Central banks accelerate shift from dollar to gold worldwide

NikkeiAsia/Haruki Kitagawa/12-29-2021

“Central banks around the world are increasing the gold they hold in foreign exchange reserves, bringing the total to a 31-year high in 2021. Central banks have built up their gold reserves by more than 4,500 tons over the past decade, according to the World Gold Council, the international research organization of the gold industry. As of September, the reserves totaled roughly 36,000 tons, the largest since 1990 and up 15% from a decade earlier.”

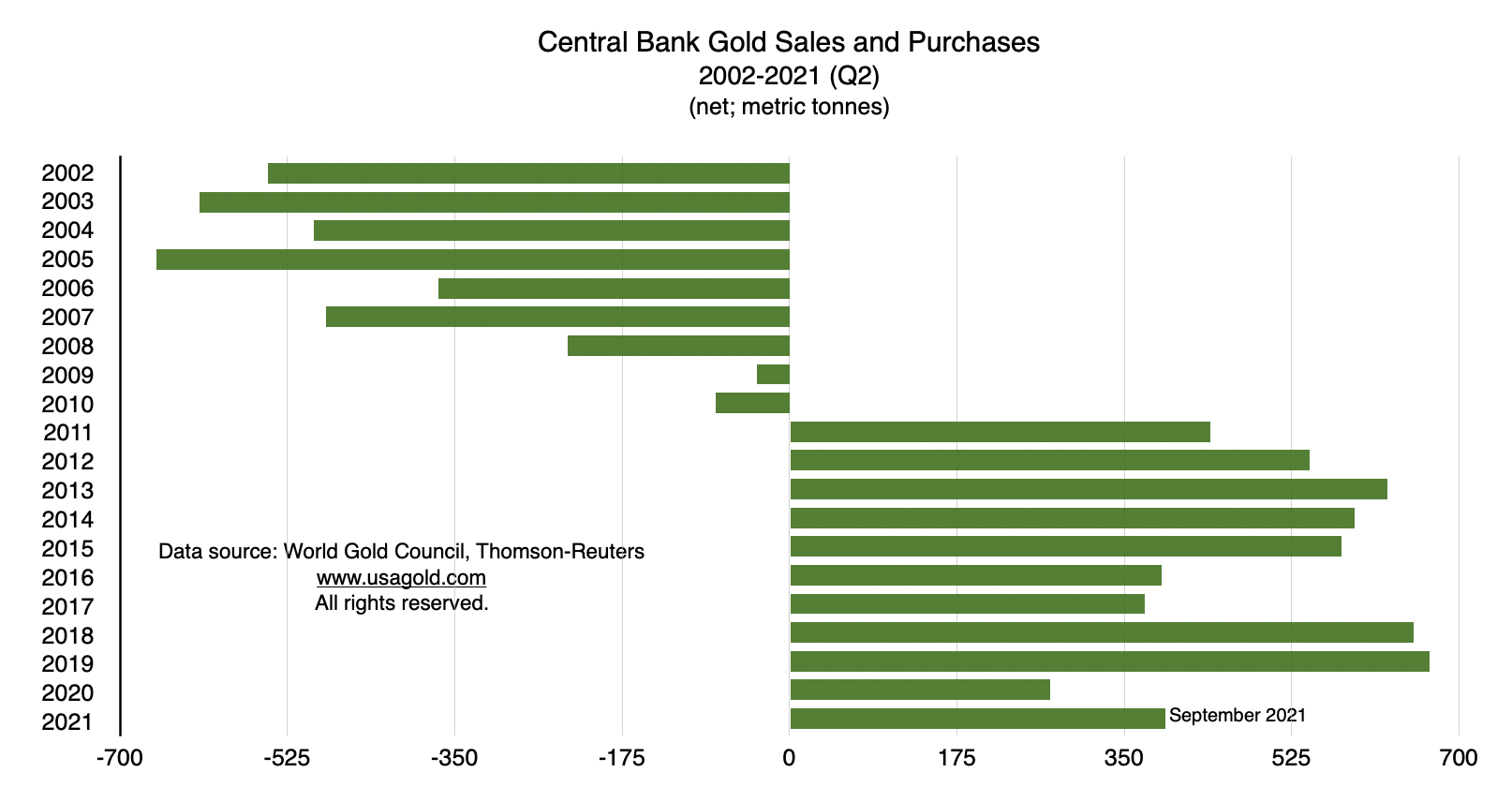

USAGOLD note: And those numbers do not include what China has added to its holdings surreptitiously via proxy reserve acquisitions by its commercial banks. The mainstream media by and large gives credit to central bank acquisitions as supportive of the price. What it neglects is something not so obvious, i.e. their withdrawal from the market as sellers of the metal. That swing – from net sellers to net buyers – has had a profound impact on the metal’s fundamentals.