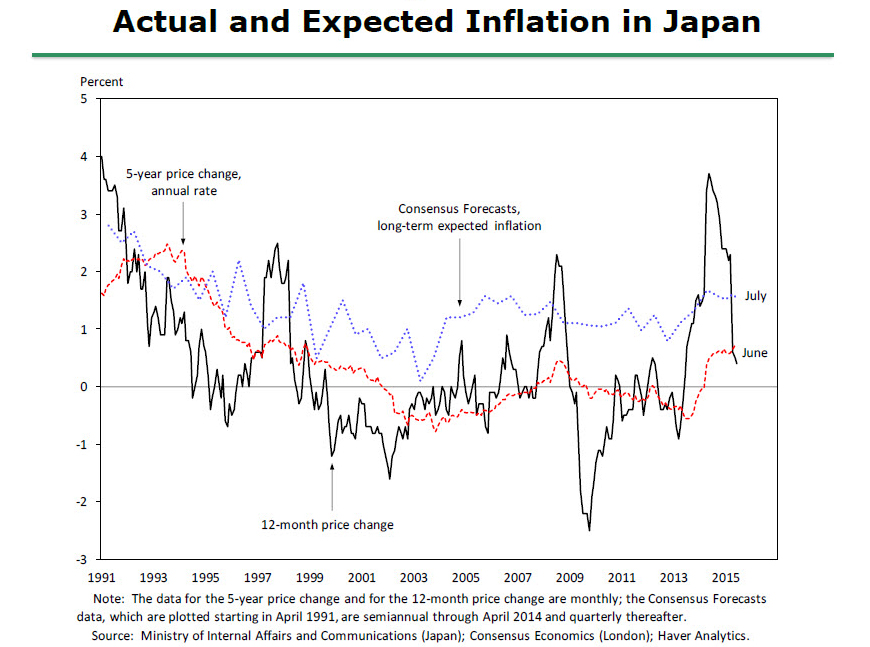

Figure 9

Yellen went on to say that “inflation may rise more slowly or rapidly than the Committee currently anticipates; should such a development occur, we would need to adjust the stance of policy in response.” There is certainly no indication at this juncture that inflation is going to rise faster than the FOMC anticipates, so one might expect a policy adjustment toward easing may be more likely.

Gold drops, hit by Yellen remarks, but still up for week

25-Sep (MarketWatch) — Gold futures slumped Friday, hurt by the Federal Reserve’s Janet Yellen saying the economy is improving and she expects an interest-rate hike in 2015.

December gold fell $10.20, or 0.9%, to $1,143.60 an ounce, while December silver dropped 7 cents, or 0.5%, to $15.06 an ounce.

The yellow metal is trading lower after “Fed Chair Yellen more or less announced during a speech yesterday evening that an interest rate hike would be forthcoming before the year is out,” said commodities analysts at Commerzbank in a note Friday.

Analysts have said that higher interest rates can hurt gold because it doesn’t pay interest, making it a less attractive investment. Plus, higher rates lift the dollar and a stronger greenback can weigh on dollar-denominated commodities as they become pricier for holders of other currencies. The dollar rose early Friday.

Gold, which has pared its weekly gain to 0.5%, had rise on Wednesday and Thursday thanks in part to safe-haven demand as stocks and other riskier assets slumped. On Friday, U.S. stocks looked on track to open sharply higher, helped by Yellen’s remarks.

[source]

Japan’s Abe airs Abenomics 2.0 plan for $5 trillion economy

25-Sep (AP, via YahooNews) — Prime Minister Shinzo Abe’s updated plan for reviving Japan’s economy and achieving a GDP target of 600 trillion yen ($5 trillion) suggests a recognition that earlier policies are not doing the trick.

Abe took office in late 2012 vowing to end deflation and rev up growth through strong public spending, lavish monetary easing and sweeping reforms to help make the economy more productive and competitive. So far, those “three arrows” of his “Abenomics” plan have fallen short of their targets though share prices and corporate profits have soared.

Recent data suggest consumers and corporations remain reluctant to step up spending — the key to getting growth back on track.

Japan’s inflation rate remained flat at 0.2 percent in August, according to data reported Friday, with core inflation excluding volatile food prices slipping 0.1 percent. A preliminary survey of manufacturers released Thursday showed a sharp drop in export orders. Recent corporate investment figures were likewise worse than expected.

In a news conference Thursday, Abe did not dwell on those harsh realities.

“Tomorrow will definitely be better than today!” Abe declared on national television. “From today Abenomics is entering a new stage. Japan will become a society in which all can participate actively.”

[source]

PG View: If at first you don’t succeed, print, print some more.

Japan falls back into deflation for the first time since 2013

25-Sep (FT) — Japan has fallen back into deflation for the first time since April 2013 in a symbolic blow to prime minister Shinzo Abe’s economic stimulus.

