Obama’s Successor Inherits Bond Market at Epic Turning Point

06-Nov (Bloomberg) — Barack Obama will go down in history as having sold more Treasuries and at lower interest rates than any U.S. president. He’s also leaving a debt burden that threatens to hamstring his successor.

Obama’s administration benefited from some unprecedented advantages that helped it grapple with the longest recession since the 1930s. The Federal Reserve kept rates at historically low levels, partly by becoming the single biggest holder of Treasuries. The U.S. could also rely on insatiable demand from international investors, led by China deploying its hoard of reserves. Global buyers added $3 trillion of Treasuries, doubling ownership to a record.

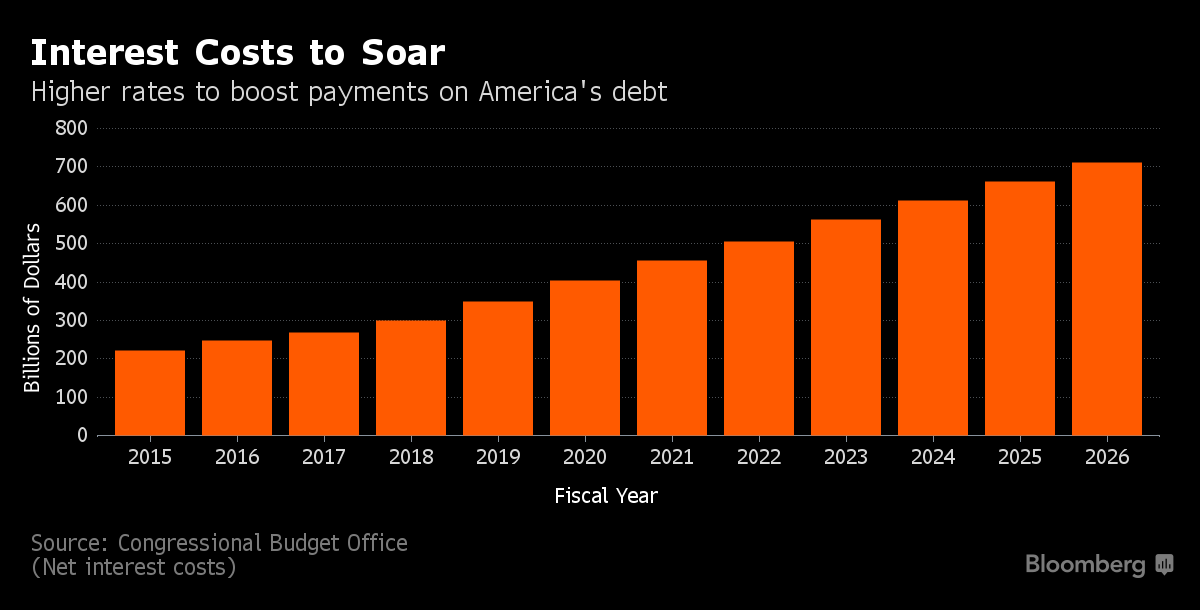

Now those tailwinds are turning around. The Fed is telegraphing more hikes at a time when interest costs on the nation’s bonds are already the highest in five years. The government’s marketable debt has more than doubled under Obama’s stewardship, to a record of almost $14 trillion. And the deficit is expanding again, after narrowing for four straight years, just as overseas holdings of Treasuries are shrinking at the fastest pace since 2013.

“We’ve really got ourselves into a pickle here,” said Edward Yardeni, president of Yardeni Research Inc. in New York, who’s been following the bond market since the 1970s. “All these years we’ve been kicking the can down the road, and suddenly we’re seeing a brick wall.”

[source]

PG View: With the national debt fast approaching $20 trillion, it becomes pretty clear that gold should remain underpinned whomever succeeds President Obama.