Headline prices, excluding fresh food, were down by 0.1 per cent compared with a year ago in August, as slumping global energy prices outweighed stronger domestic inflation in Japan.

The figures create a conundrum for the Bank of Japan: while it is encouraged by signs of inflation at home, the fall in headline prices risks creating the impression its policy has failed, especially given sluggish economic growth.

That is leading to rising pressure on the BoJ to ease monetary policy further when it updates its economic forecasts at the end of October.

…Haruhiko Kuroda, the governor of the BoJ, has taken to highlighting the spread of domestic price rises as a sign his policy is working. “If you look at goods used every day or week like food and household products, the proportion with rising prices was higher after April in particular,” said Mr Kuroda at a recent press conference.

He has continued to insist Japan can reach 2 per cent inflation by the middle of fiscal year 2016 even though most analysts think that goal is now out of reach.

[source]

PG View: Way to find the bright spot Kuroda-san.

Global Markets Rebound on Yellen Speech

25-Sep (WSJ) — Global stocks climbed Friday after Federal Reserve Chairwoman Janet Yellen reassured investors that the U.S. economy is strong enough to support an interest-rate increase.

In a speech on Thursday at the University of Massachusetts in Amherst, Ms. Yellen laid out a detailed case for raising interest rates later this year.

Stock futures indicated a 1.4% opening gain for the S&P 500. Changes in futures aren’t necessarily reflected in market moves after the opening bell.

European markets climbed sharply at the open, rebounding from Thursday’s losses. The Stoxx Europe 600 was 3.1% higher early afternoon, although it remained on track for a weekly decline.

The picture in Asia was more mixed. Japanese stocks wavered as investors digested Ms. Yellen’s speech, but rebounded after a pledge by Japanese Prime Minister Shinzo Abe to strengthen the country’s economy. The Nikkei closed 1.8% higher. China’s Shanghai Composite fell 1.6%.

[source]

PG View: Stocks apparently now like a more hawkish tone from Yellen; it provides the impression anyway that the economy is improving.

Abe and the PMs before him have been pledging to strengthen the Japanese economy for decades, but nobody has really been able to deliver.

U.S. Q2 GDP (final) revised up to 3.9%, above expectations of 3.7%, vs 3.7% in 2nd report and 0.6% in Q1.

Gold lower 1142.00 (-7.60). Silver 15.00 (-0.089). Dollar higher. Euro lower. Stocks called higher. US 10yr 2.18% (+6 bps).

The Daily Market Report: Gold Surges as the Age of Easing Seems Set to Endure

24-Sep (USAGOLD) — Gold has surged to a 4-week high on safe-haven interest. Mounting growth and price risks have fostered risk aversion and a flight to quality, which has pushed the yellow metal up more than $20 intraday.

In the conclusion of yesterday’s DMR, I said “Clearly, the age of inner-accomodative monetary policy is far from over.” That’s where we’ll begin today:

Today, the Central Bank of the Republic of China (Taiwan) unexpectedly cut it’s benchmark rate by 12.5 bps to 1.75%, amid slumping exports. Norway’s central bank also did a surprise rate cut of 25 bps, noting that “Growth prospects for the Norwegian economy have weakened, and inflation is projected to abate further out.”

Historically, weaker growth, soft exports and disinflationary pressures have prompted more accommodative monetary policy. The Reserve Bank of New Zealand cut rates a couple weeks ago and hinted at the possibility of further easing. The Reserve Bank of Australia is widely expected to cut by 50 bps when they meet the first week of October.

The PBoC has been devaluing the yuan and pumping liquidity through open market operations. The persistently weak European economy has led to recent hints that the ECB will look to expand their QE program. Ongoing weakness in the Japanese economy has heightened expectations that the BoJ will double down (again) on their QQE efforts.

I think it’s pretty evident which way the monetary policy tide is running at this point; and yet many continue to hold out hope that the Fed’s next move will be a rate hike. I think that window of opportunity closed some time ago. At this juncture, the biggest risk is probably a disinflationary recession that is going to require the Fed to ease.

With rates at the zero-bound, the question becomes, what might that easing entail? Negative rates, or QE4 are the obvious answers.

With key U.S. stocks indexes under pressure and at key inflection points, look for Janet Yellen to maintain a dovish tone when she speaks later today. In fact, in light of recent data and stock market action, she may be more overtly dovish than she was at her FOMC presser last week.

Gold is definitely benefitting from the easier policy biases. As Fed rate hike expectations diminish further, there may be a lot more long dollar / short gold speculative positions that need to be unwound.

Gold Prices Rally as Traders Seek Haven From Falling Stocks

24-Sep (Wall Street Journal) — Gold prices surged higher on Thursday as some investors sought to gird themselves from disappointing economic data and declines in U.S. stocks by purchasing the haven asset.

The most actively traded contract, for December delivery, recently was up $22.90, or 2%, at $1,154.40 a troy ounce on the Comex division of the New York Mercantile Exchange.

Investors started tiptoeing into the gold market at the start of the U.S. trading day after Commerce Department data showed U.S. durable goods orders fell a seasonally adjusted 2.0% in August from a month earlier. The data suggest that the strong dollar and economic weakness overseas may be sapping demand for U.S. goods.

Gold’s gains accelerated after the U.S. stock market fell at the open, spurring some investors to seek safety in the precious metal. The S&P 500 stocks index was recently down 1.1% at 1917.56. Gold often benefits from losses in riskier assets like stocks as some investors buy the precious metal on the hope that it will keep its value better during a period of economic turbulence.

“With the pullback in equities, there’s definitely a flight to quality (assets) right now, it’s going into Treasurys and to gold,” said Bob Haberkorn, a senior commodities broker with RJO Futures in Chicago.

[source]

PG View: The “flight to quality” is an important concept that really knows no season. Having ‘quality’ assets is always important, so you should always have some physical gold in your portfolio.

Switzerland exported more gold to Asia again in August

23-Sep (EconoTimes) — Gold proved unable to completely ignore yesterday’s downswing on the commodities markets and fell to a good $1,120 per troy ounce.

“This morning is seeing a moderate recovery movement, with gold again priced roughly $5 higher. According to data from the customs authorities, Switzerland exported 173.9 tons of gold in August, 8% more than in the previous month. Nearly 70% of this total was shipped to Asia”, notes Commerzbank.

Whereas exports to India remained constant month-on-month, 50% more gold was exported to China. Exports to Hong Kong were actually more than twice as high as in July, which suggests that China also imported more gold from Hong Kong last month.

The corresponding figures will be published by the Census and Statistics Department of the Hong Kong government in the next few days. India is also likely to import more gold again in the coming months given that the All India Gems & Jewellery Trade Federation predicts that gold demand there will pick up noticeably in the fourth quarter.

[source]

PG View: Be sure to listen to the interview with the director of one of the largest Swiss refineries. Very telling!

U.S. new home sales +5.7% in Aug to 552k, above expectations of 515k, vs positive revised 522k in Jul.

Gold Rises to Four-Week High as U.S. Orders Data Fuels Fed Bets

24-Sep (Bloomberg) — Gold climbed to four-week high after a report showing orders for business equipment stalled in the U.S., fueling speculation that the Federal Reserve will hold off on raising interest rates until next year.

Bookings for non-military capital goods excluding aircraft fell 0.2 percent last month, a government report showed Thursday. Gold has gained more than 3 percent since Sept. 17, when the Fed announced its decision to hold off on raising rates amid financial market turmoil and uncertainty over what slower global growth means for the U.S. outlook.

Investor will look for further clues on the central bank’s plans when Fed Chair Janet Yellen delivers a speech Thursday in Amherst, Massachusetts. Higher rates curb the appeal of the metal, which doesn’t pay interest or give returns like competing assets such as bonds and equities.

“Gold buyers are scrambling,” George Gero, a vice president of global futures at RBC Capital Markets in New York, said in a telephone interview. “Gold is gaining because of weakness in economics, possible postponement of a rate hike and with Yellen speaking today.”

[source]

Gold eyes second straight gain ahead of Yellen speech

24-Sep (MarketWatch) — Gold futures were picking up modest gains Thursday as global stocks turned lower and as the market awaited comments from Federal Reserve Chairwoman Janet Yellen, who is slated to speak Thursday afternoon.

December gold picked up $5.50, or 0.5% to $1,137 an ounce, after snapping a two-day losing streak Wednesday, while December silver lost 2 cents, or 0.1%, to trade at $14.77 an ounce.

Platinum prices, which have been hammered by the Volkswagen scandal, were tipping higher but still hovering around six-year lows. The German car maker’s woes with diesel-powered cars have hit the precious metal used in catalytic converters.

[source]

PG View: Gold is being lifted on a safe-haven bid, as mounting growth and disinflation risks weigh on global shares and foster a ‘risk-off’ environment.

Mexico peso slumps to record low on global growth worries

24-Sep (Reuters) — Mexico’s peso tumbled to a record low on Thursday as concerns about global growth weighed on riskier assets around the world.

The peso shed more than 1 percent to 17.3165 per dollar, its weakest since the currency was floated in the 1990s, before bouncing back to trade around 17.23 pesos per dollar, or 0.6 percent weaker than a day earlier.

Mexican policymakers had increased a dollar sales program in July to support the peso. That program is set to expire at the end of the month, but analysts expect it will soon be extended.

The central bank sells $200 million a day to the market and offers $200 million more when the peso weakens by 1 percent from the previous day’s fix rate.

Mexico’s central bank held borrowing costs steady on Monday, flagging tame inflation, but signaled it is prepared to raise rates if the peso’s losses hit consumer prices.

[source]